Gold Futures Weekly Trend Update: What You Need To Know

Image Source: Pixabay

Fundamentals:

Gold Price Consolidation and Outlook: Gold prices closed the week with a strong consolidation above the $2025 per ounce mark, setting a positive tone for the beginning of 2024. This stability suggests that gold may be well-positioned for potential gains in the coming weeks.

Week of Surprises: The past week has been far from ordinary in the gold market. It started with some mild disappointment stemming from key macroeconomic data. However, what followed were twists and turns that defied expectations and showcased the resilience of the yellow metal.

Market Trends and Smooth Trading: Interestingly, the unexpected drivers of the gold market didn't result in extreme price dislocation. Instead, when viewed on a week-over-week time series, the market exhibited a relatively smooth trading pattern. This stability, despite the surprises, is encouraging for gold's performance in early 2024 and allows for the continued consolidation of gains from late 2023.

Reaction to CPI Data: One pivotal moment during the week was the release of the CPI (Consumer Price Index) report. While it didn't signal a resurgent inflationary trend, it did show a small but unexpected increase in consumer inflation year-over-year. This seemingly had a profound impact on market sentiment.

Market Impact and Speculation: For the past several months, market participants had been quick to interpret any data as a sign that the Federal Reserve would lower interest rates. However, the CPI data seemed to challenge this expectation. Yields on US Treasury bonds rallied, and the US Dollar strengthened significantly. Gold prices experienced bouts of rapid selling but also witnessed a momentary surge, driven by traders speculating on gold's role as a hedge against inflation.

Geopolitical Factors: Adding to the market's intrigue was the influence of geopolitical tensions in the Middle East. This unexpected development caused gold to trade as a hedge against market and geopolitical instability. Prices climbed steadily, reaching a weekly high near $2060 per ounce before a moderation influenced by profit-taking.

Promising Consolidation and Caution: In summary, this week appears to have set the stage for a promising consolidation of gold prices as we enter the second half of January. However, it serves as a reminder that market dynamics are subject to change, and traders should pay close attention to external factors beyond the Federal Reserve's actions. Geopolitical events and inflation data can have a significant impact on the gold market, making it essential to stay vigilant in the weeks ahead.

Let's take a look at the weekly standard deviation report published in the marketplace section and see what trading opportunities we can identify for next week.

GOLD: Weekly Standard Deviation Report

Jan. 20, 2024, 12:13 PM ET

Summary

- Gold futures market trend momentum is bearish, but a close above the 9-day SMA could shift it to neutral.

- Price momentum also indicates bearishness, but a close above the VC PMI would change it to neutral.

- Short-term profit-taking opportunities at 2002-1974 price levels, consider going long on a weekly reversal stop.

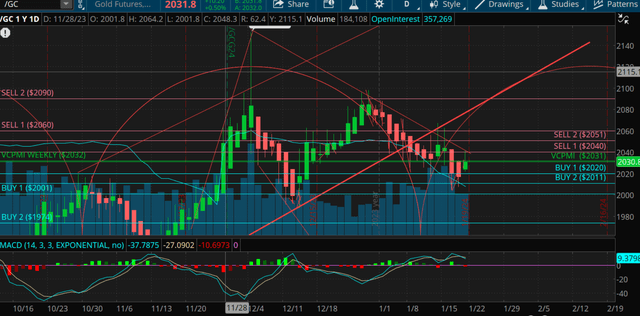

GOLD WEEKLY (TOS)

Hey there,

I wanted to give you a quick update on the weekly standard deviation outlook in the gold futures market. As of last week (ending January 19, 2024), the gold futures contract closed at 2029. Here's what's going on:

Trend Momentum: The market closed below the 9-day Simple Moving Average (SMA) of 2048. That's a clear sign that the weekly trend momentum is bearish. But don't get too worried just yet! If we see the market close above the 9-day SMA, it could shift the trend from bearish to neutral. So, keep an eye on that.

Price Momentum: It's not just the trend that's indicating bearishness; the price momentum is also in that direction. The market closed below the VC Weekly Price Momentum Indicator at 2032. Again, this confirms the bearish short-term trend. But like I mentioned earlier, a close above the VC PMI would change things to neutral.

Price Indicator: For those of you who are short in the market, look for chances to take profits during corrections when we hit the 2002–1974 price levels. And if you're thinking about going long, consider doing it on a weekly reversal stop. If you're already long, make sure to use the 1974 level as a Weekly Stop Close Only and Good Till Cancelled order. And, hey, if we get close to the 2090-levels during the week, it might be a good idea to cash in those long positions.

Cycle Update: The next cycle is expected on January 30, 2024.

Strategy: If you're long in the market, think about taking profits when we hit the range of 2060-2090.

More By This Author:

Gold Price Fluctuations: A Deep Dive Into Recent Market Trends

Gold's Roller Coaster: Surprises, Signals, And Speculation In The Precious Metal Market

Fed's Anticipated Rate Hikes Stir Market Dynamics, Pushing Gold Prices Downwards: An Impact Analysis

Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives.

Disclaimer: The information in the Market Commentaries was ...

more