Gold Won A Battle, But It Will Lose The Medium-Term War

Omicron gave gold a boost, but business confidence remains high for the next twelve months, which means the USD’s prospects look good, and precious metals will have to find a new low ground.

Despite the USD Index’s recent pullback, the PMs’ performance on Feb. 2 was rather pedestrian. For example, gold and silver rallied by 0.49% and 0.50%, respectively, while the GDX ETF rose by 0.33%. However, the GDXJ ETF declined by 0.41% and hasn’t been able to gain any real traction. Moreover, when we consider the USD Index’s recent decline, the PMs should have rallied more. And since they didn’t, it signals investors’ heightened anxiety. As a result, it’s likely another case of corrective upswings within medium-term downtrends.

Having said that, let's take a look at the situation from a fundamental point of view.

Inflated Optimism

As the PMs attempt to recover their post-Fed losses, their misguided confidence could result in hard landings. Similarly, with investors assuming that the USD Index's best days are in the rearview, it's like it's 2021 all over again.

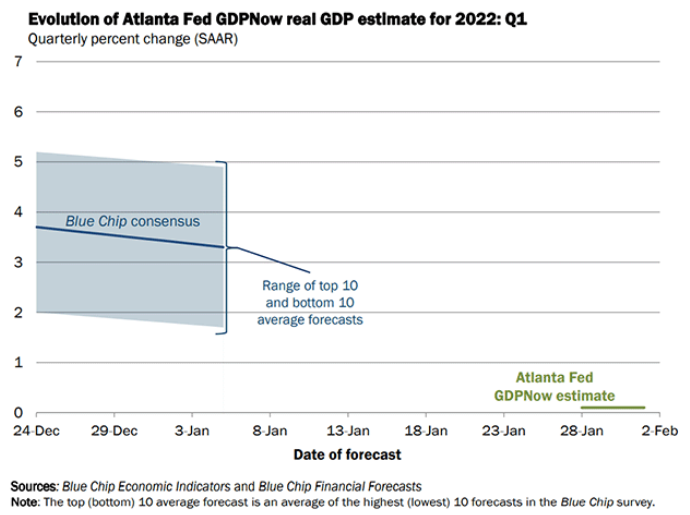

To explain, with the Omicron variant depressing U.S. economic activity, the 'bad news is good news' narrative has spread across Wall Street. For context, the phrase assumes that weak economic data will lead to a more dovish Fed. And with the Atlanta Fed predicting Q1 real GDP growth of only 0.1%, investors believe that potential Fed patience means a weaker USD Index and higher precious metals prices.

Please see below:

To explain, the blue line above tracks the Blue Chip (large investment firms') consensus Q1 GDP growth estimate, while the green line above tracks the Atlanta Fed's Q1 GDP growth estimate. If you analyze the near-flatline, you can see that the Atlanta Fed predicts next to no growth in Q1.

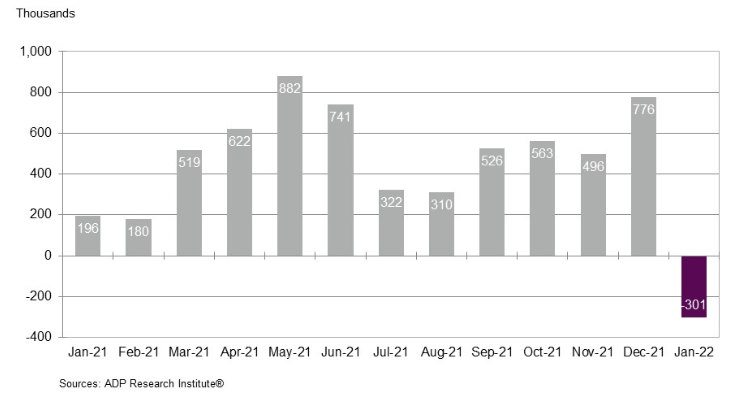

Second, ADP released its National Employment Report on Feb. 2. And with private payrolls declining by 301,000 in January (the purple bar on the right side of the chart below), ADP Chief Economist Nela Richardson said that "the labor market recovery took a step back at the start of 2022 due to the effect of the Omicron variant and its significant, though likely temporary, impact to job growth."

In addition, "leisure and hospitality saw the largest setback after substantial gains in fourth-quarter 2021, while small businesses were hit hardest by losses, erasing most of the job gains made in December 2021." As a result, with economically sensitive sectors suffering the brunt of the Omicron variant's wrath, the 'bad news is good news' narrative has investors positioning for a more dovish Fed.

Please see below:

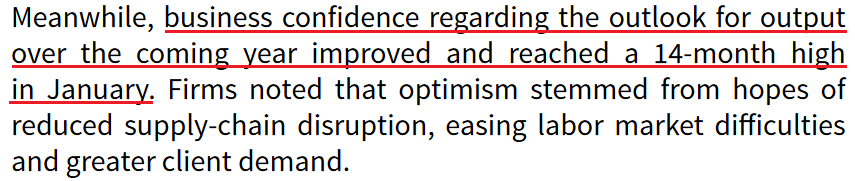

However, the short-term setback doesn’t change the medium-term implications. For example, IHS Markit released its U.S. Manufacturing PMI on Feb. 1. And after the headline index declined from 57.7 in December to 55.5 in January, Chris Williamson, Chief Business Economist at IHS Markit, said:

“The Omicron outbreak has hit manufacturing hard, exacerbating existing headwinds by subduing demand, creating further supply chain issues and causing widespread staff shortages, often through absenteeism due to the surge in COVID-19 infections.”

Despite that, though, business confidence regarding the 12-month outlook hit its highest level in more than a year. As such, Williamson opined that "the current downturn may prove short-lived."

Please see below:

Source: IHS Markit

Thus, while weak short-term data helps the PMs and hurts the USD Index, the Omicron variant's economic impact should decelerate when the warmer weather arrives. Likewise, with roughly 800 of the largest U.S. manufacturers sharing this sentiment, the 2021/2022 theme of 'USD Index up, the PMs’ should be down over the medium term.

On top of that, with inflation still an issue, one-half of the Fed's dual mandate is in the danger zone. For example, the Institute for Supply Management (ISM) released its Manufacturing PMI on Feb. 1. And while the headline index decreased from 58.8 in December to 57.6 in January, the report revealed:

“The ISM Prices Index registered 76.1 percent, an increase of 7.9 percentage points compared to the December reading of 68.2 percent, indicating raw materials prices increased for the 20th consecutive month, at a faster rate in January. This is the 17th month in a row that the index has been above 60 percent…. In January, 17 industries reported paying increased prices for raw materials.”

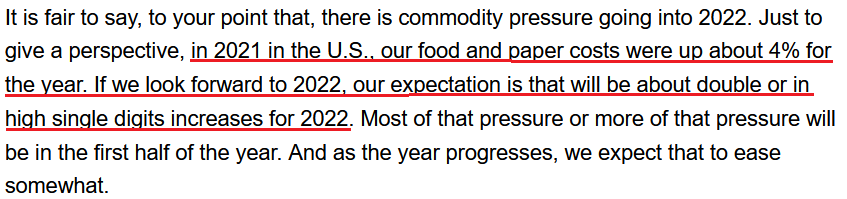

In addition, McDonald’s – the world's largest fast-food restaurant chain – released its fourth-quarter earnings on Jan. 27. CFO Kevin Ozan said during the Q4 conference call:

“In 2022, we anticipate our operating margin percent will continue to be in the low to mid-40s range as strong top-line momentum and minimal other operating income will be hampered by significant commodity and labor inflation in the near term.”

Moreover, Ozan said that McDonald’s input costs may “double” in 2022.

Source: McDonald’s/Seeking Alpha

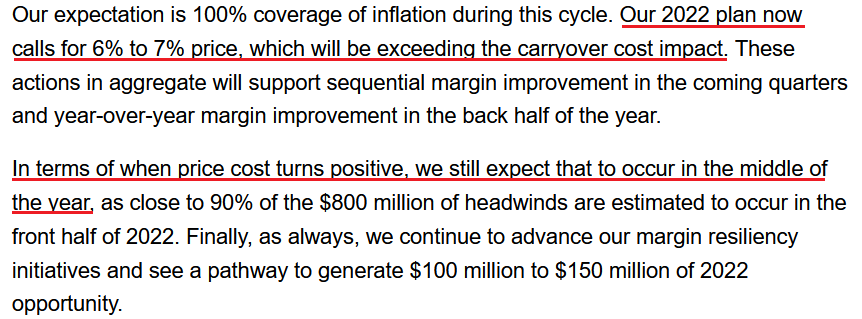

If that wasn’t enough, Stanley Black & Decker released its fourth-quarter earnings on Feb. 1. For context, the Fortune 500 company manufacturers hand, power, and industrial tools, and provides security services.

Moreover, CFO Don Allan said during the Q4 conference call that “the operating margin rate for the [tools & storage] segment was 11.4%, down versus last year as pricing benefits were more than offset by inflation, higher supply chain costs, growth investments in volume.” However, looking to avoid a repeat performance in 2022, management stated:

Source: Stanley Black & Decker/Seeking Alpha

As a result, while investors assume that weak short-term economic data handcuffs the Fed, the medium-term issues are far from resolved. And with major U.S. corporations still sounding the inflationary alarm, price hikes should continue until their input costs come down. As a result, the ‘bad news is good news’ narrative is much more semblance than substance.

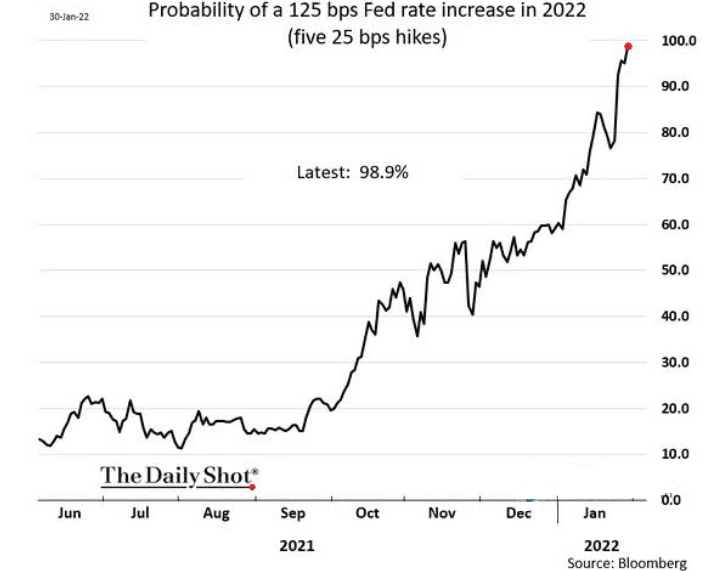

Finally, while investors hope the Fed will perform a dovish 180, the futures market isn’t buying the hype. And with the probability of five rate hikes by the Fed in 2022 hitting nearly 99% on Jan. 30, the short-term narratives impacting the PMs and the USD Index should reverse sharply over the medium term.

The bottom line? While the USD Index has suffered recently, the greenback’s fundamentals remain robust. Moreover, with investors’ upside-down narrative akin to a short-term reprieve, the medium-term implications remain unchanged. To that point, after the Delta variant’s July/August outbreak led to weak U.S. nonfarm payrolls in September, I wrote the following on Sep. 8:

With U.S. nonfarm payrolls coming in at 235,000 vs. 720,000 expected on Sep. 3 (though, the weakness was largely expected due to the disruptions from the Delta variant), the USD Index and the U.S. 10-Year Treasury yield should have suffered the brunt of investors’ wrath.

Weak economic data often elongate the Fed’s taper timeline. And with that, bullish bets on the U.S. dollar and U.S. Treasury yields often unwind when Fed tightening is perceived as delayed. However, whether the taper is officially announced in September, November, or December (which is largely immaterial), investors realize that a one or two-month wait doesn’t derail an investment thesis.

As a result, we find ourselves in the same situation now. However, despite the short-term implications that materialized in September, the USD Index is higher now, and the GDXJ ETF is lower now. Thus, similar outcomes should emerge this time around.

In conclusion, the PMs were mixed on Feb. 2, and the GDXJ ETF was the lone member in the red. And while the USD Index remains under pressure, it’s likely another rerun of 2021. As a result, while the PMs may win the short-term battle, the USD Index should win the medium-term war.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more