Gold: The 2021 Annual Target Of $2164 Has Been Activated

Fundamentals

From the end of May, we came down aggressively to $1761 on the comments made by Chair Powell at the May Fed meeting about possible tapering. The market appears to have discounted all the talk about stimulus and the threat of inflation exploding. The markets are saying that the consequences of printing the amounts of money that the government is printing are unsustainable.

Image Source: Pixabay

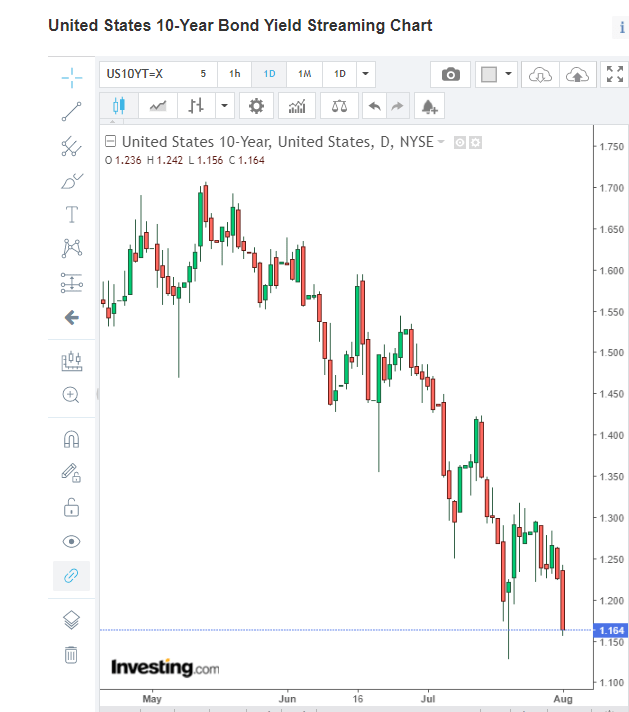

Congress is looking at approving another $1 trillion bill for infrastructure and more is on the way. This printing of money looks like it will continue. Based on the 10-year note, interest rates are not going up. The ten year has gone from 1.77 to about 1.16%. If it closes below the 1% yield, it will provide the fuel for a rally in gold and silver, and commodities in general, which could be explosive. There is a high probability that as we move into the next few months, we could see gold hit $2164, as predicted by our yearly gold report from last October.

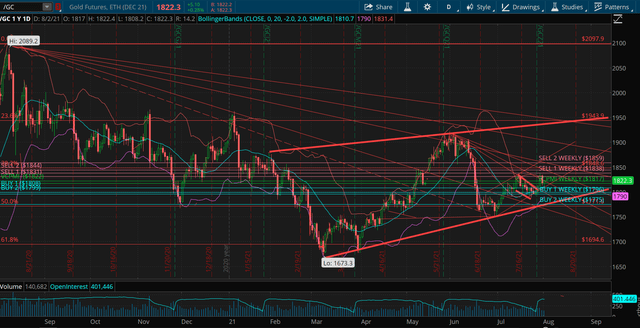

In October 2020, we published our gold annual targets based on our proprietary Variable Changing Price Momentum Indicator (VC PMI).

Courtesy: ema2trade.com

Back in October 2020, the 360-day price trend momentum was at $1771, which was bullish. The VC PMI for the 360-day cycle of $1810 was also bullish. A close below $1810 negates this bullishness to neutral. If long, take profits at $2164 to $2442. With the market closing at about $1888 at the time the report was published, it gave us a pretty good picture in terms of the different filters that the VC PMI uses. The first filter is the 360-day trend momentum. It is the annual average of $1771. This identifies the relationship with the 9-month cyclical moving average, which was at $1771. Since the close was above the average price, we came into this year of 2021 with a bullish trend momentum. Regardless of any fundamentals, this gave us a probability model of the extremes above and below the mean and the extreme levels of speculation.

The VC PMI is a mathematical probability model that identifies the extreme levels above and below the average price. Once we identify the average price as $1810, we can then extrapolate the extreme levels above and below that price. That shows us when the market reaches an extreme level, when it is most likely to then revert to the mean. It is never 100% certain, but it is highly probable.

Since we published the report at the end of September 2020, the direction and trading instructions have been pretty accurate. It has not quite completed the target of $2164, which is the target for the 360-day cycle. The Sell 1 level is $2164 and the VC PMI Sell 2 level is $2442. Below the mean, the VC PMI Buy 1 level is $1532 and the Buy 2 level is $1178. If the market trades above the mean, watch for the market hitting the sell levels to go short; if the market trades below the mean, then watch for the market hitting the buy levels to go long. The Buy 1 and Sell 1 levels have a 90% and the Buy 2 and Sell 2 levels have a 95% probability of the market reverting from those levels to the mean.

Courtesy: TD Ameritrade

The market has reverted from a 61.8% retracement to around $1673. This seems to be the first level or bottom of this current correction that has occurred since mid-May. A $1914 high was made and we have been in a corrective pattern ever since. We are trading close to $1810 and for those who feel that they might have missed the move, this could be a great opportunity to enter the gold market since that $1919 level. This has been a counter-trend correction. The market is in a fair value area of around $1810 with the annual target of $2164. We appear to be looking at a five-wave pattern developing. The low on March 8 to the high on May 24, of $1915 is the first leg. This also established an uptrend resistance level and an uptrend pattern.

Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives. wrote this article myself, and it expresses my own ...

more