Gold, Silver & Stock Liquidation Continues

Image Source: Pixabay

I don’t know how much this helps gold and silver investors on a day like today, but if it makes you feel any better, just about everything was getting clobbered this week.

Gold and silver were no exception again on Friday, as the vicious selloff continued in the precious metals as well.

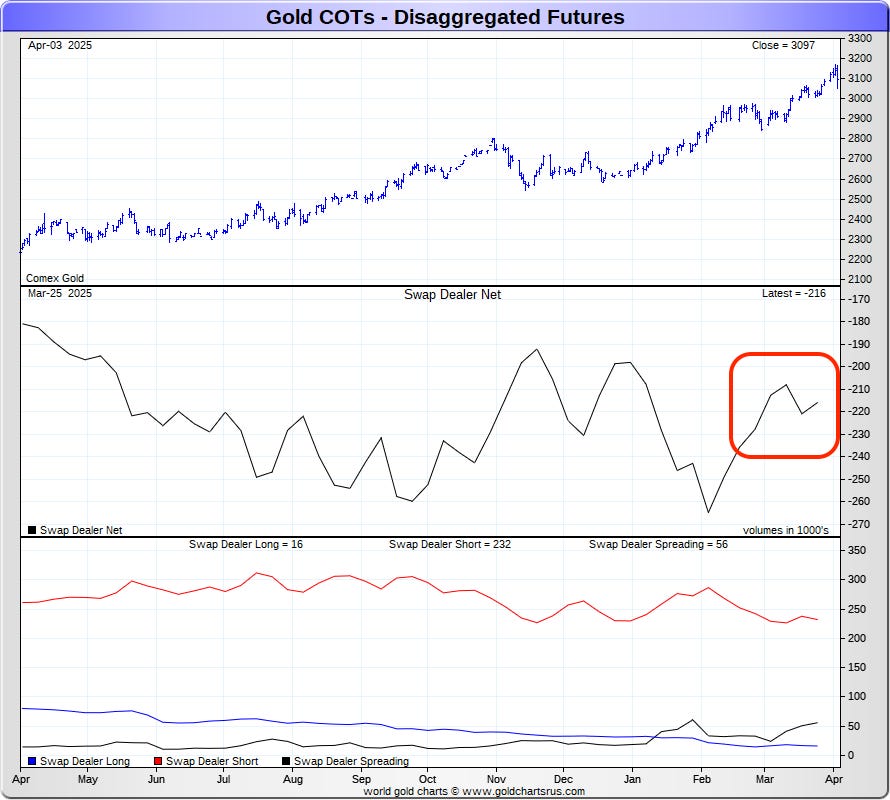

The gold futures are now down $118 since the tariff announcement on Wednesday, although still comfortably over the $3,000 mark at $3,056 per ounce.

(Click on image to enlarge)

We’ll find out next week how many more contracts can be liquidated on the decline, but to see a selloff like this, yet gold still holds the $3,000 mark seems like the kind of thing that has some psychological market impact.

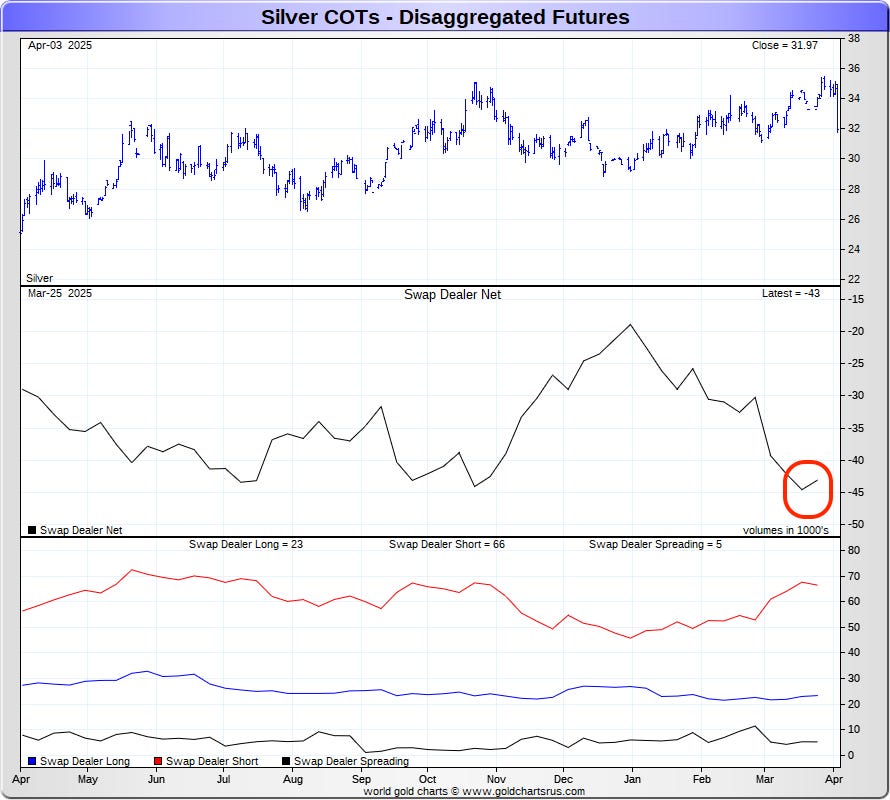

Silver on the other hand is now down $5.57 from where it was trading when the tariffs were announced on Wednesday, falling from $35.10 down to $29.53.

(Click on image to enlarge)

One can only imagine the stops that were blown through, and the cascade of algorithm trading that piled on top of that.

And I know I shared this one earlier this week, but it’s really that important, especially if you haven’t seen it before. Because here former CFTC commissioner Bart Chilton explains clear as day what’s happening on some of the events like what we saw this week, when the price falls sharply, and the same banks that were short are buying the contracts back.

Keep in mind that the CFTC would later go on to fine JP Morgan $920 million for exactly what Chilton described.

Yet aside from how things theoretically ‘should be,’ it still will be fascinating to see how much the bank short positions were reduced on the watershed declines this week.

The banks had already reduced their collective gold and silver short positions over the previous reporting week, and you’d have to guess they’ve pared them down significantly further over the past 3 days.

(Click on image to enlarge)

Here’s the picture in silver.

(Click on image to enlarge)

Now as someone who used to focus a lot on market manipulation, and who has in past years tried to see both sides of the argument, I try to avoid thinking that every time the price is down it’s because the banks did this or that.

But with that said, it sure would be fun to see inside some of the trading records, and get a glimpse of whatever the Plunge Protection Team was doing over the past few days. Of course we never will (at least theoretically:), but this is the first time in a while where something has felt like more than a bit suspicious.

Hey…what do I know….but at least in case you’re wondering my gut reaction, well there you have it. Something about it feels reminiscent of the $7 price plunge back in 2011, that was the last time we saw silver trade above $49.

Of course amidst the price decline, it’s not exactly as if the underlying conditions are calming down at all.

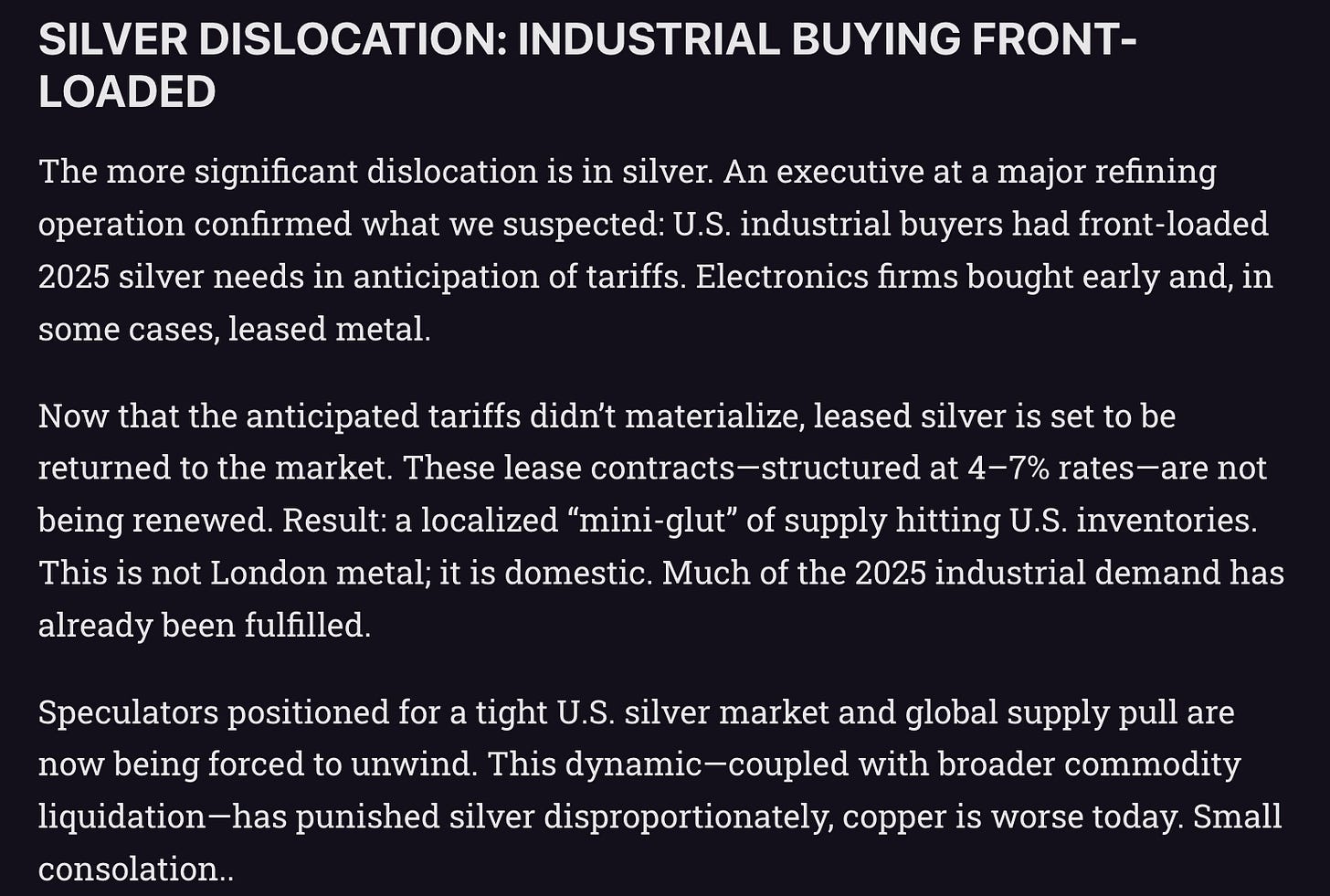

Here’s what Vince Lanci of Goldfix was reporting today:

In case you were wondering what Robert Gottlieb, formerly of JP Morgan had to say about today’s events, here’s his latest commentary.

It's also interesting to think back to a week ago when Robert posted about how one of the banks’ silver short positions had become extremely large, and the bank ‘may have become exposed’, and then a week later we see silver drop $5 on news that was largely already expected and priced in.

So make of that one what you will.

Although consider what Luke Gromen has to say about this week’s events.

It also sounds like the Germans weren’t particularly impressed.

At the same time, President Trump is now calling for the Fed to lower interest rates.

So much for that whole government and central bank independence, right?

Can you start to get a feel for where this is all headed yet?

Although to save the best for last, of course we have Treasury Secretary Scott Bessent’s absolutely stunning comments to Tucker Carlson, about why all of the gold and silver has flowed from London to New York, even as there were never any threats of new tariffs between England and the US.

I know it’s been a long week with a rollercoaster of emotions.

But selloff or not, your long-term thesis on gold and silver is either really right, or really wrong. What happened on the COMEX over the last few days won’t change that. And perhaps a month from now we’ll be able to see if what we saw this week was the equivalent of 2020’s silver price dip below $12 per ounce.

More By This Author:

COMEX Sees Massive Amount Of Gold Stand For Delivery With 'Reciprocal Tariffs' On Deck

Gold Price Sets Another New Record, Silver Drops Under $35, & EFP Premiums Spike Again

Silver Alert On Bank Short Positions -"Someone May Be Very Exposed"

Disclosure: None.