Gold Secular Bull Depends On This

I have written about this topic quite a few times. I am writing about it again today because it will become an extremely important indicator for precious metals within the next 12 months.

Gold has enjoyed a great rebound and has approached its 2020 and 2021 highs. But the stock market has also rebounded and has outperformed Gold strongly in the past few weeks.

The latest rebound in the stock market has removed it from the course of what I deem a mega-bear market. Nevertheless, economic data is slowly getting worse, and a recession and rate cuts are, eventually, likely.

In the meantime, to get a better picture of precious metals’ current standing, we should consult history.

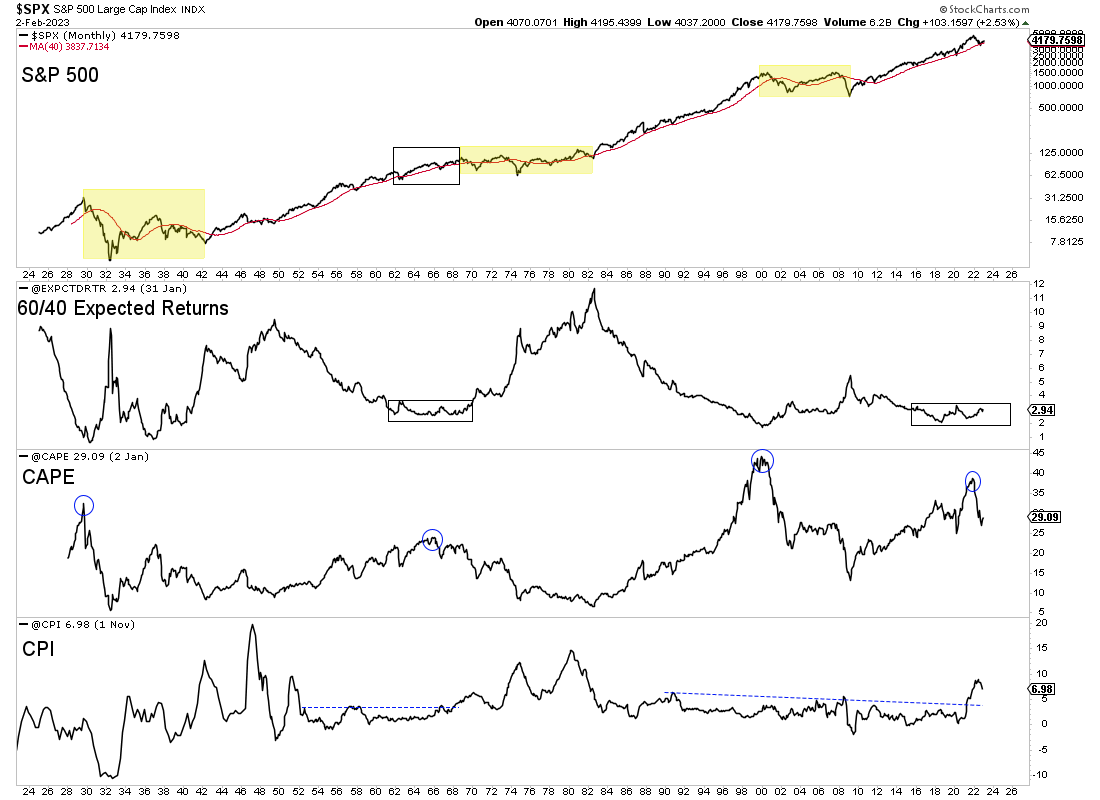

The chart below plots the S&P 500 with our 60/40 expected returns data set, the CAPE ratio (10-year PE Ratio), and CPI Inflation. The yellow is the secular bear markets.

Today appears much like the mid-1960s. In both cases, expected returns were very low, valuations were historically extreme, and the inflation rate had just broken out after being dormant for many years.

(Click on image to enlarge)

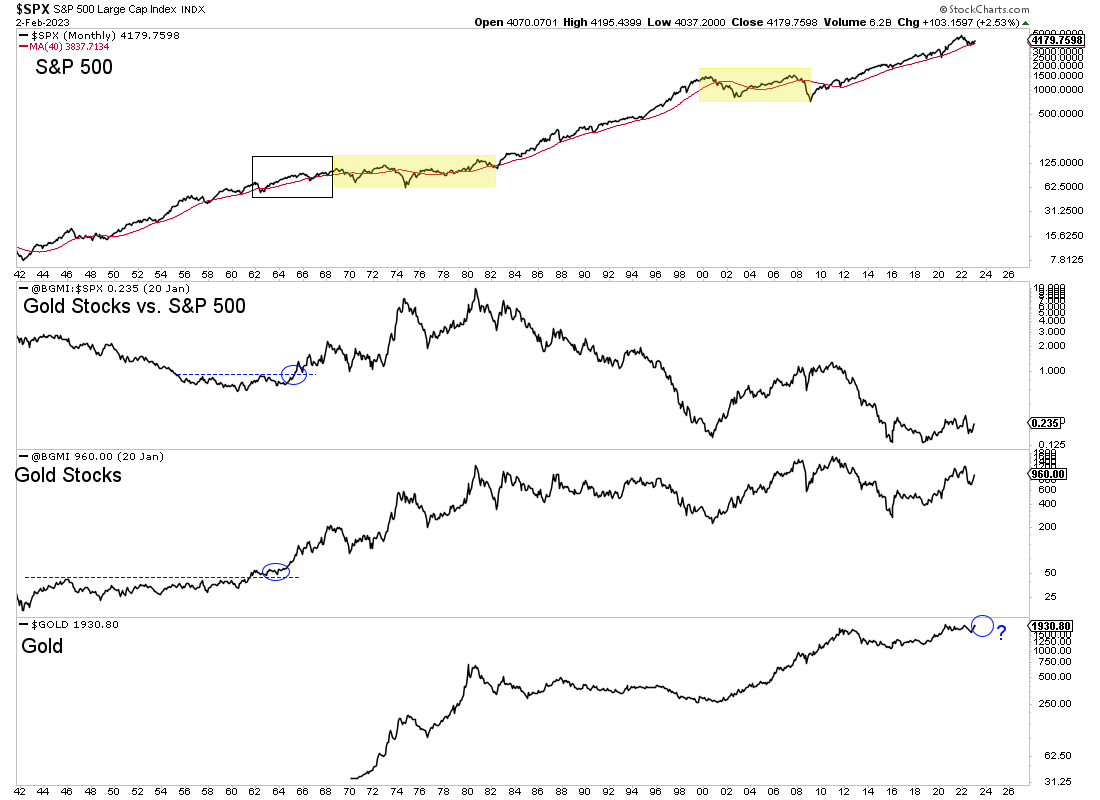

Gold today could be where the gold stocks were in the early to mid-1960s.

In the chart below, we plot the S&P 500, the gold stocks against the S&P 500, the gold stocks, and at the bottom, Gold. The gold stock data is from the Barron’s Gold Mining Index.

In the 1960s, the gold stocks were the proxy for precious metals, as one could not own Gold.

The gold stocks made a multi-decade breakout in 1964, which was powered by the ratio (gold stocks against the S&P 500) breaking out from a 9-year-long base.

(Click on image to enlarge)

Gold today could be in a similar position.

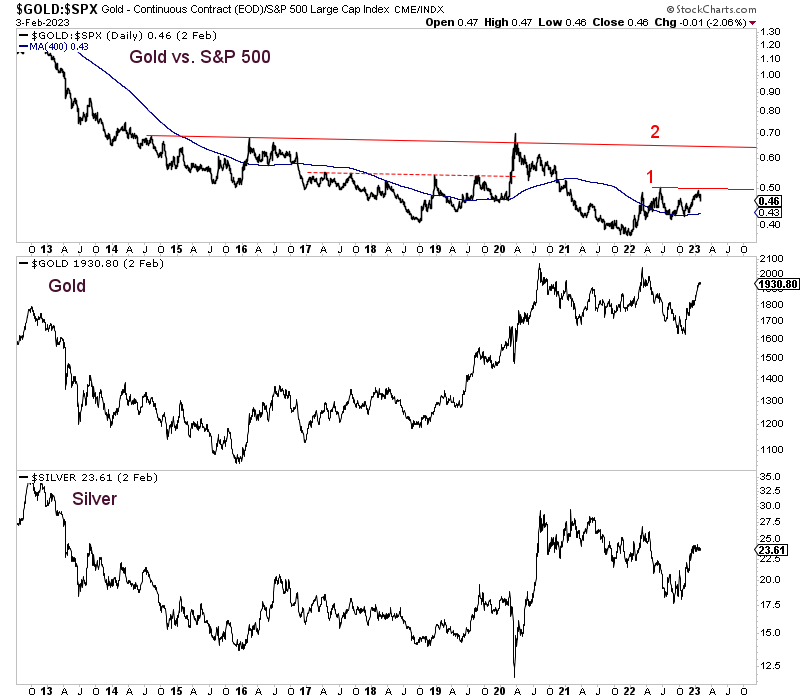

For precious metals to embark on a real and secular bull market, Gold against the S&P 500 must break above its 2016 and 2020 highs, signified by the “2” in the chart below.

If the Gold to S&P 500 ratio can break above 1, Gold should move above $2100 and Silver to at least $30. However, breaking above 2 would confirm a new secular bull market in precious metals.

(Click on image to enlarge)

Last week we wrote that there were signs that precious metals would correct.

With the correction underway, keeping an eye on the stock market will be important. The stronger the stock market and the better the economic data, the longer the precious metals will correct.

If the stock market reverses lower before spring and economic data falters, precious metals will quickly sniff out the approaching rate cuts.

Even in a mild recession, the Fed will have to cut rates, and Gold should climb to at least $2400.

More By This Author:

Fed Week & Monthly Close Could Mark Turns For Gold & Silver

Gold Sentiment: Room For More Bulls

Gold & Silver Vs. Stock Market Update

Disclaimer: TheDailyGold.com and TheDailyGold Premium are not investment advice. The website, email newsletter and premium ...

more