Gold Sentiment: Room For More Bulls

Image Source: Unsplash

Last week we wrote about the propensity for mild corrections in the early stages of gold bull markets. Corrections in gold tend to be limited to 8% to 10% at the most, while corrections in the gold miners tend to be limited to 15%. The exception is when you get a vertical recovery, like the one from the Q4 2008 low in metals and miners.

Neither gold nor gold stocks have moved far enough to anticipate a sharp correction, and sentiment-related indicators reveal only a moderate increase in bullish sentiment in the face of a $300 rebound in gold.

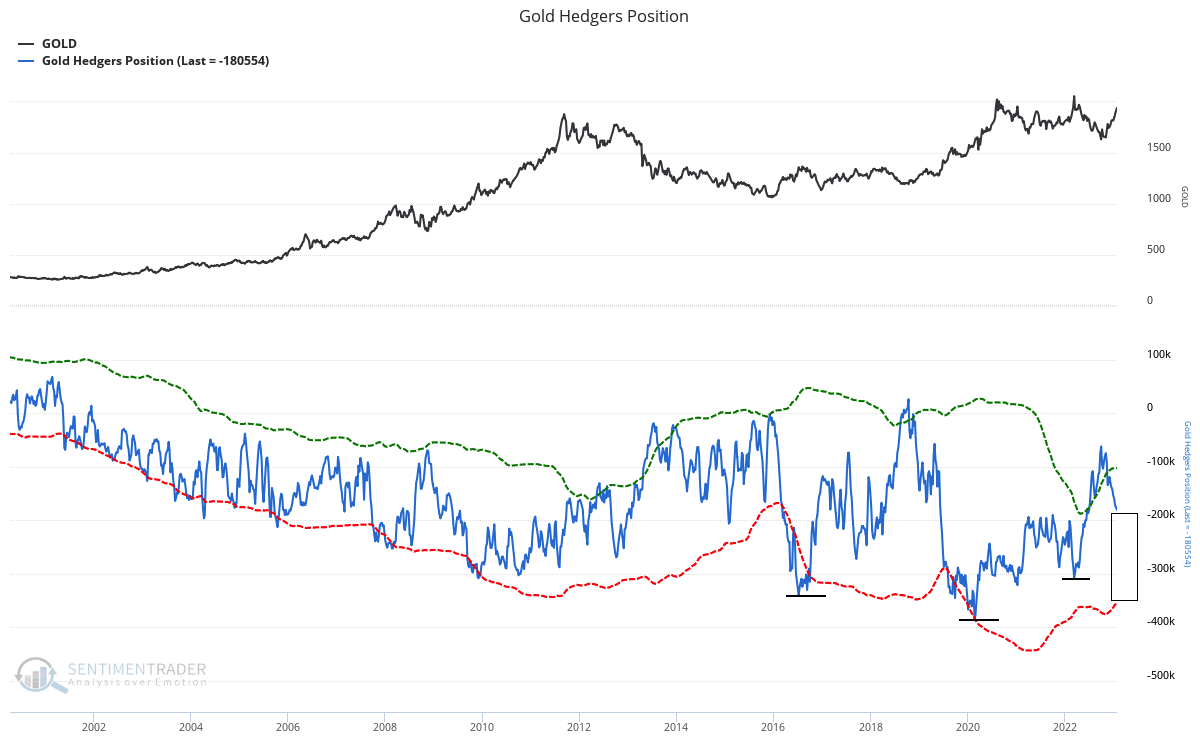

I waited until now to write this article because I thought there may be a big increase in the net speculative position. I was wrong. Gold has traded within 6% of the all-time high, yet the net speculative position remains below 200 thousand contracts and well below positioning at the 2022 peak, the 2019 gold breakout, and the 2016 peak.

As of Tuesday, the net speculative position was 180 thousand contracts. Roughly nine months ago, with gold trading above $2000/oz, it was over 300 thousand contracts. During the 2019 breakout, the position nearly reached 400 thousand contracts.

Chart from SentimenTrader.com, with my annotations

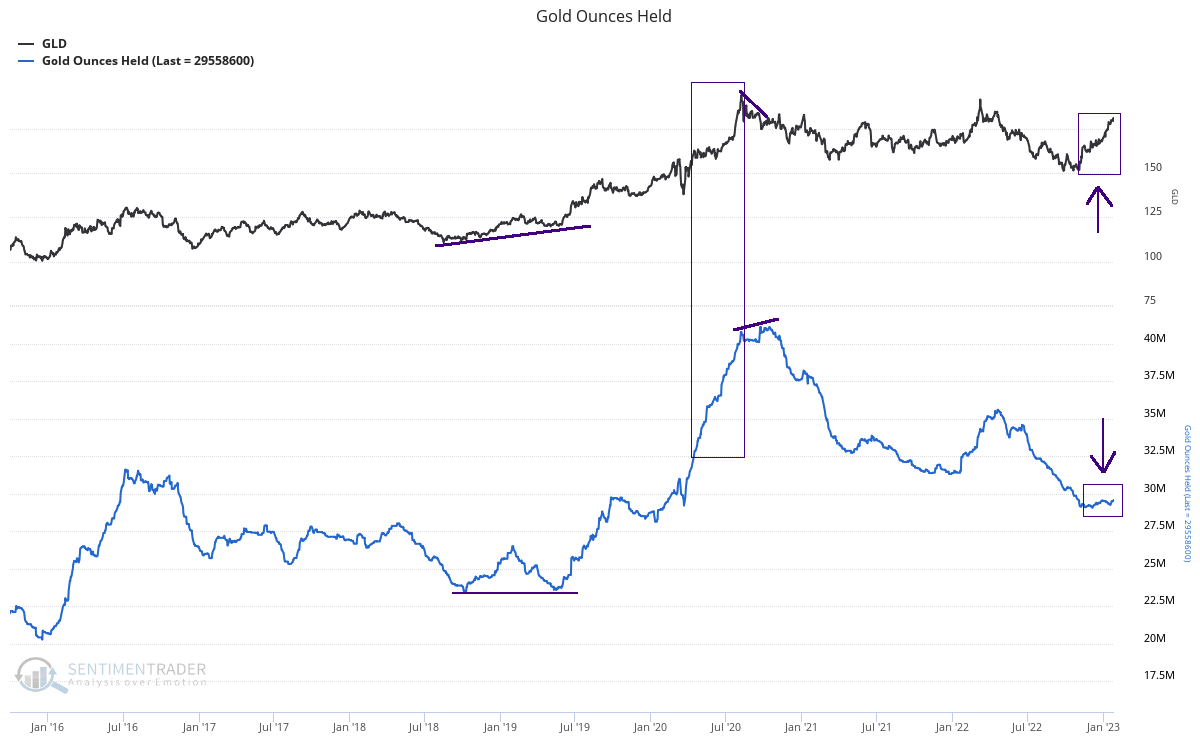

When the gold prices rises, ETF demand usually increases. The chart below plots the gold price and the ounces held in the GLD ETF.

The number of ounces held in the GLD ETF has barely moved during this rebound. There was limited demand right before gold’s breakout in 2019 and excessive demand leading up to gold’s peak in August 2020.

Chart from SentimenTrader.com, with my annotations

However, there are signs the market should correct. Silver, which led this rebound, has barely moved in the last five weeks. Gold is approaching stiff resistance, and it is due for a rest. That could begin at the $1950 or $2000 levels.

If gold is in a new bull market, the correction will be mild, as history and some sentiment indicators argue. There’s no need to worry about gold being too overbought or gold bulls being too exuberant, however.

If gold were to correct more than expected or rest for two quarters, it would be due to a negative change in the fundamentals. An example would be the economy avoiding recession and the S&P 500 rallying back to its all-time high. While I anticipate gold will correct very soon, I do not see either of those things happening.

More By This Author:

Gold & Silver Vs. Stock Market UpdateTargeting $1950 For Gold & Bit More Upside For Gold Miners

Post-Bottom Sentiment & Sentiment Pre-Breakout In Gold

Disclaimer: TheDailyGold.com and TheDailyGold Premium are not investment advice. The website, email newsletter and premium ...

more