Gold: Ready For Take-Off, Or Is It Another Big Flake Off?

Fundamentals

Fundamentally, gold and silver have a bullish future. There are shortages in both sectors, which should drive prices higher. They are also attracting buyers with prices moving up in gold and silver. We recommend holding onto your long positions in precious metals.

Image Source: Unsplash

Monetary policies also appear to be bullish for precious metals. Gold is a flexible instrument and has been a currency for thousands of years. Fiat paper currencies, such as the US dollar, have been losing value since the US went off the gold standard in 1971. The entire economy is now based on fiat money and debt. The economy is sustained by debt provided by central banks. What we saw last March was the Feds opening up floodgates of easy money. Now more and more cash is chasing a finite number of real assets, such as real estate, fine art, precious metals and commodities.

Courtesy: TDAmeritrade

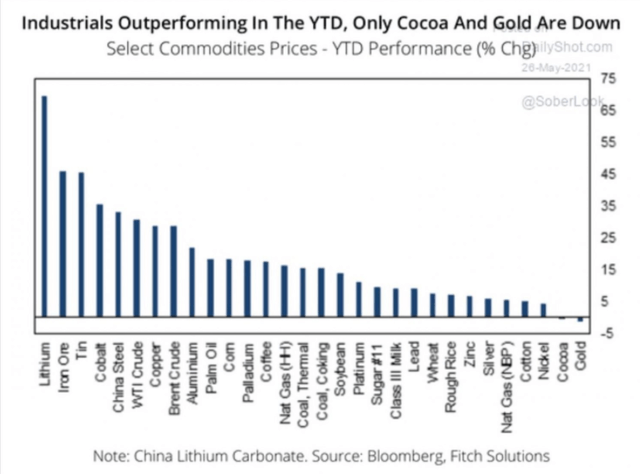

After gold hit $1167 it shot up above $2089 on the basis of the Fed printing more and more money through stimulus packages. The Fed is creating money out of thin air and, in doing so, devaluing the US dollar, as well as the assets valued in that currency. Inflation is already here if you look at commodities. Corn, wheat and oil are all shooting up, but those increases are caused by the continuing devaluation of the dollar and more dollars chasing fewer real assets.

Globally, central bankers have accelerated the amount of money that is coming into the system. We are looking at a potential situation like Japan in the 1980s, which went into a stagnant economy for more than twenty years. No matter how much stimulus the government provided, people did not spend money and Japan was in a situation of stagflation for two decades.

The Feds face a painful dilemma. They have to keep the economy going, provide stimulus, all while not raising interest rates. If they raise interest rates, then the massive amount of debt will lead to defaults rippling across the world. The problem is that, with interest rates already so low, the Feds don't have many options to influence the economy. If interest rates rise even a tiny bit, the cost of that debt will explode and defaults will mount quickly with every percentage increase in interest rates. Even a three or four percent rate increase will devastate the global economy and will be unsustainable.

Courtesy: TDAmeritrade

With fiat currencies losing value, virtual currencies have gained a great deal of attention. Bitcoin (BTC-USD) and Coinbase (Nasdaq: COIN) and others are gaining a great deal of interest. We trade GBTC the Grayscale Bitcoin Investment Trust as a proxy for Bitcoin. It is regulated, unlike Bitcoin, so we are more comfortable trading the trust rather than Bitcoin itself. We may be entering a period like the 1970s, with inflation hitting double digits, 14%, and gold rising fast. Today, commodities are rising in price, and we could be seeing a major move up in all commodities.

Some argue that we are about to enter a period of explosive economic growth. We believe such statements are overblown. We are seeing some economic growth, but it is based on fiat money and the printing of fiat money. It is not real economic growth. It does not appear that such a system can last long, since it is not based on real economic factors. The government can't continue to support everyone and everything indefinitely. It seems that we will see a spike in interest rates. In order for the Fed to bring down interest rates in the future, they will have to allow inflation to rise now and interest rates to also rise. Then the Fed will have the ability to lower rates from those new higher levels. To control interest rates, the Fed will allow short-term rates to rise while capping long term rates on the 30 year bond. Long term rates cannot go up or dominos will fall and we will be in a catastrophe. The economy is still fragile and it is possibly getting worse as the debt increases. Over the next few weeks we face the prospect of more inflation, interest rates rising, and where the US dollar is heading. We are beginning to see a premium in the gold and silver markets, as well as in virtual currencies because of the fear that the US dollar will decline even further. When such fears exist, people run to hard assets, like real estate and precious metals. This is not temporary. Real estate is not going to come down any time soon, unless we begin to hear the language changing from the government in terms of interest rates. In the meantime, stay long precious metals.

Gold and Silver

Courtesy: TDAmeritrade

Gold is at $1905.60. It is up about 70. It is all over the place today. Silver is at $28.04. We have been testing the Variable Changing Price Momentum Indicator (VC PMI) average price of $1899 in gold for the week. The VC PMI daily average for today is $1905. Since last night, gold has traded toward the weekly average of $1899. By trading below the daily average, it activated a bearish trend momentum. But then it activated a bullish weekly trend momentum, which negated the daily bearish momentum. Now is has a daily and weekly bullish trend momentum. The daily VC PMI Sell 1 target is $1916.

Courtesy: TDAmeritrade

Silver has penetrated the VC PMI weekly average price and by trading above it, has activated a weekly bullish trend momentum. The initial target is $28.21, which is the daily average price. If we close above that, then we will have a daily and weekly bullish trend momentum. Right now we are neutral, unless silver closes above $28.21.

By trading below the average prices in gold and silver, there is a 50/50 chance of the markets going up or down, so we wait to see when the markets reach an extreme above or below the average price, which provide much higher probability trades.

We appear to be breaking out of an upward channel that started at around $1673. The weekly upper range target is $1939. For the rest of the week, these targets potentially could be completed, which would match the Sell 2 daily of $1930. We are entering what the VC PMI identifies as a high probability area where supply should come into the market.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company ...

more