Gold Price Unchanged Under $2,000 After PMI Data

Image Source: Pexels

Gold price slipped lower after reaching today’s high of $1,998. The metal is trading at $1,993 at press time. The bias remains bullish despite minor corrections.

Gold lost altitude as the US dollar rebounded after the Canadian inflation data release and the FOMC Meeting minutes.

Yesterday, Greenback received a helping hand from the Unemployment Claims and the Revised UoM Consumer Sentiment.

Today, the US banks are closed in observance of Thanksgiving Day, so the volatility could be low during the US session.

Earlier, the UK Flash Manufacturing PMI came in at 46.7 points above 45.0 points expected, while the Flash Services PMI jumped to 50.5 points, confirming expansion again.

Furthermore, the German and Eurozone manufacturing and services sectors remain in contraction territory.

Still, despite high-impact data publication, the XAU/USD changed little in the short term. New Zealand will release the Retail Sales and Core Retail Sales data tonight. The economic figures should bring some action.

Tomorrow, the US Flash Manufacturing PMI and Flash Services PMI represent high-impact events. In addition, the Canadian retail sales data could bring life to XAU/USD.

Gold Price Technical Analysis: Challenging Dynamic Support

(Click on image to enlarge)

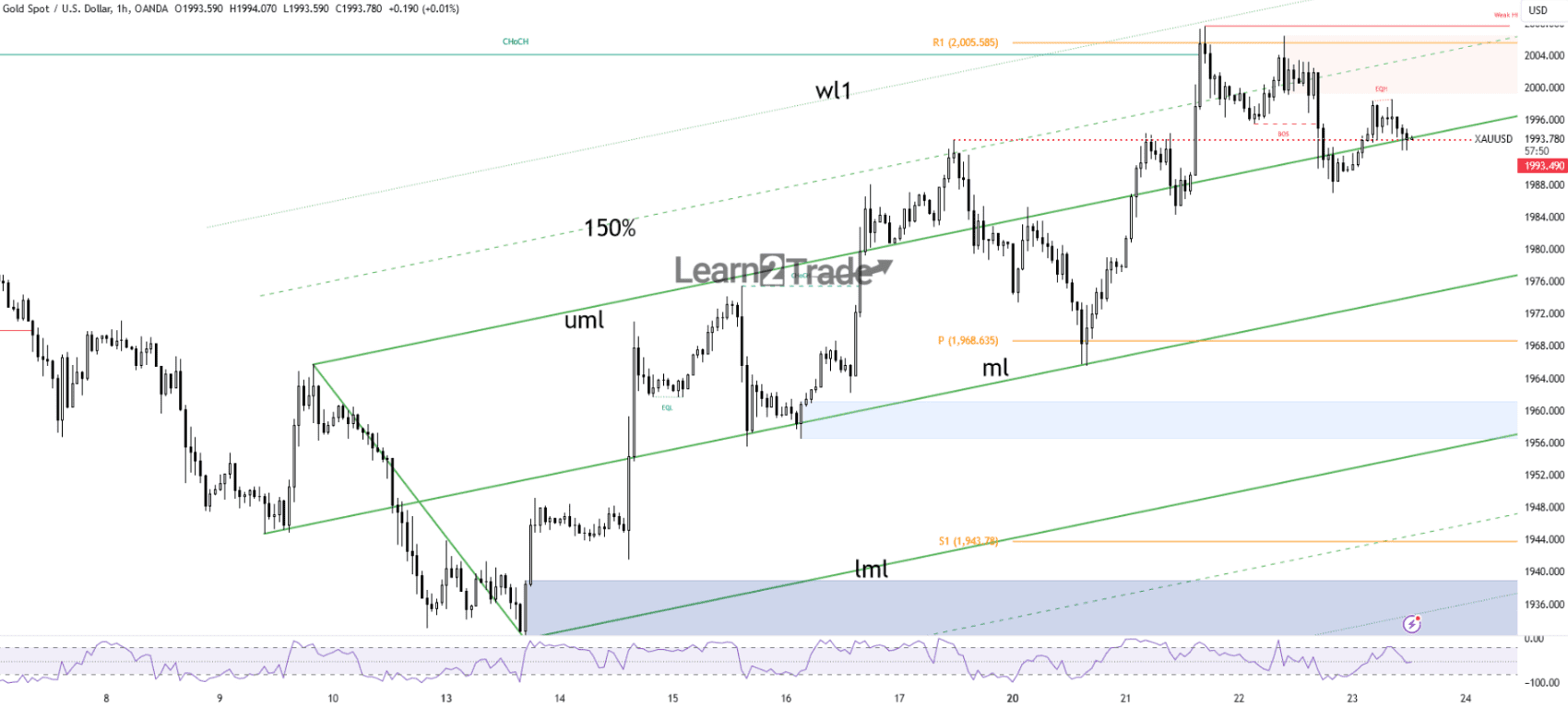

Gold price hourly chart

As you can see on the hourly chart, the price found resistance at the weekly R1 (2,005). Now it has turned to the downside. The false breakouts confirmed exhausted buyers and an overbought situation.

Now, it challenges the upper median line (uml), representing dynamic support. If it stays above it, the XAU/USD could resume its growth anytime. On the contrary, dropping and stabilizing below it may trigger a larger downward movement.

More By This Author:

GBP/USD Forecast: Pound Retains Bid Tone At 10-Week Top

EUR/USD Price Slips Below 1.09 As Market Awaits FOMC

USD/CAD Price Analysis: Loonie Loses Strength As Inflation Dips

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more