EUR/USD Price Slips Below 1.09 As Market Awaits FOMC

The EUR/USD price went down, trading at 1.0899 at press time, way lower than yesterday’s highest point of 1.0963. The downtick move is attributed to the stronger US dollar.

The Greenback got stronger after Canada’s inflation numbers came out. The CPI and Core CPI showed higher inflation than last month’s reading. Even though US Existing Home Sales were not as good as expected, the US dollar is still strong in the wake of FOMC Meeting Minutes. The FED said they’re keeping the same monetary policy and won’t change the interest rates.

Today, US data could drive the market. The Unemployment Claims may drop from 231K to 226K last week. Also, Revised UoM Consumer Sentiment could go up from 60.4 to 61.1 points. Also, Durable Goods Orders might show a 3.2% drop after growing by 4.6% last time. Core Durable Goods Orders might show a 0.2% growth.

On the other hand, the Eurozone will release the Consumer Confidence indicator, which might stay at -18 points.

EUR/USD Price Technical Analysis: Down Leg

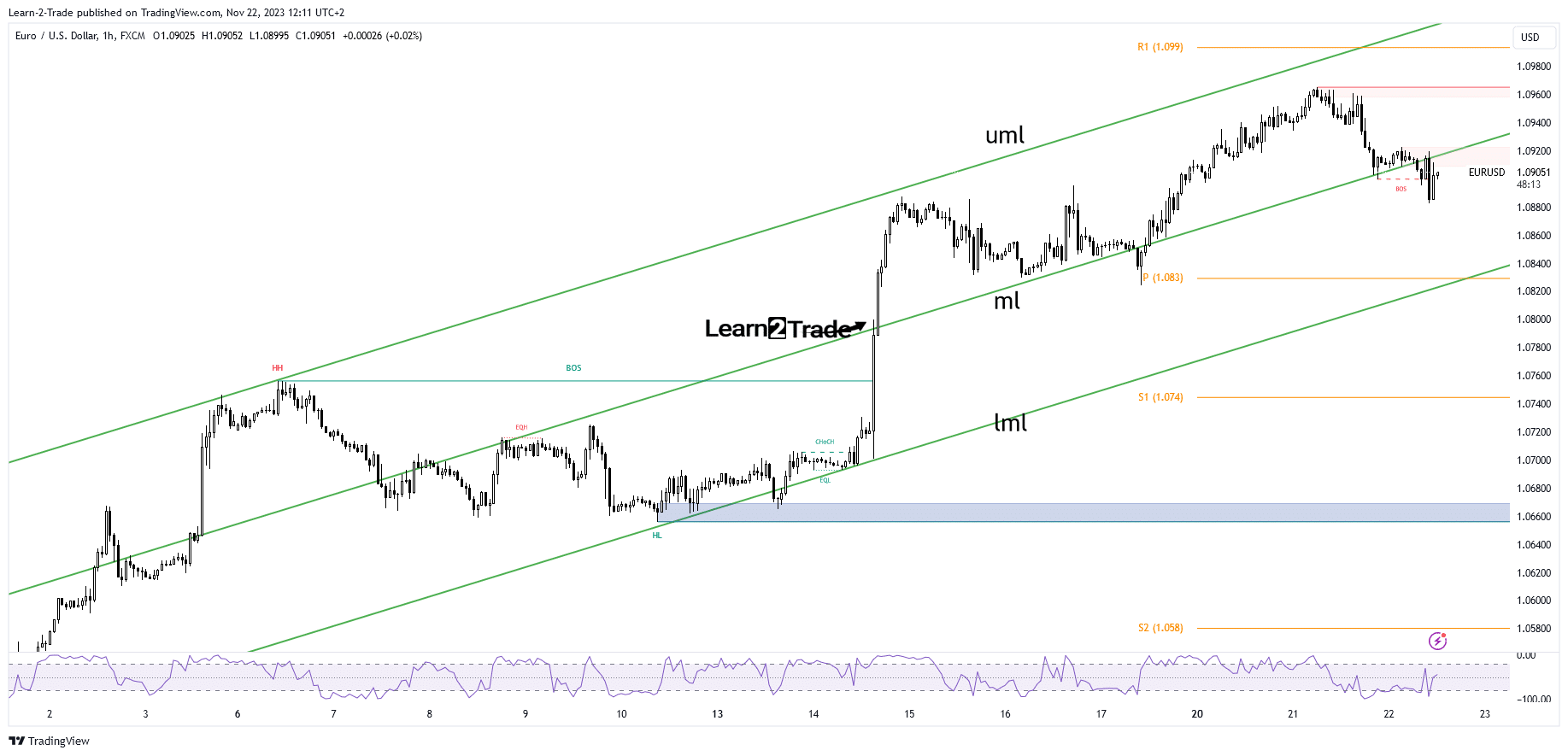

EUR/USD hourly chart

The currency pair failed to retest the ascending pitchfork’s upper median line (uml), signaling exhausted buyers. The pair has now dropped below the median line (ml), representing dynamic support.

After its sell-off, the price could retest the median line (ml) before extending its sell-off. The downside obstacle turned into an upside obstacle, so false breakouts may result in a downside continuation. The lower median line (lml) and the weekly pivot point of 1.0830 represent key targets if the rate continues to drop.

More By This Author:

USD/CAD Price Analysis: Loonie Loses Strength As Inflation DipsUSD/JPY Outlook: China’s Yuan Guidance Weakens The Dollar

GBP/USD Outlook: Pound Peaks at 1.25 Amid Softer Dollar

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more