Gold Price Forecast: XAU/USD Slides Below $1930, Erasing Its Earlier Gains Ahead Of FOMC’s Decision

Image Source: Pixabay

Gold price retraces from the day’s high and failed to hold to earlier gains after a busy US economic calendar released its first tranche of data, which was worse than estimated. In addition, a soft US Dollar (USD), capped the XAU/USD’s fall, while US Treasury bond yields continued to push downwards. At the time of writing, the XAU/USD exchanges hands at around $1925.

US economic data was mixed ahead of the FOMC’s meeting

Wall Street remains depressed ahead of the Fed’s monetary policy decision. US economic data showed that the labor market continues to ease as the ADP National Employment Change, which reports private hiring revealed that companies hired 106K employees, well below the 178K foreseen. Later, the JOLTs Job Openings report showed that vacancies rose to 11.01M exceeding estimates of 10.25M.

In addition, factory activity was updated by two firms, showing that manufacturing activity remains in contractionary territory. The S&P Global Manufacturing PMI for January jumped by 49.9 above the 46.8 estimates, better than expected but at recessionary territory. Elsewhere, the ISM Manufacturing PMI for January plunged to 47.4, below December’s 48.4, and dropped for the third straight month pushing the index to its lowest level since May 2020.

Aside from this, Gold traders remained laser-focused on the US Federal Reserve decision. Traders expect a 25 bps rate hike and further guidance from the US central bank. At around 13:30 GMT, the Fed Chair Jerome Powell would hit the podium, and each word would be scrutinized as investors expect a Fed pivot, from hiking rates, to cutting them by the second half of 2023.

Gold Technical Analysis

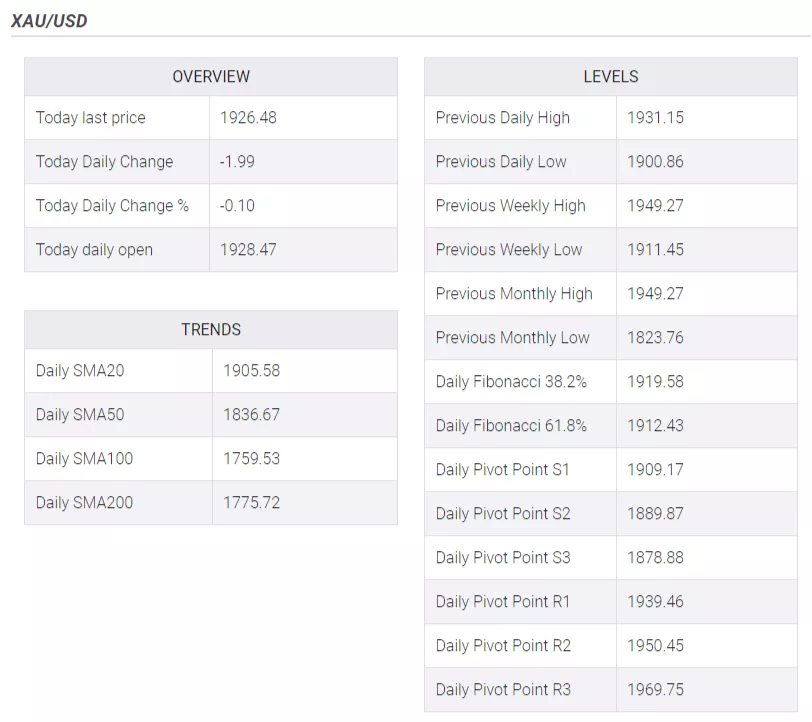

In the last five trading days, XAU/USD has failed to crack the $1950 psychological barrier, reaching a YTD high of 1949.16. on January 26. Since then, the XAU/USD dropped toward the 20-day Exponential Moving Average (EMA) at $1902.38 and gained traction toward the $1930 area, unable to re-test the YTD highs. That could be attributed to traders booking profits or awaiting Powell and Co.’s decision.

Gold’s key resistance levels lie at the current week’s high of $1934..47, followed by the YTD high at $1949.16, and then the $2000 mark. On the other hand, XAU/USD’s demand areas would be the 20-day EMA at $1904.83, followed by the January 18 swing low of $1896.74.

More By This Author:

WTI Bears Taking Control Into The Fed, Eyes On $75.00bbl

EUR/USD Holds At Around 1.0860 As Traders Brace For The Fed And ECB’s Decisions

USD/CAD Sticks To Modest Intraday Gains, Lacks Follow-Through Amid Bullish Oil Prices

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more