EUR/USD Holds At Around 1.0860 As Traders Brace For The Fed And ECB’s Decisions

Image Source: Pixabay

- The US core PCE, the Fed’s preferred gauge for inflation, edged down, sparking speculations for a Fed pivot.

- Consumer Sentiment improved, while inflation expectations ticked lower.

- The EUR/USD pair appears to have upward bias, but it may turn neutral over the short-term ahead of Fed and ECB’s decisions.

The EUR/USD currency pair got rejected from the 1.0900 psychological barrier for two consecutive days. On Friday, it slipped to the 1.0860 region after data from the United States cemented the case for a 25 bps rate hike by the Fed. At the time of writing, the EUR/USD has recently been trading at around 1.0866.

Soft US Core PCE Increased the Likelihood of The Fed Lifting 25 BPS

Wall Street finished the week with gains, shrugging off worries about an impending recession in the United States. Thursday’s data cemented the case for a robust economy, with Q4’s numbers expanding by 2.9% quarter-over-quarter above estimates of 2.6%, while Q3 remained at 3.2%. That sparked conversations of a possible “soft landing” by the US Federal Reserve.

In the meantime, Friday’s data revealed that inflation is cooling down, probably at a faster pace than estimated. The Fed’s favorite inflation gauge, the core Personal Consumption Expenditure (PCE), was aligned with estimates of 4.4% year-over-year, but it was below November’s 4.7%.

That augmented speculations around the Fed would slash the size of rate hikes, as December marked the first lift in rates not being at 75 bps. Instead, Powell and Co. went for a 50 bps move while emphasizing that the pace was not as important as the peak of rates.

As Friday’s session ended, the CME FedWatchTool showed that the odds for a Fed’s 25 bps rate hike stood at approximately 99.2%, and traders were foreseeing the Federal Funds rate (FFR) to peak at around 5%, by March’s meeting.

In another tranche of data, a poll from the University of Michigan reported the US Consumer Sentiment, which improved vs. the preliminary reading of 64.6 to 64.9. Data revealed that inflation expectations for one year are estimated at 3.9%, lower than the previous poll, while for a five-year reading, they stood at 2.9%.

Across the pond, European Central Bank (ECB) officials had reiterated they would raise rates at the upcoming meeting on Feb. 2. ECB’s President Christine Lagarde said that the bank would “stay the course” with a 50 bps rate hike in January and the next meeting after that, although inflation in the Eurozone slid to 9.2%.

That said, the stage is set with the Fed lifting rates to 4.50-4.75% and the ECB to 2.50%, which would reduce the spread between the US and the Eurozone. Hence, the EUR/USD pair could resume its upward bias and test the 1.1000 level unless an unpleasant dovish surprise by Lagarde caps the rally and causes the currency pair to tumble.

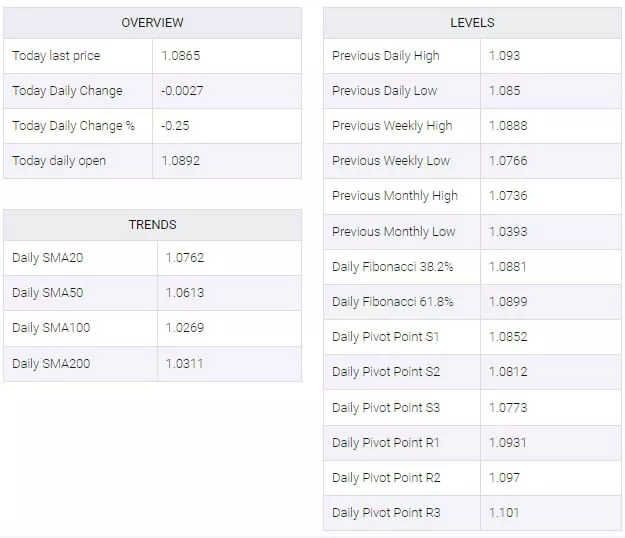

EUR/USD Technical Analysis

Ahead into the next week, the EUR/USD duo remains upward biased. The pullback in the last couple of days could be attributed to the 1.0900 mark proving to be a difficult resistance level to overcome. Also, the monetary policy decisions of the ECB and the Fed served as an excuse for traders to close their positions.

Even though the EUR/USD pair is pressured, the price action from Thursday and Friday formed a series of successive candlesticks with a long bottom wick, suggesting that some buying pressure could be put to rest. Nevertheless, the commitment to hold EUR/USD long positions throughout the weekend, and with uncertainty in the financial markets, kept the EUR/USD pair shy of reclaiming the 1.0900 level.

A breach of the latter would expose the 1.1000 mark. As an alternate scenario, if the EUR/USD pair were to dive below 1.0835, the weekly low, the pair may dip toward the 20-day Exponential Moving Average (EMA) at 1.0788.

EUR/USD

More By This Author:

USD/CAD Sticks To Modest Intraday Gains, Lacks Follow-Through Amid Bullish Oil Prices

Tesla Stock Forecast: TSLA Blasts Through $154 Resistance, $167.50 Next Up

Gold Price Forecast: XAU/USD Eyes $1,950 As US Dollar Index Cracks, US Q4 GDP Eyed

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more