Gold Price Forecast: XAU/USD Looks South Ahead Of The Fed Decision

Gold (XAU/USD) wavered in a $10 range around $1855 on Tuesday, settling in the red amid a broadly firmer US dollar. Uncertainty over the US $1.9 trillion stimulus plan, covid growth concerns and US-Sino tussle weighed on the market mood and boosted the US dollar’s appeal as a safe-haven. Meanwhile, upbeat US CB Consumer Confidence data also added to the upbeat momentum in the greenback. The International Monetary Fund's (IMF) upward revision of the 2021 global growth forecasts further exerted bearish pressures on gold.

Image Source: Pixabay

On the Fed, gold remains depressed amid encouraging vaccine news from the US. President Joe Biden announced Tuesday that his administration will ramp up weekly vaccine supplies. However, expectations of the stimulus approval keep the buyers hopeful. Senate Majority Leader Chuck Schumer said Democrats will move forward on Biden’s covid relief package without Republican support if necessary.

However, markets remain nervous and refrain from placing any directional bets on the metal ahead of the Fed decision due later on Wednesday. The Fed is likely to strike a dovish tone at its first policy meeting of 2021, in the wake of new virus cases and the need to do more to stimulate the economic recovery. Ahead of the Fed outcome, the US durable goods orders data will be closely eyed for any impact on the greenback.

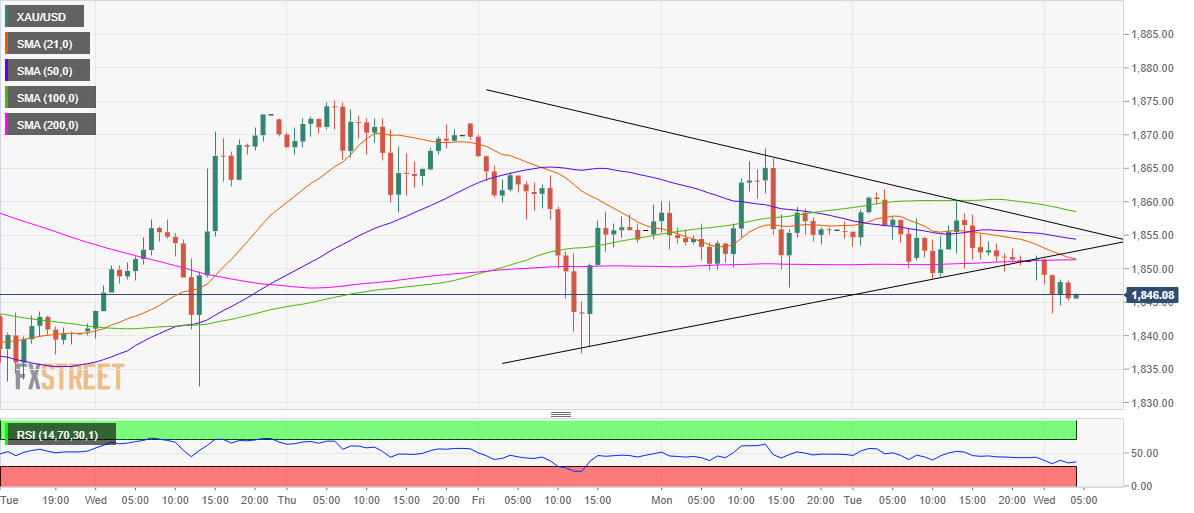

Gold Price Chart - Technical outlook

Gold: Hourly chart

(Click on image to enlarge)

Having confirmed a symmetrical triangle breakdown on the hourly chart, gold is consolidating the downside around $1845, as of writing.

An impending bear cross on the given timeframe backs the case for additional weakness. Also, the Relative Strength Index (RSI) trends in the bearish zone, allowing for more declines.

Therefore, the price could drop further to test the January 22 low of $1837, below which $1832 (Jan 20 low) could be put at risk.

Meanwhile, any pullbacks could meet strong supply at $1851, which is the confluence of the horizontal 200-hourly moving average (HMA) and 21-HMA.

Further up, the pattern support now resistance at $1853 could be probed. The XAU bulls need to recapture 100-HMA at $1858 to negate the near-term downside bias.

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more

I like it that you're not shooting for bearish targets. Nice momentary assessment.