Gold Price Forecast: XAU/USD Buyers Take A Breather Around $1910s As The USD Recovers

Image Source: Pixabay

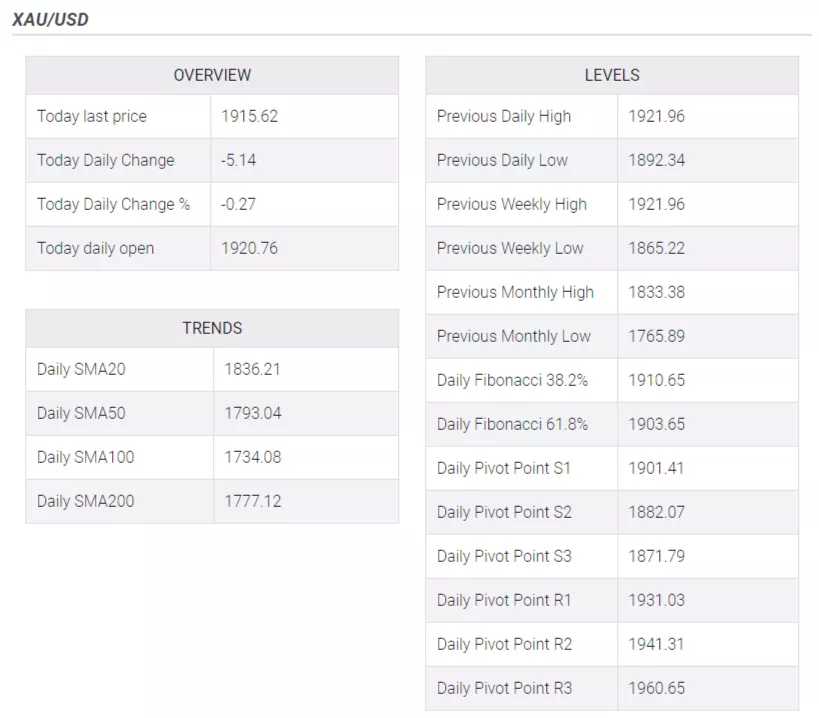

Gold price retraces as the North American session begins, even though Wall Street would remain closed in observance of Martin Luther King Jr. day. Nevertheless, the US Dollar (USD) has recovered some ground, snapping two straight days of losses, while the 10-year US Treasury bond yield finished the week around 3.50%. At the time of writing, XAU/USD is trading at $1,915.62, with losses of 0.34%.

Gold’s trade negative on dampened sentiment and Friday’s uptick in US yields

Global equities are trading negatively. US equity futures remain dealing with losses, while last week’s inflation data in the United States (US) pressured the US dollar. The University of Michigan, Consumer sentiment poll showed that 1-year inflation expectations eased to 4% from 4.4%, while for a 5-year horizon, edged up to 3% from 2.9%. Also, a slew of US Federal Reserve (Fed) officials backed the idea of slowing the pace of interest rate hikes.

In the meantime, the US Dollar Index (DXY), which measures the buck’s value against six currencies, has recovered some ground, up 0.15% at 102.332. With the US markets closed for a holiday, US Treasury bond yields remained unchanged, but traders should be aware that US yields ended on a higher note on Friday.

Ahead of the week, the US economic docket will feature the US Empire State Manufacturing Survey, alongside Fed speaking and the Beige book, as the US Central Bank prepares for the year’s first monetary policy. On Wednesday, US Retail Sales and PPI will get a look, while Initial Jobless Claims and Housing data will be revealed on Thursday.

Gold Price Forecast: Technical outlook

From a daily chart perspective, Gold remains upward biased, even though the yellow metal spurred an uptick to overbought conditions, per the Relative Strength Index (RSI). The Rate of Change (RoC) flashes that buyers continue to gather momentum, so the current pullback seems to be used by Gold longs, which could be adding to previous positions, as the non-yielding metal printed a new 9-month high at $1,928.95.

XAU/USD resistance levels lie at $1,930, followed by April’s 22 daily high of $1955.60, followed by April 19 high of $1,981.95, ahead of the $2,000 barrier.

(Click on image to enlarge)

More By This Author:

EUR/USD Refreshes Eight-Month High Above 1.0870 As Risk Profile Soars, US PPI In Focus

EUR/USD Price Analysis: Bears Attacking The Bullish H4 Trendline Support

USD/JPY Slides Toward 127.00 As Japanese Yen Keeps Rallying Ahead Of BoJ Decision

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more