Sunday, January 15, 2023 9:14 PM EST

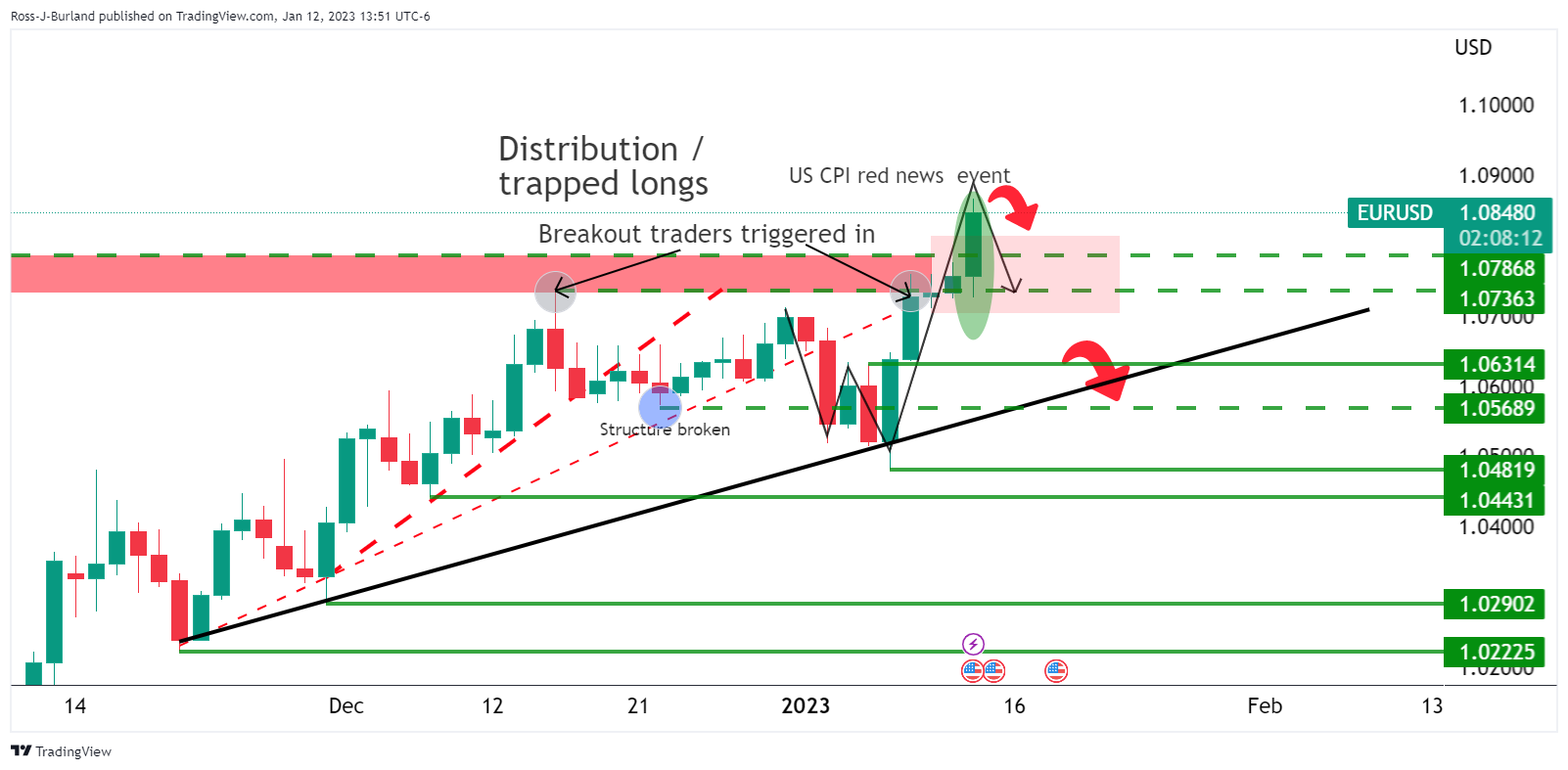

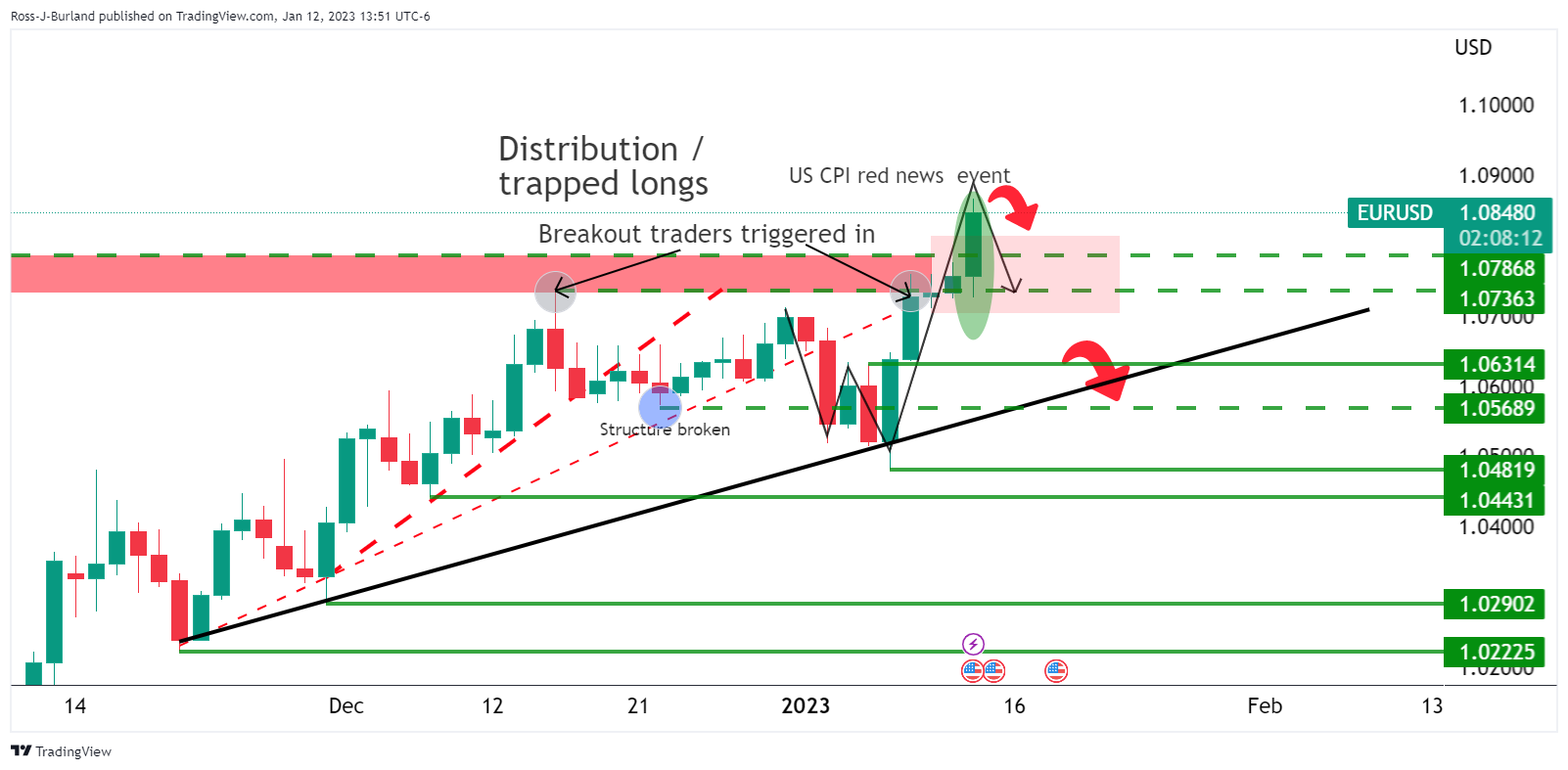

As per the prior analysis, EUR/USD Price Analysis: Bulls could be running into a trap, it was explained that the breakout traders had been triggered into the market ahead of the Consumer Price Index event. However, the data ignited a rally that took out the 1.0800 and likely hunted down stops in the 1.0850s. This leaves the scope of a reversal on the cards for the days ahead as per the poster CPI technical analysis, EUR/USD prints fresh bull cycle highs, on course for a 5-day rally.

EUR/USD prior analysis

This puts the downside thesis into play as follows:

(Click on image to enlarge)

The analysis highlighted the downside risks as illustrated above.

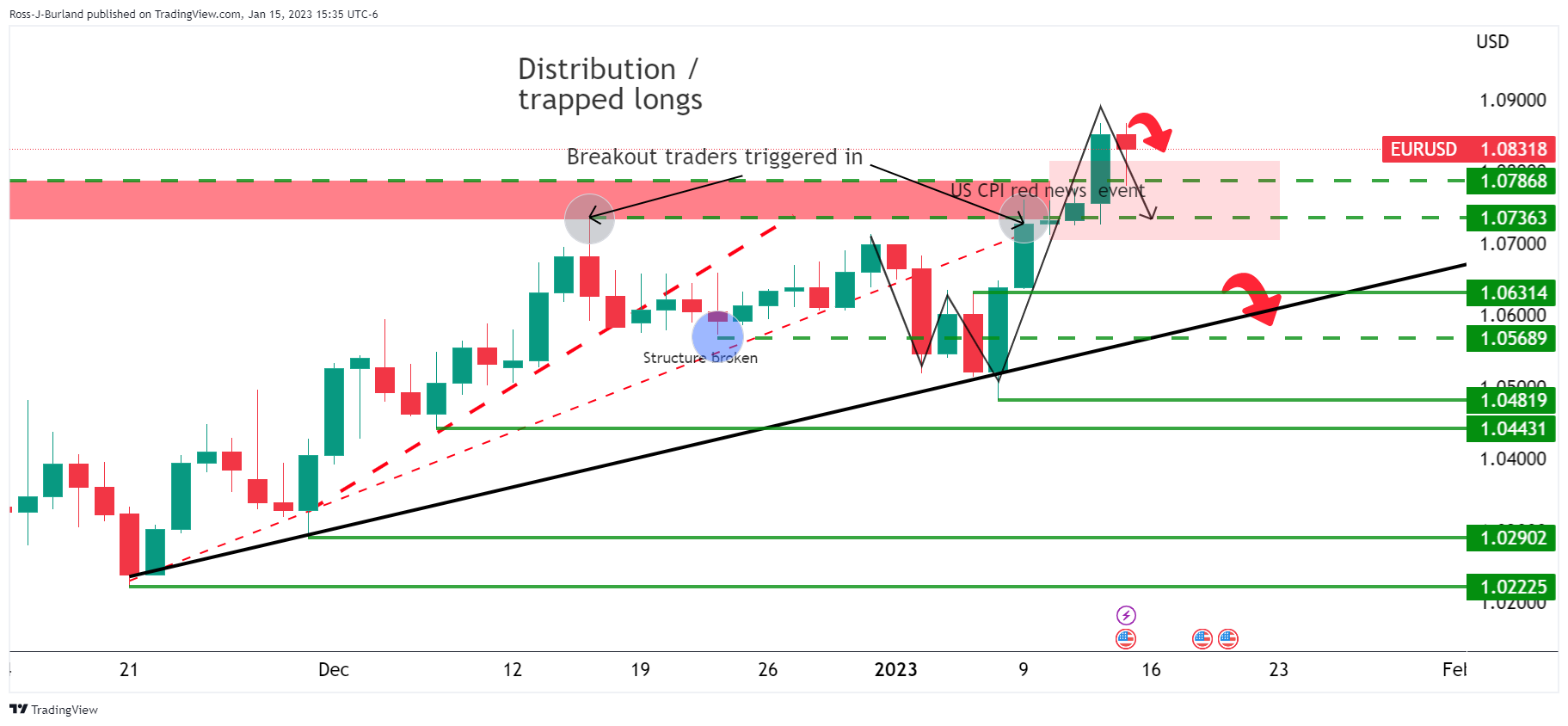

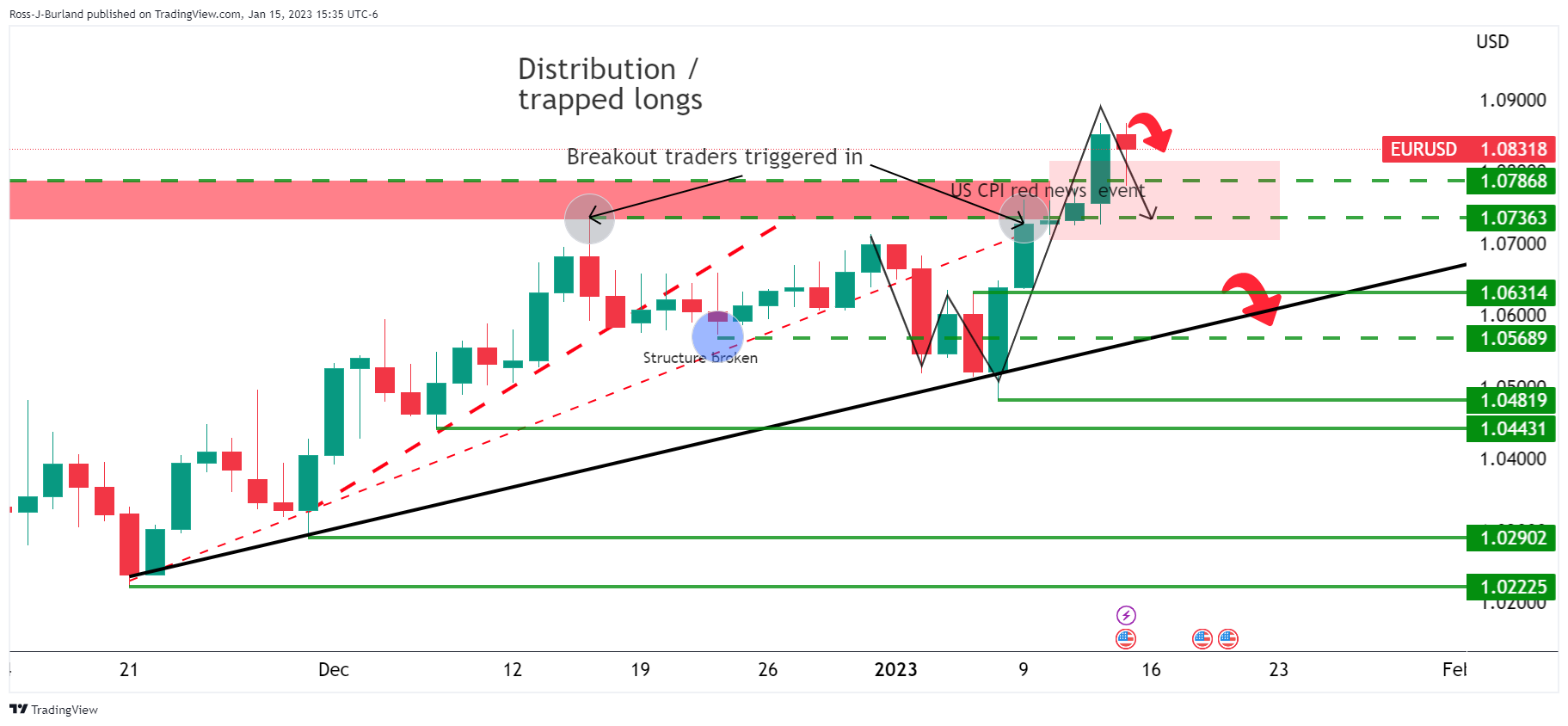

EUR/USD update

(Click on image to enlarge)

The price has since stalled and is on track for a re-test of 1.0780s and lower towards 1.0700. However, the bears need to break trendline support on the lower time frames, such as the 4-hour chart as follows:

(Click on image to enlarge)

The M-formation is compelling in this regard. the neckline needs to hold for the open this week to reaffirm the bearish bias and prospects of a break of the trendline and downside potential for the week ahead.

More By This Author:

GBP/USD Sees An Upside Above 1.2250 Ahead Of UK Inflation Data

Aud/usd Price Analysis: Bullish Breakout On The Cards Or Have We Seen The Highs?

USD/CAD Price Analysis: Stalled Its Rally At The 100-DMA, Dropped Beneath 1.3400

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

less

How did you like this article? Let us know so we can better customize your reading experience.