Gold Preparing For Next Rally In 2023

Image Source: Pexels

Higher inflation expectations, higher interest rates, and geopolitical events are having a negative effect on the U.S. economy. The negative economy has a bad impact on the currency and therefore US dollar attempted a peak at long-term resistance with a big decline. The article examines the current state of the US economy in terms of inflation, rising interest rates, and geopolitical events. The focus lies on the few circumstances under which the gold price could exceed the $2,075 pivot point and reach the target range of $2,500 to $3,000.

The US Economy

The economy is the system by which a society manages the production, distribution, and consumption of goods and services. It includes the processes and institutions through which resources are allocated and encompasses issues such as economic growth, inflation, and unemployment. There are many different types of economic systems, including capitalism, socialism, and communism, each with its own unique characteristics and principles. The United States economy is one of the world’s largest economies. It has high GDP, high Purchasing Power Parity (PPP), and strong employment parameters. Consumer Price Index (CPI) is the measure of the change in prices for US consumers and is measured by the weighted average of prices for goods and services in the United States of America (USA). The CPI for the USA has risen by 7.1% in 2022, however, a slight decline in the CPI values was noted within the last quarter of 2022. This decline has impacted the US Treasury yield as well. The decline in the CPI value is due to the high wage growth in the second half of 2022. Therefore, the labor market is also tight and impacting further inflation in the USA. Due to higher inflation, the Fed will likely increase interest rates in 2023, which will produce a negative effect on the US Economy.

(Click on image to enlarge)

.webp)

On the other hand, geopolitical tensions are also increasing globally including the Russian-Ukraine Conflict and Covid-19 situation in China. The geopolitical events will have a negative effect on the US monetary system in the long term. The above-mentioned events will probably result in an economic fall-out for the USA since the global financial trade in Europe has been affected and it affects the gold investment. Therefore, these scenarios will impact the gold demand, which will likely increase gold prices in 2023.

Gold Technical Analysis for 2023

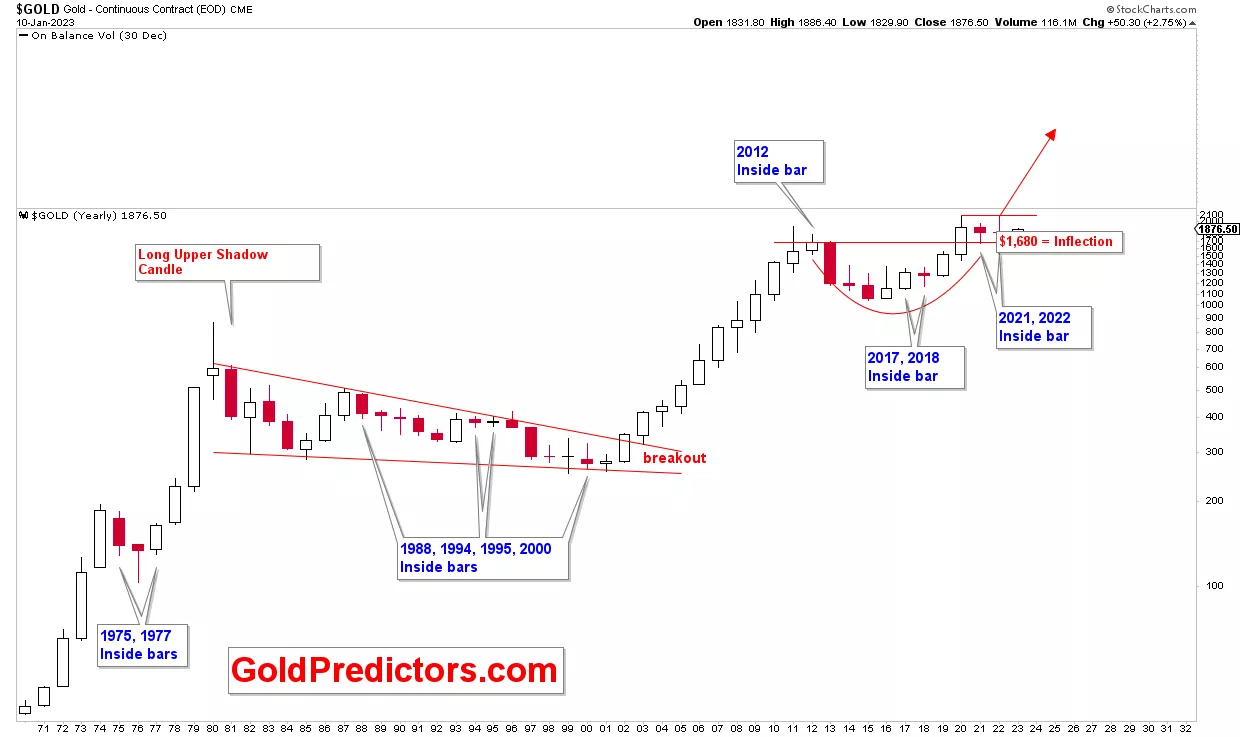

An inside bar is a candlestick pattern that occurs when the high and low of a candle are completely within the high and low of the previous candle. This indicates a period of consolidation or indecision in the market and is often considered a signal of a potential reversal or continuation of the existing trend. Inside bars can be found in all time frames, but are more significant in longer time frames such as daily charts. One candle represents one year on the yearly gold chart shown below. All of the inside candles for the past forty years can be observed. When gold generates an inside candle, the subsequent breakout results in a massive price increase.

(Click on image to enlarge)

The yearly candle for 2021 and 2022 are highlighted in the chart below. The inside bar for 2022 indicates that if the price of gold moves above the highs of 2022, it will initiate a quick rally to much higher levels. Currently, the gold market is trading between $1,680 and $2,075, with a likely breakout in 2023. Due to the higher inflation and interest rates, it is likely that the breakout will occur to the upside based on the preceding discussion. Therefore, any pullback in the gold market in 2023 must be viewed as a buying opportunity. However, the rally will not be initiated until $2,075 is breached.

(Click on image to enlarge)

Conclusion

On the basis of the aforementioned data and projections, it is probable that the US economy is in trouble and that the US dollar will decline substantially. The decline in the value of the U.S. dollar will have a positive impact on the gold market in 2023, leading to an increase in gold prices. The gold market's pivot point is $2,075, and any breakout from this point will likely result in an increase in price. The likely price target range is $2,500 to $3,000, highlighted by the 40-year blue trend line.

More By This Author:

The Silver Market Looks Higher

What are Support and Resistance?

Gold With Another Bullish December

Gold Predictors is a web application to provide free and premium articles and trading signal alerts on gold and silver ...

more