What Are Support And Resistance?

Support and Resistance are two of the most important concepts in trading, where the price of a security or asset stops moving or reverses direction. Support is a price level where buying pressure is strong enough to prevent the price from going lower, while resistance is a price level where selling pressure is strong enough to prevent the price from going higher.

Identification of Support & Resistance

To determine where support and resistance might exist, traders use a combination of technical indicators. One of the most popular indicators for analyzing support and resistance is to use of chart patterns. A chart pattern illustrates the possible price action that can be used to indicate potential support or resistance.

How to Trade?

When trading with these levels, it’s important to keep in mind that the price can reverse at any point. Thus, it’s important to use stops to protect your position from unexpected reversals. If a price moves past a key level, it may indicate that the market sentiment has shifted. It also indicates that a large number of orders are being placed to either buy or sell the asset.

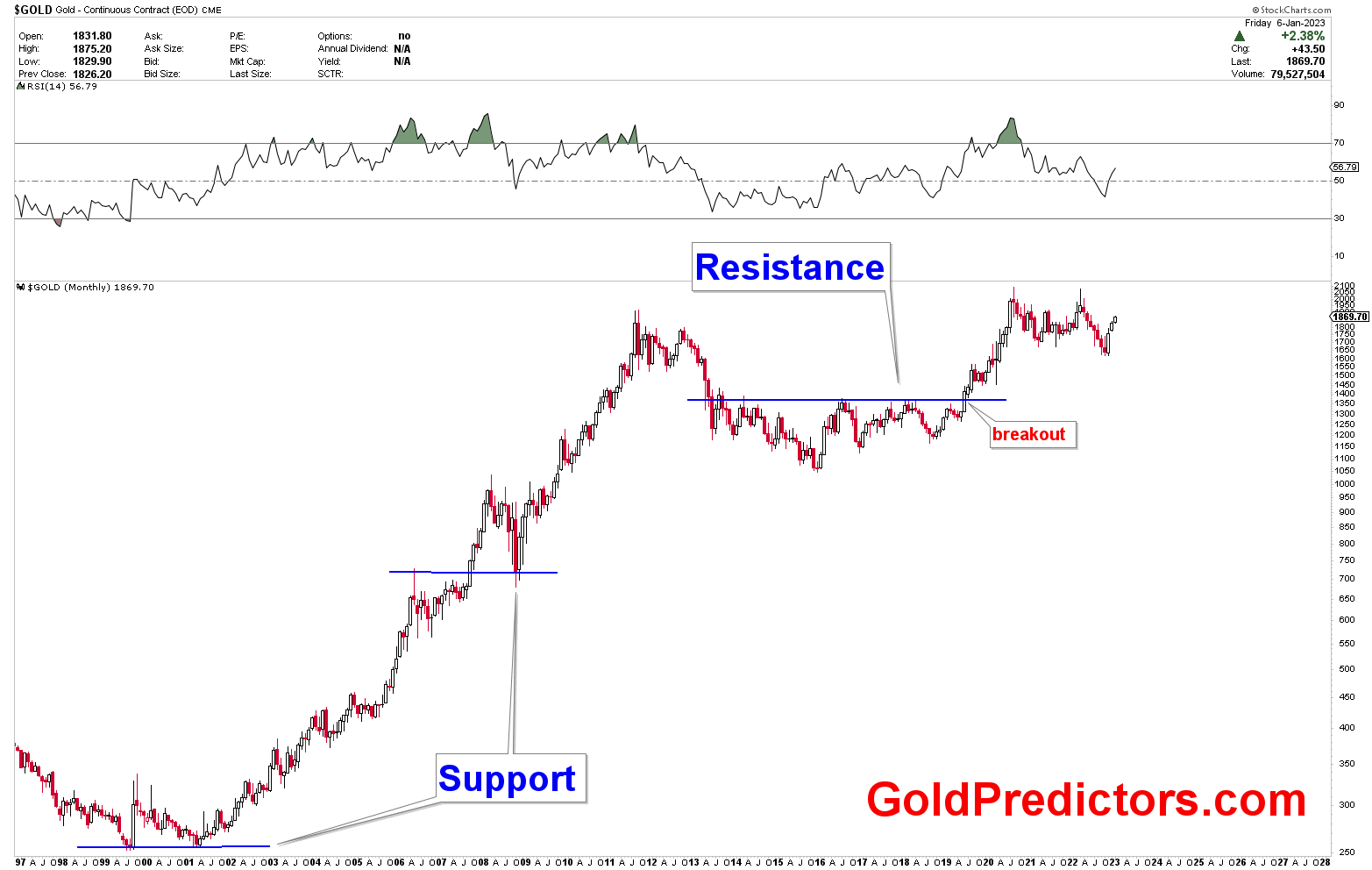

To capitalize on this move, traders will often place orders near the broken line to benefit from an increased likelihood of profits. The order will be placed, if the price continues to move in its current direction. However, this type of trading also carries inherent risks – as prices can always retrace back toward the original lines. Therefore, traders must enter trades with proper risk management strategies. The chart below presents the support and resistance lines whereby the price has stopped moving in certain directions.

Another way to make money off of the levels is by waiting for breakouts. If the price breaks through a level of strong resistance, then there is likely going to be momentum which could lead to bigger gains as seen in the chart above. As long as there is sufficient confirmation (indicators or chart patterns) then it could be worth taking advantage of the opportunity.

Finally, traders should always be aware of the timeframes – as different timeframes may show different supports/resistances. By keeping track of multiple time frames, traders can be more prepared for potential trades. The preparation will ensure that the positions remain profitable regardless of which timeframe traders are analyzing.

Benefits of Support & Resistance

Trading with support and resistance levels offers a number of advantages for traders. First, it provides traders with a simple way to identify areas in the market where prices may turn.

These key levels can help traders identify areas where one can enter or exit a trade. Second, because these levels tend to be monitored by many traders, potential breakouts or reversals in a trend are expected. Finally, traders can use these key levels to set stops and limits which can help limit losses on trades. This can help protect traders from overtrading and other risks associated with too much exposure to the markets.

Conclusion

Support and resistance levels can be a great way to help traders identify potential opportunities in the market. By understanding the principles of support and resistance levels, traders can more effectively develop an appropriate trading strategy to fit the risk tolerance.

More By This Author:

Gold With Another Bullish December

US Dollar Sell-Off Continuation

U.S. Dollar Index Tests Strong Resistance