Gold: Prepare For Bull Market To Begin Any Day

Precious metals prices on Friday settled higher on a weaker dollar and on the massive amount of monetary stimulus that global central banks are pumping into the financial system.

The 10-year T-note yield on Friday fell -20.3 bp, which is bullish for gold after the New York Times reported late Thursday that the Trump administration has asked state labor officials to hold off on releasing figures for unemployment filings until the federal government issues national totals. Several states have already released running totals of claims this week, which has prompted Goldman Sachs to estimate that U.S. unemployment benefits are poised to surge to a record 2.25 million by next week.

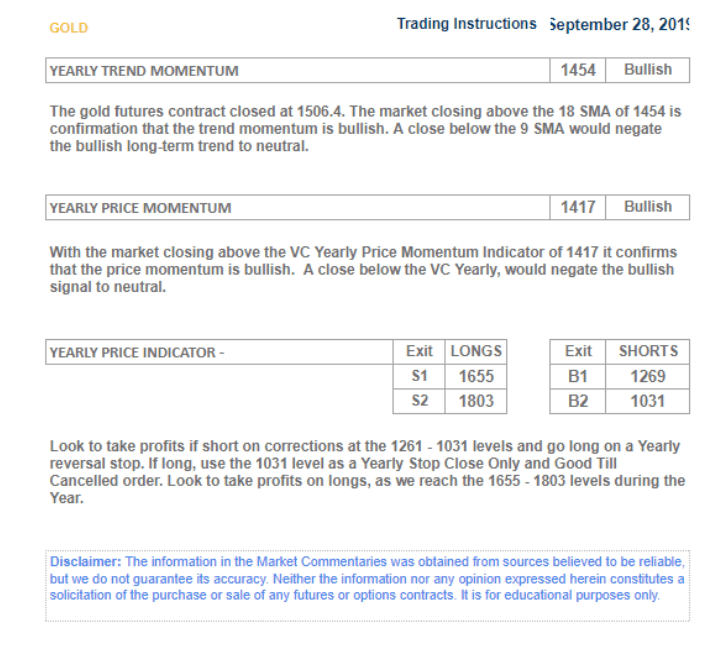

The gold and silver markets plunged after meeting the targets of the annual supply and demand that we published on September 28, 2019. During this time, when gold was at about $1,700, we had a conglomeration of data points that indicated that a close below $1,650 would complete the annual targets for the immediate future. If the market were to close below $1,650, that would activate a short trigger. That short trigger activated the yearly mean of $1,417 as a target.

(Click on image to enlarge)

VC PMI AI Strategies for next week

One of the metrics that we use in the Variable Changing Price Momentum Indicator (VC PMI) automated algorithm is the 9-month simple moving average. This average came in at $1,454. The immediate target that was activated after a short trigger initiated on a close below $1,655 was $1,454. That level identifies the shift in the trend-momentum of the market. With the market coming down to a low that we saw of $1,450.90 on March 16, it completed the 9-month simple moving average target anticipated on September 28. Then the market reverted. The artificial intelligence of the VC PMI identified these levels back on September 28, 2019. When the market touched these levels, it activated a new setup or a trade alert. When the price closed right above that target, it activated a bullish or buy trigger from that level.

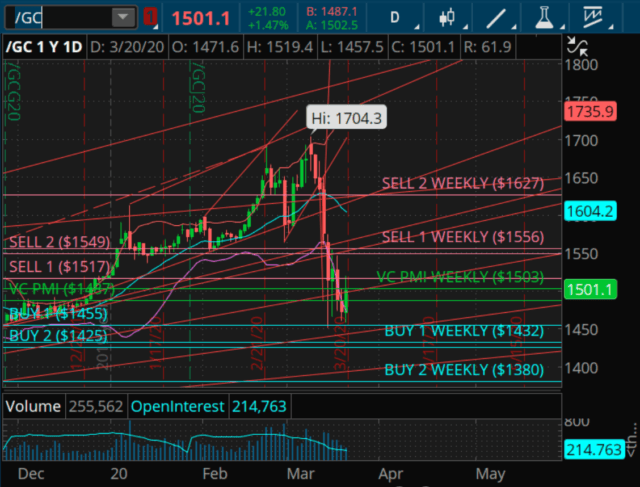

GOLD

(Click on image to enlarge)

The market closed Friday at $1,501. It consolidated the past week after the lows were made and reverted right back up to make a high of $1,554. It has been trading in that range since Friday with stabs into that $1,450-55 area. It made the low of $1,457.50 and reverted right back up on the close to $1,451.

Is more downside likely?

When we look at the relative implied volatility factor, with the market coming down in such a short time to meet these targets, it tells me that the VC PMI is expecting a swing rally, which could start any day. The fact that the market came down and the volatility increased to record levels, at the very least, we are looking at a substantial relief rally that could start very soon.

We also use cycles in relation to the VC PMI. This came right into an expected 180-day cyclical forecast that coincided with price bottoming during this period. We’ve seen a convergence of the cycles coming together. We could be looking at a bottom in the price of gold.

Silver

(Click on image to enlarge)

The silver market is bottoming with a conglomerate of significant cycles on a weekly basis, which indicates that we could be at a turning point. A convergence of cycles is indicating that silver price and time have come together harmonically based on the short-, intermediate- and long-term data in the area of accumulation. We are about to experience a very powerful rally that could reach 16.71 Sell 2 targets over the near term.

COMMENTARY

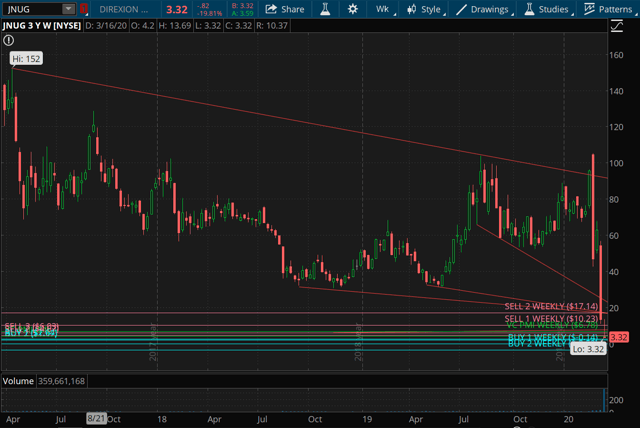

JNUG

(Click on image to enlarge)

We have been trading the Direxion Daily Junior Gold Miners Index Bull 3x Shares ETF (NYSEARCA: JNUG) profitably since the beginning of the year. You always have to be aware that something unprecedented might happen. In this case, we are dealing with a phenomenon, which is a pandemic. It has upset the equilibrium of the market in relation to volatility, leading to trading at historic levels above and below the mean. It is like throwing a rock into a pond. You see the rock hit and the waves, but you don’t see the ripple effects once the rock disappears beneath the surface. We are in that same scenario in that the coronavirus was the rock and we are now living through all the ripple effects. That ripple effect has broken any previous benchmarks related to the relative implied volatility. It has disrupted portfolios and turned upside down strategies in place before the virus struck, especially traders using aggressive triple X ETFs. Such ETFs move at three times the velocity of the underlying instrument, such as JNUG and others. Most people who have commented about JNUG are unaware that what is going on is an incredible anomaly between the physical metals market and the paper market, which is the futures market in derivatives. It is difficult to buy physical gold or silver without paying a hefty premium. This is similar to the situation during the 2008 economic crisis.

JNUG does have a time decay factor, so you don’t want to hold them long term. Compared to the volatility, however, that decay is minimal. Even so, you don’t want to hold them long term. When this occurred in 2008, gold fell below $1,000 briefly, and silver came down to $7 or $8. Then both rallied consistently and confirmed a bull market that lasted from December 15, 2015, from a low of $1,037 to September 2017, when gold reached $1,370 — a $323 move. JNUG traded April 10, 2017, at $152 a share. When gold began in December 2015, JNUG was in the $6 to $7 area. Within 6 months, NUGT rose 2,500% as of April 17, 2017.

If you are trading JNUG, do not despair. Do not put all your money into JNUG. This should be speculative money; money that you can, in the worst, case, lose. Try to look at the situation from a fresh perspective. If you are an experienced trader, you can recalibrate your position by looking now in areas, such as put options, which have incurred an incredible amount of premium. This is a time to learn to recalibrate your position. You can use put-credit spreads, so you get a premium or credit to buy call options, preferably at the money with a lot of time value. In times like this, when the volatility has been skewed almost to zero, the options, even though they have intrinsically collapsed to zero when the volatility returns to the upside, the option premium will pay you to double in terms of the intrinsic and time value.

I believe that this is a dip. If you did not buy more than you can handle, there is great value in gold mining shares and gold at these levels. It is not the end of the world. It is a trade, right now, that is underwater. I have lost all the profit I have made in the past six months. But I am buying assets without margin calls and managing my risk intelligently in an aggressive market. I am eliminating the risk of a margin call.

I am looking at the market presenting a range of opportunities at fire-sale prices across the board. Now that we’ve seen this re-set and adjustment in values, which eliminated over-leveraging in the equity, energy and commodity markets. Once we see the light at the end of the tunnel and begin to see some stability come back, by identifying the mean of various markets, it will give us a chance to make a difference in our financial future, if you are willing to take and manage the risk accordingly. The VC PMI allows you to do that unemotionally and intelligently based on its artificial intelligence. It is not guaranteed, but it gives you the highest probability trades. It is crucial at such times to analyze the markets technically and not fundamentally, and the VC PMI is an excellent means to technically analyze the markets.

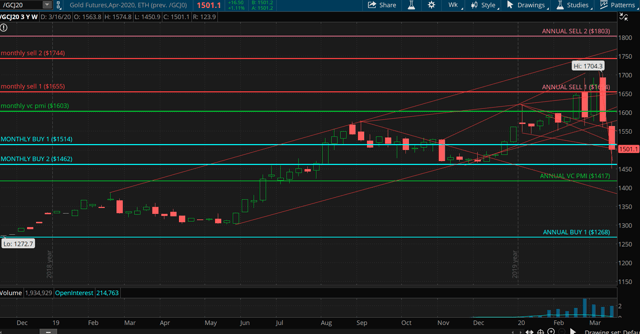

GOLD MONTHLY AND ANNUAL TARGETS

(Click on image to enlarge)

Courtesy; TDAmeritrade

It appears that there is a very high probability that as we come into next week, that we will see a relief rally in precious metals that could bring back the price of gold to the monthly mean of $1,603. A close above $1,514 would activate a monthly buy trigger, activating the mean of $1,603 as the target. We are in a monthly buy trigger, which was activated last week, by the market coming down and testing the $1,462 area (Buy 2 level). It has a 95% probability of the market reverting from there back to the mean. We have established a bottom to the gold market. The probability is very high that we are going to find buyers. It could also put into place the Sell 1 level of $1,655 and the annual target of $1,650, which we published back on September 28, 2019.

Disclosure: I am/we are long GDX.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on more

Here's hoping for a pop now...