Gold: Annual Targets And S&D Prices For 2019/2020 Season

On September 28, 2018, we published our annual S&D report on for the gold market. In that report, the Variable Changing Price Momentum Indicator (VC PMI) annual price indicator anticipated, as the report was written with gold closing at $1,196, a Sell (S1) level of $1,336 to the Sell 2 (S2) level of $1,476. The average price was $1,251, and we clearly stated that the market closing above $1,251 activated the extreme levels above the annual price indicator of $1,476, which is the Sell 2 (S2) level.

Courtesy: TDAmeritrade

If we look at the action in the gold market since then, gold has rallied to a high made on September 2 at $1,576. It obviously exceeded the S2 level of $1,476, and since gold closed above the S1 and S2 annual levels, it shifted the long-term trend to a higher fractal in price for the rest of the year as we move into the next seasonal 360-day cycle for the September 28, 2019, to September 28, 2020, cyclical and seasonal period.

As you can see in the chart, depending on whether you are a day, swing, or position trader, the annual report gave you the extreme levels based on the average yearly price of $1,251. When the price exceeds the S2 level, it validates that the previous fractal price has been eliminated and we are setting up a new higher fractal price as the S2 level becomes the level of support for the next fractal period, which extends the price to September 28, 2020.

Looking Forward To 2019/2020 Cyclical Targets

Courtesy: ema2trade.com

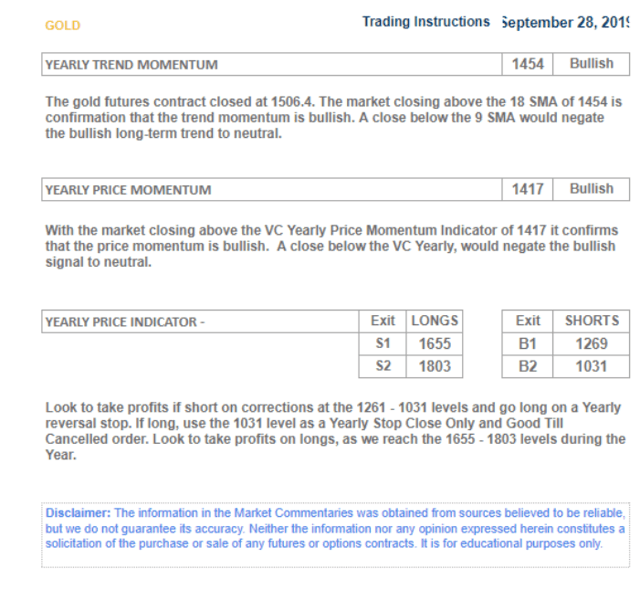

Based on the structure that has begun for the next 360-day cycle period, the VC PMI has identified the average price at $1,417. With the market closing at $1,506.40 on September 27, 2019, it activated a bullish trend momentum for the rest of the period into 2020. The trend momentum identified by the VC PMI using the long-term monthly average is $1,417. With the price closing above it confirms a bullish trend momentum for 2020.

The fact that the market closed above $1,417, activated the targets of $1,655 to $1,803. The $1,655 is the S1 level, which indicates a 90% probability of a reversion to the mean to occur if activated back down to $1,417. The market has to validate the trigger points first. If it does not, it has the potential to rally to $1,803 if we don't see a short trigger activated at $1,655. After completing the target, the next target becomes active at $1,803.

The trend momentum is to be protected on a close below $1,454. The average price for next year is $1,417, so this is another level of protection you can use to protect your long-term positions if you have a long-term bias in the market that the S1 and S2 levels will be completed in 2020, as we strongly believe. Ideally, the work indicates that this will happen in the first quarter of 2020.

The VC PMI artificial intelligence gives you the directional trend of the market based on the yearly price indicator, it also gives you the alternative to protect your position. The first level is a close below $1,454, which would negate this bullish trend momentum to neutral. A close below $1,417 would negate this long-term bullish trend to neutral and a close below $1,417 activates the targets below the mean of $1,269 (Buy 1) to $1,031 (Buy 2).

The VC PMI Automated Algorithm

We use the proprietary Variable Changing Price Momentum Indicator (VC PMI) to analyze the precious metals markets and several indices. The primary driver of the VC PMI is the principle of reversion to the mean ("Mean Reversion Models of Financial Markets," "The Power of Mean Reversion in Factor-Based Investing"), which is combined with a range of analytical tools, including fundamental logic, wave counts, Fibonacci ratios, Gann principles, supply and demand levels, pivot points, moving averages, and momentum indicators. The science of Vedic mathematics is used to combine these elements into a comprehensive, accurate, and highly predictive trading system.

Mean reversion trading seeks to capitalize on extreme changes in the price of a particular security or commodity, based on the assumption that it will revert to its previous state. This theory can be applied to both buying and selling, as it allows a trader to profit on unexpected upswings and buy low when an abnormal low occurs. By identifying the average price (the mean) or price equilibrium based on yesterday's supply and demand factors, we can extrapolate the extreme above this average price and the extreme below it. When prices trade at these extreme levels, it's between 90% (Sell 1 or Buy 1 level) and 95% (Sell 2 or Buy 2 level) probable that prices will revert to the mean by the end of the trading session. I use this system to analyze the gold and silver markets.

Strengths And Weaknesses

The main strength of the VC PMI is the ability to identify a specific structure which price level traders can execute with a high degree of accuracy. The program is flexible enough to adjust to market volatility and alerts you when such changes take place, so one can adjust strategies accordingly. Such changes include when the market breaks out of a consolidation phase or a trend accelerates. Such volatility usually happens when the market has produced a signal at the S2 or B2 level and the market closes above or below these extreme levels.

The day trading program then confirms that a higher fractal in price has been identified and the market will move significantly higher, although the same principle applies if the market falls significantly. The price closing above the S2 level indicates that the buying demand is greater than the supply. This means that the market has found support for the next price fractal. Conversely, the price closing below the B2 level indicates that the selling pressure has met demand greater than supply at the extreme below the mean, and prices should revert back to the mean.

The basic concept of the VC PMI is that the program trades the extremes of supply and demand based on the average price daily, weekly, and monthly.

The strongest relationship we find in the algorithm is when the daily price is harmonically in alignment with the weekly and monthly indicators. We call this "harmonic timing." Such an indication produces the highest probability (90%) that the price will revert from these levels to its daily, weekly, or monthly average.

Disclosure: I am long NUGT.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on more