Gold Poised For $4,000 As Rally Extends Into 2026?

- Gold nears $3,860 after record highs

- US Gov. shutdown delays key US economic data

- Fed cuts expected as labor market cools

- State Street sees 75% chance of gold reaching $4,000

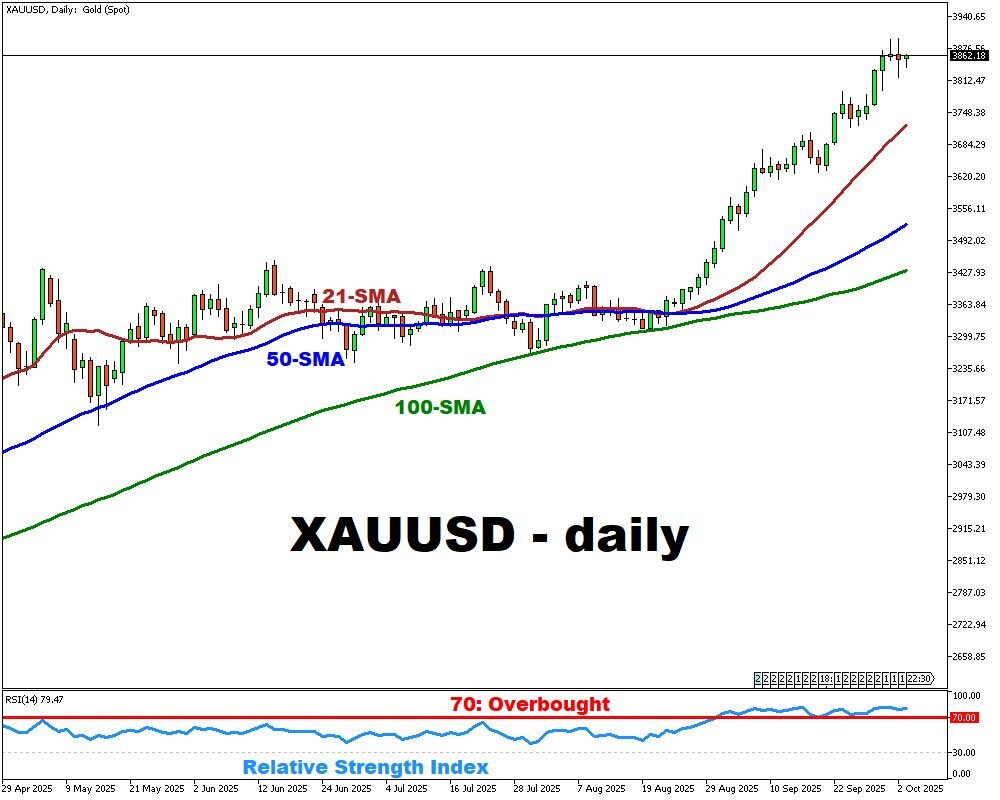

Gold prices are consolidating just under the $3,860 per ounce mark after setting a fresh record earlier this week, extending what could become a seven-week winning streak.

Market participants have been leaning toward bullion as both a hedge against uncertainty and a play on softer US monetary policy. The partial US government shutdown has added to risk aversion, with the suspension of official economic releases pushing traders to rely on private labor data.

Those figures have pointed to a slowdown in hiring and weaker job turnover, fueling expectations that the Federal Reserve may deliver two more rate cuts this year despite inflation staying above target.

Against this backdrop, State Street Investment Management has raised its conviction that gold will climb above $4,000/oz by late 2025 or early 2026, assigning a 75% probability to that outcome.

Among the structural supports cited: a declining dollar, renewed ETF demand, the prospect of stagflation, and steady purchases from central banks and Chinese households. While the team acknowledges the possibility of a 7–8% correction in the fourth quarter due to seasonal softness in ETF flows, they see such weakness as a buying opportunity rather than a trend reversal.

Wall Street outlooks remain divided. J.P. Morgan projects a climb past $4,000 in 2026, Goldman Sachs anticipates $3,700 by next year’s end, and Citi has warned of downside scenarios under stronger growth.

Even with those differing forecasts, the consensus is that gold retains solid long-term drivers.

More By This Author:

Gold Steadies, Oil Slides On Fed, Geopolitics

Gold Steady, Brent On Track To 3rd Daily Gain

This Week: BoE Rate Decision & Trump’s Tariffs In Focus

Disclaimer: This material should not be viewed as financial advice. The content provided, including views and opinions, is for information purposes only.