Gold Steadies, Oil Slides On Fed, Geopolitics

- Gold holds near $3,650

- Fed cuts rates, signals gradual easing ahead

- Powell: cut aimed at jobs, not big easing cycle

- Gold up 39% YTD on risks, central banks demand

- Brent falls below $67

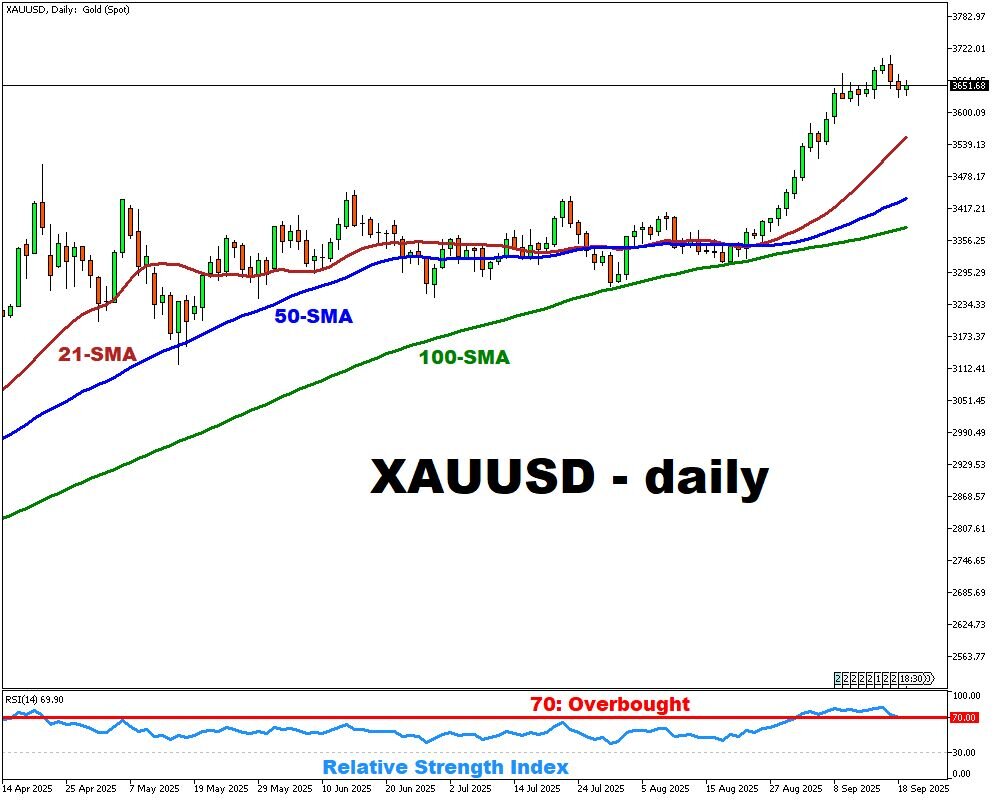

XAUUSD

Gold steadied near $3,650 per ounce on Friday, consolidating after a brief pullback that ended its month-long climb.

The Federal Reserve’s first rate cut since December has been the central focus for traders, with policymakers signaling a willingness to ease further while warning that stubborn inflation may keep the process gradual.

Fed Chair Jerome Powell described the decision as a “measured step” to counter labor-market weakness rather than the start of an aggressive easing cycle, tempering overly dovish bets.

Even so, bullion has rallied nearly 39% so far this year, repeatedly marking record highs on the back of strong central-bank accumulation, geopolitical unease, and investor demand for safety.

Physical flows also reinforce the picture: Swiss shipments of gold to China surged by more than 250% in August, highlighting Asia’s key role in sustaining momentum.

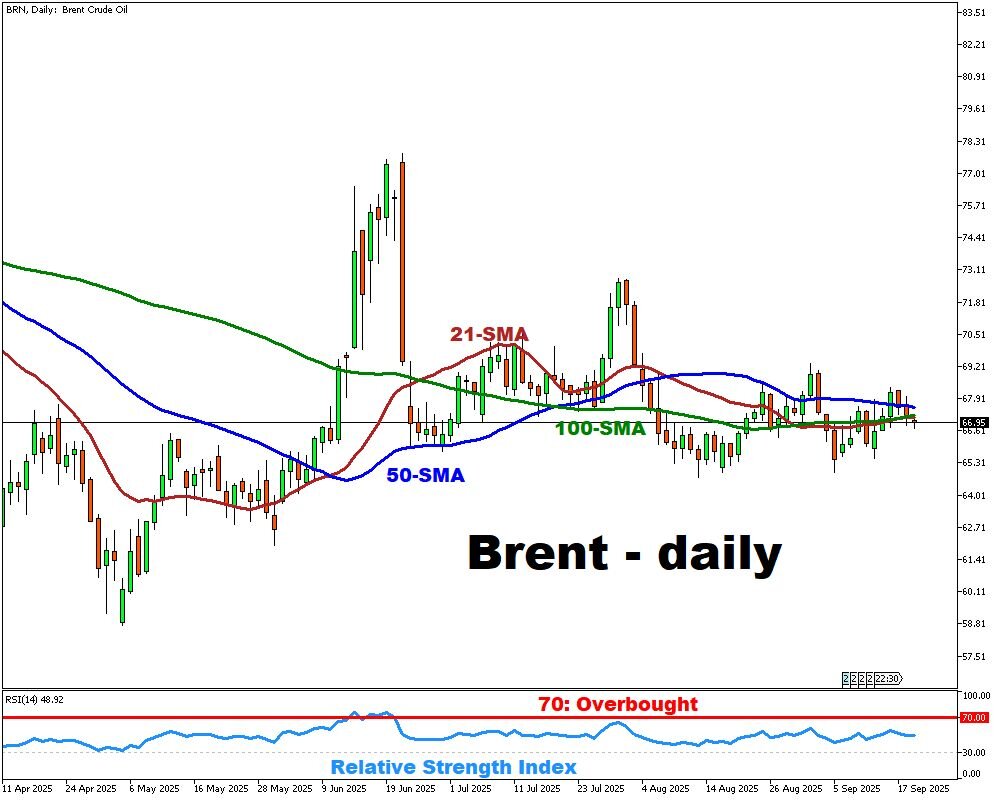

Brent

Oil has moved in the opposite direction. Brent futures slipped below $67 a barrel, falling for a third straight session and reversing part of the week’s earlier advance.

U.S. President Donald Trump’s renewed call for lower energy costs, saying he would rather see cheaper crude than impose additional sanctions on Russia, eased concerns of supply disruption. This political backdrop countered bullish impulses from damages on Russian infrastructure.

The Fed’s rate cut also produced a mixed read-through for energy markets: while looser policy could eventually support fuel consumption, investors are wary that it also reflects mounting downside risks in the world’s largest oil consumer.

U.S. inventory data added to the caution, with headline crude stocks drawing sharply on exports but distillate supplies climbing to their highest levels since January.

More By This Author:

Gold Daily Forecast - Friday, Jan. 18

Gold To Continue Consolidation

Gold Markets Give Back Gains

Disclaimer: This material should not be viewed as financial advice. The content provided, including views and opinions, is for information purposes only.