Gold Miners: Rooted To The Ground

Gold finally managed to rally temporarily. However, the gold miners barely moved or even declined. With the market so weak, what will come next?

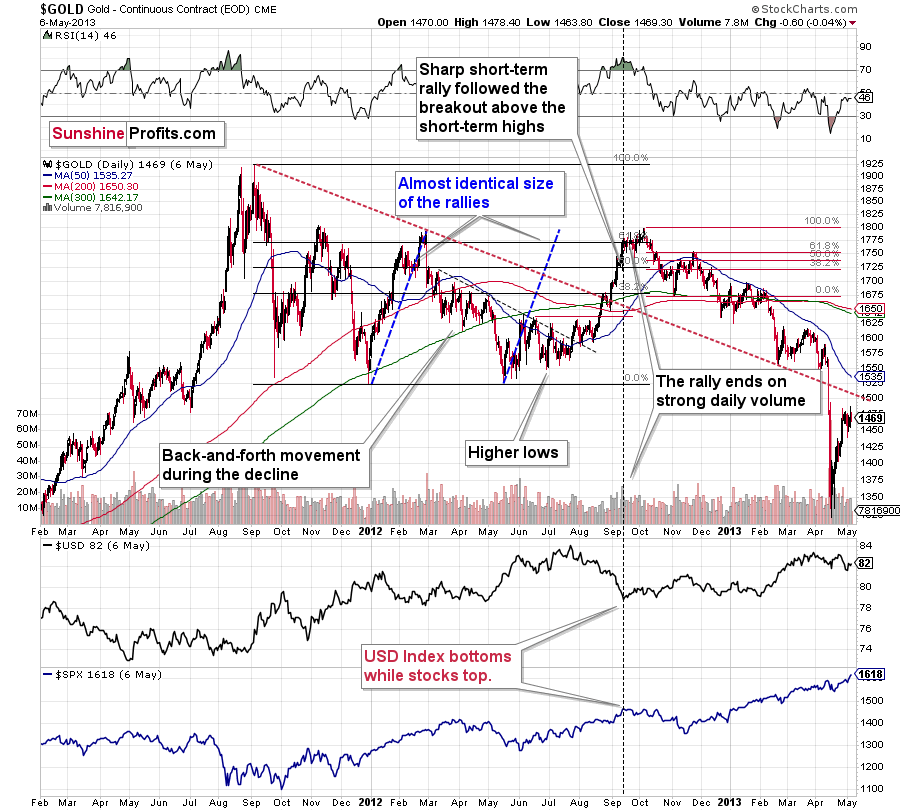

In my previous analyses, I wrote about the possibility of seeing another move higher in gold, and that it wouldn’t last long – if we saw it at all. I also wrote that mining stocks would likely disappoint, just as they did in 2012. And what happened yesterday was in tune with the above.

Namely, gold did move higher, but only on a very temporary basis.

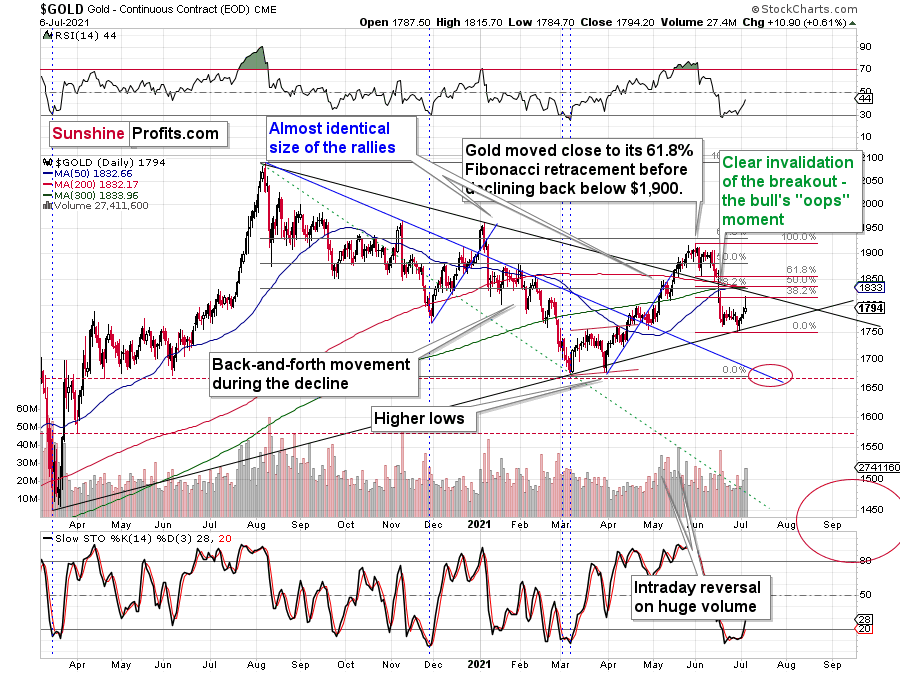

In fact, the rally ended even before the closing bell, as gold futures reversed their course and ended the session only $10.90 higher (after being even ~$20 higher intraday). This price action created a bearish reversal candlestick called the shooting star. Such candlesticks tend to be important if they form on relatively big volume. And indeed, yesterday’s volume was relatively big, which means that the implications are bearish.

Well, they were bearish even before yesterday’s session, but seeing confirmations adds credibility to the bearish narrative.

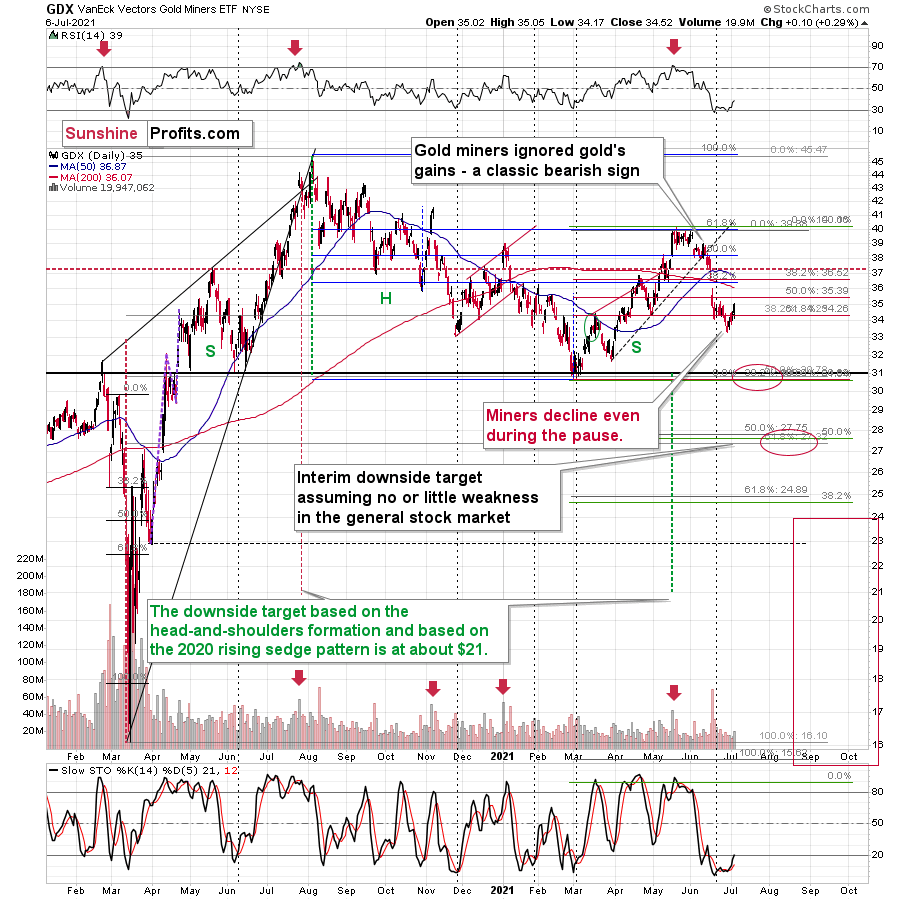

Another detail that serves as a bearish confirmation is the performance of the mining stocks.

The senior gold stocks were barely up yesterday. Unlike gold, they didn’t move above their recent intraday highs (which is exactly what happened in 2012 at the end of the corrective upswing).

By the way, back then, gold corrected to its 61.8% Fibonacci retracement, and this time it moved slightly above the 38.2% retracement (intraday) before declining.

This time the market is weaker, but the similarity between both periods remains intact.

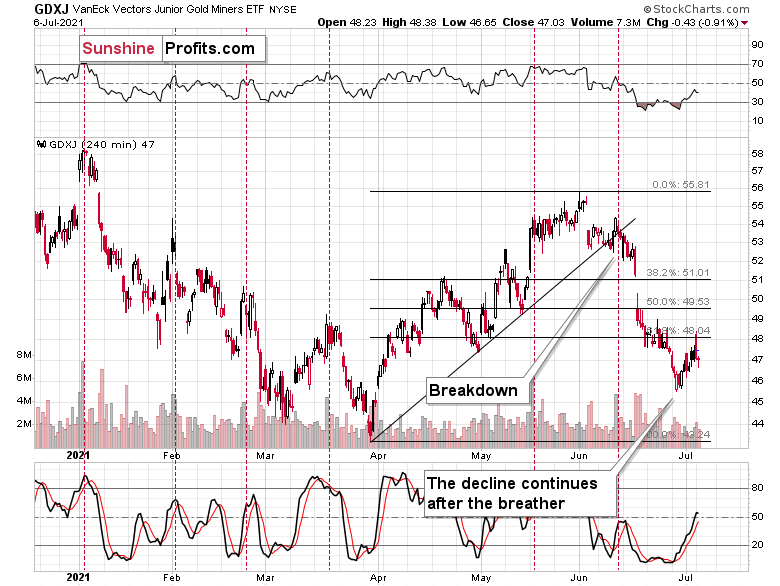

Getting back to the mining stocks, while senior miners moved slightly higher, junior miners declined. This is most clearly visible on the 4-hour chart.

After an intraday attempt to rally back above its recent low, the GDXJ turned south once again and ended the session lower.

I’ve already written why the junior mining stocks’ bearish potential is bigger than the one of the senior miners, and yesterday’s session provides yet another confirmation.

Hence, the outlook remains bearish.

Silver and the USDX

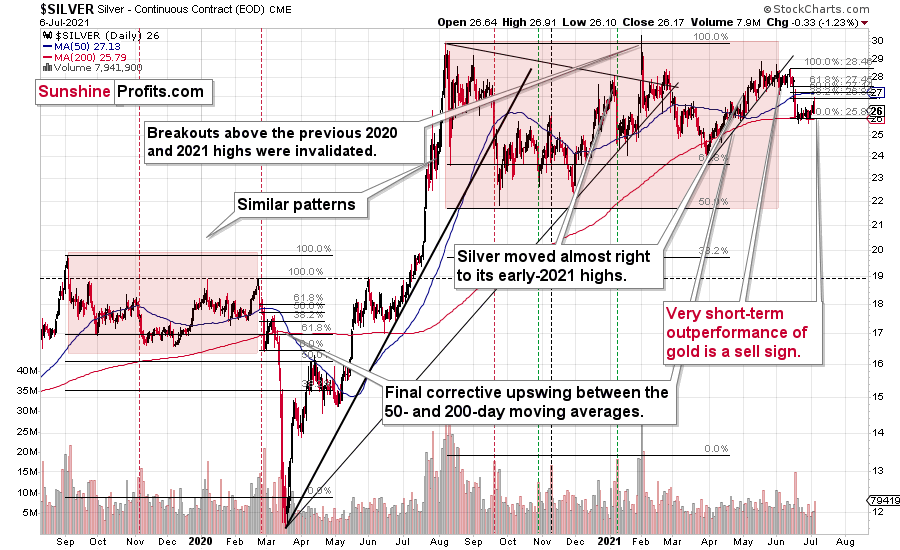

Let’s keep in mind the sell signal from silver too. Quoting yesterday’s analysis:

As further evidence, with silver outperforming gold, the behavior often serves as a prerequisite to significant tops. As a result, the white metal’s outward strength on Friday (silver rallied by $0.40 while gold gained only $6.50) has extremely bearish undertones and the 2012 analogue remains the most likely predictor of silver’s medium-term path.

Silver ended yesterday’s session lower but not before rallying. The above-mentioned sell signal remains intact.

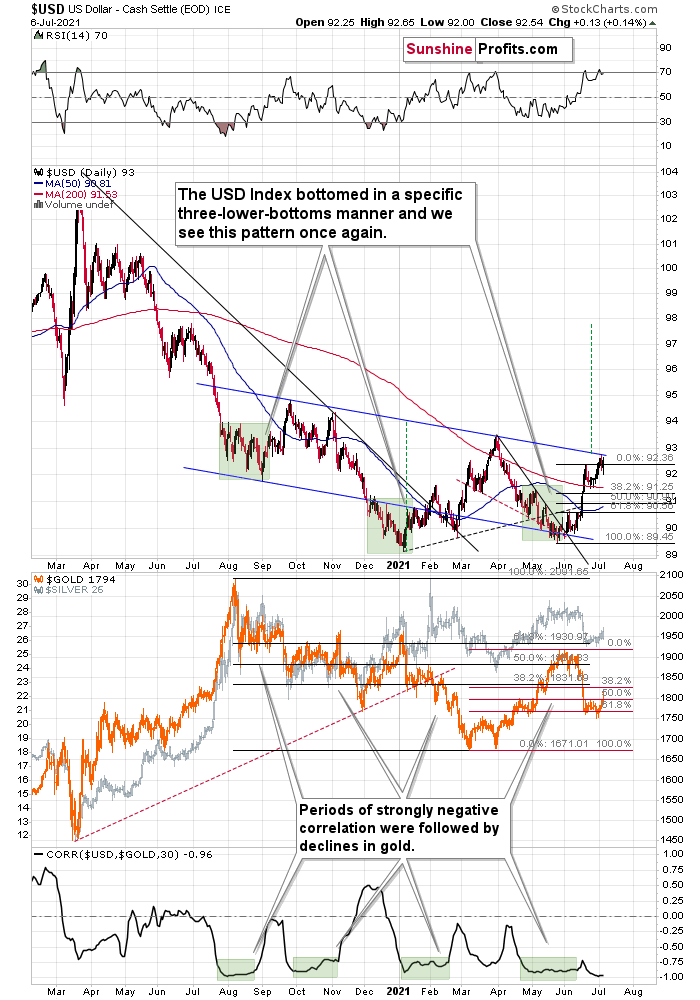

The situation in the USD Index is quite specific as well.

On one hand, we have a situation in which the USDX is just below the medium-term resistance line, so it suggests some difficulty in moving higher from here. On the other hand, we see that the USDX already corrected yesterday and rallied back up immediately. This could be a sign that it’s ready to break above the neck level of the pattern. This would be a major development as the target based on the head and shoulders pattern is equal to the size of the head (I marked it with green, dashed lines). The breakout here would, therefore, imply a move to about 98 –approximately the late June 2020 highs.

Naturally, the above would be very bearish for gold and the rest of the precious metals sector.

It seems quite likely that the USD Index will break higher, if not soon, then shortly. And when that happens, gold will likely slide to its previous 2021 lows. That’s when we might see a short-term rebound before a huge price plunge to $1,500 or lower.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more