Gold Just Showed You Exactly What's Coming For The S&P

Image Source: Unsplash

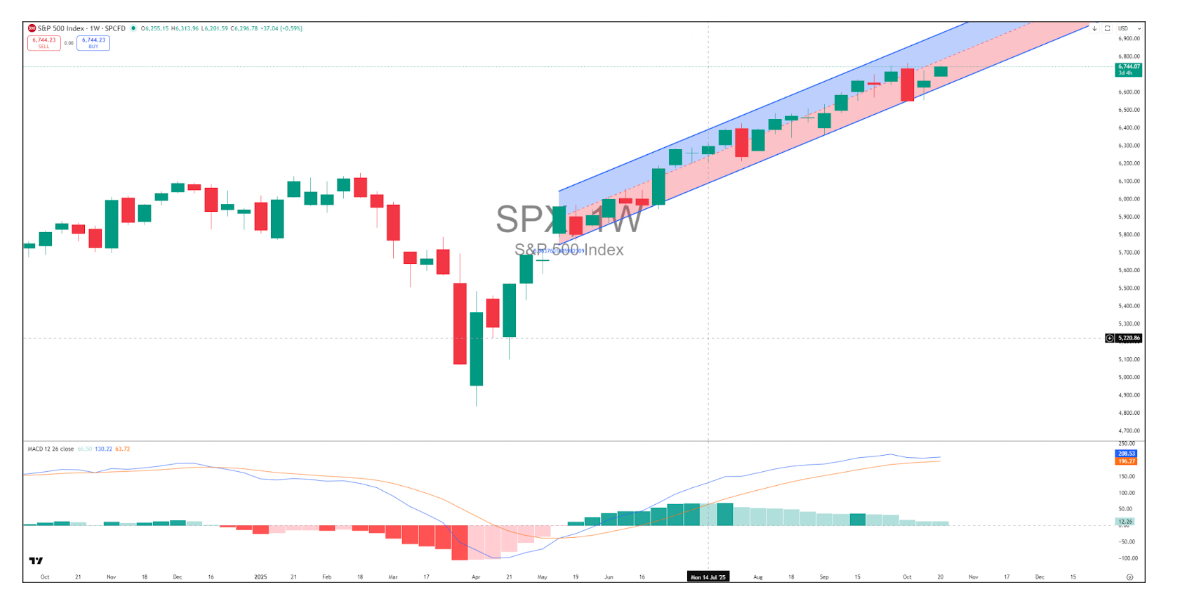

The S&P just printed another all-time high.

Six months of relentless buying….every dip defended within hours…retail traders rushing into calls every morning like clockwork.

You're watching the market overshoot, running past the cliff edge but somehow staying suspended in mid-air.

Not falling. Not climbing higher either. Just hovering there, defying gravity while everyone below waits for the inevitable drop.

This is your Wiley Coyote moment.

The cartoon character who runs off the cliff, keeps his momentum for a few precious seconds, then looks down and realizes there's nothing underneath him. That split second before the fall? That's exactly where this market sits right now.

The machines controlling 90% of daily volume are still programmed to defend the upward slope.

But the momentum that carried us higher for months just ran out of road.

And when these algorithms finally flip from systematic buying to systematic selling, you won't have time to react.

That's exactly why I built the Genesis Cog system: To detect when algorithmic momentum is exhausting itself, before the crowd realizes there's nothing underneath.

Because when you can see the slope integrity breaking in real time, you position ahead of the fall instead of getting crushed by it.

Click here to see how Genesis Cog detects algorithmic exhaustion before the collapse begins →

Today I'm showing you the three signals that prove momentum is exhausted, why this sideways grind is more dangerous than a crash, and what happens when the last buyer finally gives up.

Because when gravity takes over, there's no reset button for your account.

The Overshoot Nobody Sees

Pull up any chart from the past six months. The market climbs, consolidates, climbs again. Every 50-point selloff gets bought back within a day. Every correction finds support at precisely the right level.

This isn't natural price discovery. This is algorithmic defense running on autopilot.

The machines controlling 90% of daily volume operate on one principle: defend the slope. They calculate liquidity absorption rates and execute systematic buying at predetermined levels.

No emotion. No hesitation. Just mathematical precision protecting upward momentum.

But here's what changes everything. We're not climbing anymore. We're stuck between 6,600 and 6,800 on the S&P. Each day brings smaller gains. The momentum that carried us higher for months is exhausted, but the algorithms haven't switched to selling yet.

We're suspended in that moment right after the roadrunner disappeared and Wiley Coyote kept running forward. Still moving. Still in the air. But the ground is gone.

What Happens When Machines Run Out of Buyers

You want proof this pattern is already playing out? Look at what just happened to gold.

Gold collapsed 5% in two sessions. Down $140 after a vertical run that defied every bearish argument for months. That wasn't a correction. That was algorithmic unwinding the moment the bid disappeared.

The same machines that walked gold higher in a perfect linear channel for six months flipped to systematic selling when momentum broke. No warning. No gradual rollover. Just instant liquidation.

This is what happens when algorithms exhaust their order flow. They don't slowly transition from buying to selling. They flip programming instantaneously. One minute they're defending every dip. The next minute they're attacking every bounce.

Right now the S&P is operating on identical mechanics. Each new high comes on less volume. Each rally requires more effort. The rate of gains is decelerating. Up 70 points one day, up 20 the next, up one the day after that.

The law of large numbers is catching up. When you're at 6,700 and trying to push to 6,800, you need exponentially more capital than when you were at 5,000 pushing to 5,100.

The pool of willing buyers at these levels is finite. And when that pool finally dries up, you get what just happened to gold. Instant reversal.

The Pattern I've Watched Destroy Accounts Three Times

I've been tracking markets for 37 years. And I can tell you exactly what algorithmic exhaustion looks like because I've watched it destroy accounts three separate times.

Look at what's happening intraday right now. The market opens, attempts to push higher, fails, then grinds sideways for hours before attempting again. This is classic flag formation behavior at a major top.

Not the bullish continuation pattern from textbooks. The exhaustion pattern that forms when upward momentum dies but selling pressure hasn't taken over yet.

The 2000 dot-com peak spent three months in this exact pattern. Making new highs but going nowhere. Vertical move into sideways consolidation. Failed breakout attempts. Then the cable snapped and the Nasdaq collapsed 78%.

The 2007 financial crisis top showed identical behavior. The S&P chopped sideways at all-time highs for weeks. Each rally attempt weaker than the last. Each consolidation burning more buyers. Then gravity took over and we dropped 57% in 18 months.

Even the 2021 growth stock peak exhibited this same sideways churn at the highs. Peloton, Zoom, Roku all spent months going nowhere at their peaks before collapsing 80%.

You're watching it happen again in real time. The market keeps hitting 6,800, failing, dropping back to 6,600, then climbing back up. Over and over. Each cycle burning more buyers. Each failure eroding confidence.

The algorithms are programmed to defend the linear slope. But when the slope goes flat, when you're no longer making higher highs, the programming shifts. The machines that defended every dip will attack every bounce with identical precision.

Why the Technical Signals Everyone's Watching Don't Matter

Here's the part that trips up most traders. They're staring at their indicators waiting for confirmation. But those indicators are designed to tell you what already happened, not what's about to happen.

Right now the weekly MACD is still trending up. The RSI sits at 72. The stochastic indicators haven't rolled over. Every technical signal says "uptrend intact."

These indicators are lagging. They tell you where you've been, not where you're going. They'll confirm the breakdown after you're already down 10%.

The real signal is what's happening right now at these highs. The inability to break through 6,800. The declining volume on each rally attempt. The way every pop gets sold before it can sustain.

This is what algorithmic exhaustion looks like. The machines are still programmed to buy. But they're running out of counterparties. And when the last buyer finally exhausts themselves, there's no support underneath.

Wiley Coyote stays suspended in mid-air until he looks down. The moment he recognizes there's no ground beneath him, gravity takes over instantly. No gradual descent. Just acceleration downward.

The market works identically. Confidence holds prices aloft until psychology shifts. Then the fall happens faster than anyone expects. Just like gold. Just like the three major peaks I've watched in my career.

What You Need to Do Right Now

Stop treating this sideways action like normal consolidation. This is the overshoot. This is the market running past the cliff edge with nothing underneath.

The difference between survivors and casualties is recognizing the pattern before the fall begins. When gold collapsed 5%, did you see it coming? Or were you still convinced the uptrend would continue forever?

The S&P is showing identical patterns. Vertical slope. Failed breakouts. Sideways churn at highs. Declining momentum on each rally attempt. The same exhaustion signature that preceded every major correction I've studied in four decades.

You don't need to sell everything. You need to recognize where you are in the cycle. Reduce exposure. Take profits on extended positions. Get hedged before the psychology shifts.

The behavioral pattern is unmistakable. The algorithmic footprints are clear. The momentum exhaustion is visible in real time. What's missing is the psychological break, the moment when enough participants look down and realize they're running on air.

When that moment comes, when the weekly MACD finally rolls over and the algorithms flip from systematic buying to systematic selling, you won't have time to react. The machines will gap the market down 300 points before you finish your morning coffee.

The suspension doesn't last. Gravity always wins. The only question is whether you'll see it coming or get crushed by it.

The Genesis Cog system tracks these exact momentum shifts in real time. It detects when algorithmic slope integrity is breaking, when volume is declining on rallies, when the machines are running out of buyers.

The same logic I helped build at ThinkorSwim, now revealing when the overshoot is about to end.

Because I didn't build this system to predict crashes. I built it to detect when algorithmic momentum is exhausting itself, before the crowd realizes there's nothing underneath.

More By This Author:

Tesla's About To Rip?

The $10 Trillion Fear Signal Wall Street Doesn't Want You To See

Most Traders Just Wasted One Of Their 12 Best Days This Year

Neither TheoTrade nor any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, registered ...

more