Gold Hits Record High; Further Gains Ahead?

XAUUSD has set a new record high (~2235.64) ahead of the US PCE reading slated to be released today at 12:30 PM (UTC).

Gold’s further trajectory may be affected by this economic release as it is believed to be the Fed’s preferred way to measure the inflation.

According to the market consensus, the MoM and YoY change are expected to be at 0.3% & 2.4% respectively.

An uptick in inflation may complicate the highly anticipated rate cuts. This may translate in to XAUUSD moving lower, as Investors may refrain from investing in to zero-yielding bullion.

However, the lower-than-expected PCE reading may contribute to the Fed’s decision to start cutting rates sooner, which in turn could potentially extend support for XAUUSD.

At the moment, the market expects (with 63,6% probability) the Fed to start cutting rates in June 2024.

Still persistent geopolitical fears in the Middle East and Europe, combined with the upcoming US elections (November 2024) may too have a significant effect on gold prices.

On the demand side …

During the period of 25.03-28.03.2024 the total net asset value of the world’s largest gold ETF (SPDR Gold Shares) has posted a 1.1% increase, bringing the total value up to $59.1 billion.

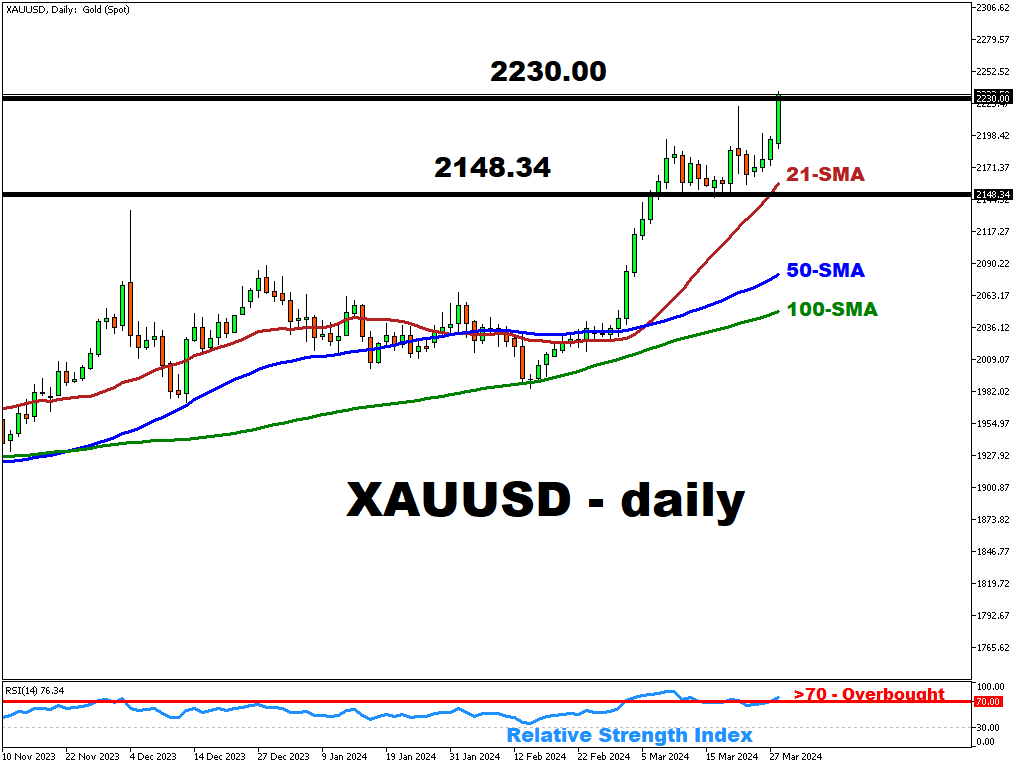

From the technical perspective …

- XAUUSD is trading above the key 21,50 and 100-period simple moving averages (SMAs), underscoring strong bullish momentum

- To the downside the 21-period SMA along with $2148.34 level are set to provide support for gold if the XAUUSD bears try to regain the momentum

- While to the upside the $2240 level may act as a next prime target (-resistance level) for XAUUSD bulls

- A relative strength index is in the overbought territory (>70 – overbought, <30 – oversold), signaling a potential for a technical correction

More By This Author:

USDJPY To Reach New All-Time High?

USDCHF Continues To Rise, Trading Above 0.94000 Level

Ethereum: Bullish Test At 21-Day SMA

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more