Gold ETFs Record Record Inflows In September

Image Source: Pixabay

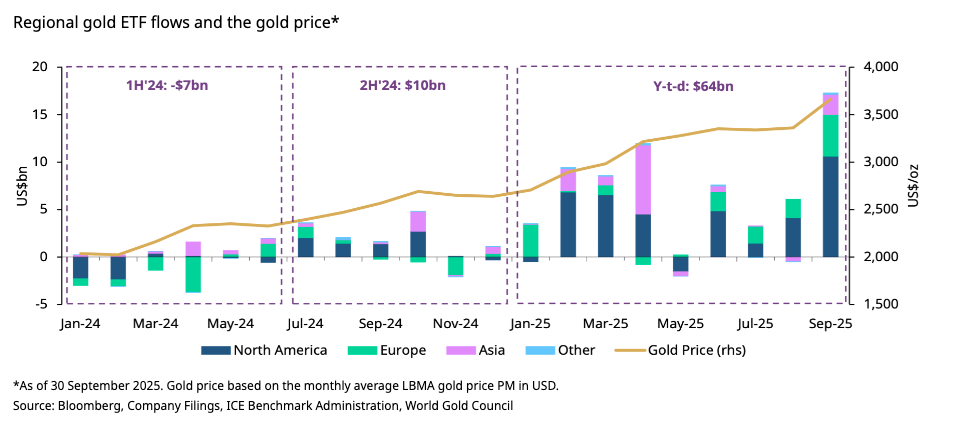

Inflows of gold into ETFs set a record in the third quarter, driven by the largest September increase on record.

This reflects Western investors finally getting off the sidelines and joining the gold bull market.

(Click on image to enlarge)

Based on assets under management (AUM), flows of metal into gold-backed funds set another record in September at $472 billion. AUM rose by 23 percent quarter-on-quarter in Q3.

However, even with the surge of gold into ETFs, global holdings remain below the all-time high in tonnage terms set during the pandemic.

Total gold holdings by ETFs globally rose by 6 percent quarter-on-quarter in Q3, hitting 3,838 tonnes. That is 2 percent below the November 2020 peak.

ETFs globally added 145.6 tonnes of gold in September alone.

North American funds led the way, increasing their gold holdings by 89.4 tonnes, totaling $10.6 billion. It was the fourth straight month of inflows for North American funds.

That pushed North American ETF gold holdings up by $16.1 billion through the third quarter. It was the largest Q3 inflow on record and the second-largest quarterly increase ever.

The World Gold Council cited ongoing trade conflict and geopolitical risks, dollar weakness, and the Federal Reserve rate cut as factors driving gold investment in North America.

SPDR Gold Shares, the world’s largest gold ETF, increased its gold holdings by 35.2 tonnes in September. It gobbled up 18.9 tonnes of gold in a single day (Sept. 19), the biggest single-day increase on record.

State Street Investment Management's head of gold strategy, Aakash Doshi, emphasized that even with the big surge in ETF investment, holdings in gold funds remain below the peak in 2020.

“Through most of this rally, gold has been underowned by investors. In January, GLD was still seeing outflows. So, from that standpoint, despite the growth, gold is still not an overowned asset.”

European funds reported an increase of 37.3 tonnes of gold totaling $4.4 billion last month.

During the third quarter, European ETFs added $8.2 billion in gold, the second-strongest quarter on record, just $74 million below the all-time high set in Q1 2020.

Funds based in the UK, Switzerland, and Germany led European activity. The World Gold Council said, “The strong gold price rally has been a key contributor to gold ETF demand across the region.”

Stagflation fears in the UK could be another key factor attracting gold ETF inflows.

After a couple of months of outflows, gold moved into Asian funds once again in September with the addition of 17.5 tonnes totaling $2.1 billion.

Funds based in India led the way, with Chinese and Japanese funds adding support.

The World Gold Council said strong price performance in local currencies helped drive demand.

“We attribute this to favorable local currency dynamics and increased investment demand as investors look for safe havens amid weaker domestic equities and persistent geopolitical and trade risk.”

Funds in other regions, including Africa and Australia, reported a modest 1.4-tonne gold inflow.

ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

ETFs are relatively liquid. You can buy or sell an ETF with a couple of mouse clicks. You don’t have to worry about transporting or storing metal. In a nutshell, it allows investors to play the gold market without buying full ounces of metal at the spot price.

Since you are just buying a number in a computer, you can easily trade your ETF shares for another stock or cash whenever you want, even multiple times on the same day. Many speculative investors take advantage of this liquidity.

But while a gold ETF is a convenient way to play the price of gold on the market, you don’t actually possess any gold. You have paper. And you don’t know for sure that the fund has all the gold either, especially when the fund sees inflows. In such a scenario, there have been difficulties or delays in obtaining physical metal.

Gold Trading Volumes

The gold price set 13 all-time highs in September, and gold market trading volumes surged, averaging $388 billion per day. That was a 34 percent month-on-month increase.

Trading on the COMEX was up 58 percent, and it rose 84 percent on the Shanghai Gold Exchange.

Over-the-counter trading activity hit $191 billion per day, a 12 percent month-on-month increase. That was 50 percent higher than the daily average in 2024.

Total net longs in COMEX gold rose 23 percent in September. Money manager net longs rose 7 percent to 493 tonnes. Other net longs drove a notable share of demand, increasing 33 percent to 313 tonnes and reaching their highest level since September 2022.

More By This Author:

With Gold Over $4,000, Mainstream Analysts Scramble To Raise Price ForecastsIs Gold Six Weeks Overbought... Or 60 Years Oversold?

Gold Miners Are Outperforming AI Chip Stocks This Year