Gold Dives As U.S. PPI Surges, Cutting Into Fed Dovish Bets

Image Source: Unsplash

Gold Price takes a hit and dives over 0.60% on Thursday following a red-hot factory gate inflation report in the United States (US), which prompted investors to price out the chances for a 50-basis-point rate cut at the Federal Reserve’s (Fed) upcoming meeting. The XAU/USD trades at $3,334 at the time of writing.

The US Producer Price Index's (PPI) July figure from the Bureau of Labor Statistics (BLS) crushed estimates and June’s print. Core PPI soared and was shy of touching 4% amid an environment in which the White House demands lower interest rates, saying that tariffs are not inflation-prone.

Other data revealed that the labor market, which showed signs of weakness, remains strong, as the number of Americans filing for unemployment benefits dipped below forecasts and the prior week’s report.

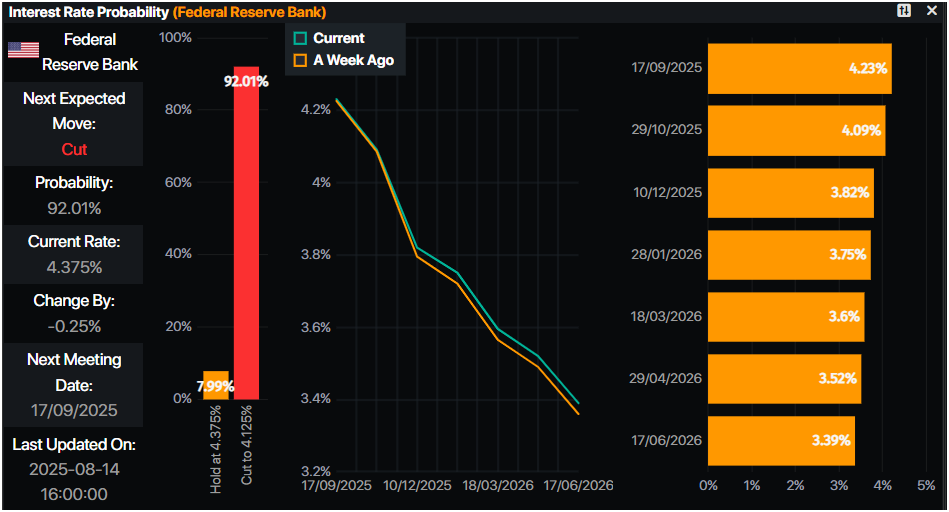

After the data, traders discounted a 50-basis-point (bps) rate cut by the Fed. Instead, they had priced in a 25 bps cut, with a slim chance that Powell and his colleagues would hold rates unchanged.

In the meantime, the St. Louis Fed President Alberto Musalem, one of the most hawkish members at the Federal Open Market Committee (FOMC), said that inflation is running close to 3%, with tariffs feeding through inflation.

Ahead this week, the US economic schedule will feature additional Fed speeches, Retail Sales for July, and the University of Michigan (UoM) Consumer Sentiment for August.

Daily digest market movers: Strong PPI boosts the Dollar, a headwind for Gold prices

- The US PPI rose 0.9% MoM in July after being flat in June. On an annual basis, PPI accelerated to 3.3% from 2.3%, well above the 2.5% forecast. Core PPI — which feeds into the Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) Price Index — soared 3.7% YoY, up sharply from 2.6% in the prior month, underscoring that companies will likely pass higher tariff-related costs on to consumers.

- Other data showed that Initial Jobless Claims for the week ending August 9 fell to 224,000, better than expectations of 228,000 and down from 226,000 the previous week. Continuing Claims rose to 1.953 million from 1.964 million, tempering concerns of a cooling jobs market.

- Now that inflation data on the producer and consumer sides are out, investors have turned cautious regarding the path of interest rates in the US. Friday’s Retail Sales data would be of interest to know the strength of the economy. A higher reading, and the markets could take a Fed rate cut at the September meeting off the table.

- The US Dollar Index (DXY), which tracks the performance of the buck’s value against a basket of its peers, surges over 0.47% at 98.24. The recovery of the Dollar has pushed Gold’s prices lower beneath $3,340.

- The US 10-year Treasury note yield surges five basis points to 4.289%.

- Traders have priced in a 92% chance of a 25 bps rate cut at the September meeting, according to Prime Market Terminal data.

(Click on image to enlarge)

Technical outlook: Gold price dips but remains bullish above $3,300

Gold price slips below $3,350 as factory gate prices in the States reignited fears of a reacceleration of inflation. The XAU/USD dipped below the confluence of the 20-day and 50-day Simple Moving Averages (SMAs) near the $3,349-$3,357 range. In the short term, momentum has turned bearish as depicted by the Relative Strength Index (RSI), but from a price action standpoint, Bullion should turn sideways below the July 31 low of $3,274.

If Gold clears $3,300, the next support would be the 100-day SMA at $3,292. Once surpassed, further downside lies below $3,274 as sellers eye $3,250.

On the other hand, if Bullion clears $3,357, the next resistance would be $3,380, followed by $3,400. Key resistance levels lie overhead, like the June 16 high at $3,452, followed by the record high of $3,500.

(Click on image to enlarge)

More By This Author:

GBP/USD Slips As Hot US PPI Data Erodes Aggressive Fed Cut Bets

Silver Price Forecast: XAG/USD Jumps To 3-Week High As The Dollar Sinks

EUR/USD Rises Towards 1.1700 On Soft U.S. CPI, Fed Rate-Cut Bets Increase