Gold Bulls Are Hoping 3rd Time Is The Charm

Image Source: Unsplash

The precious metals sector has remained elevated, yet volatile, over the past two years. Call it consolidation, but in my humble opinion, something has got to give.

Inflation, war, politics… gold bulls have the catalysts and tailwinds to see higher prices.

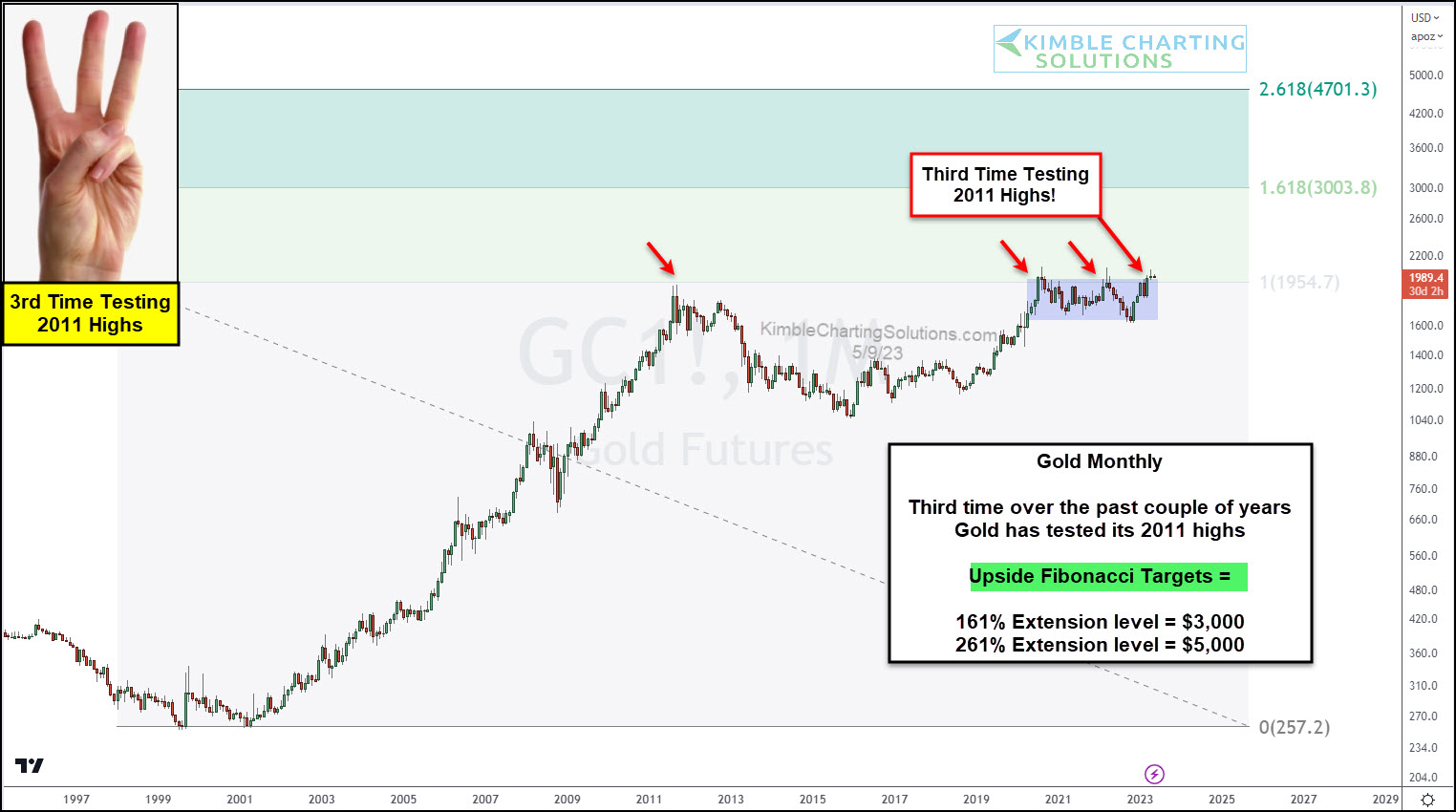

Today, we look at a long-term “monthly” chart of gold. As you can see, gold is testing breakout resistance for the third time over the past two years (see red arrows).

Over the years, I’ve heard that the more times an asset tests resistance, the more likely it is to take it out. If gold does break out, Fibonacci extension price targets include $3,000 (161%) and $5,000 (261%).

Seems like an important price area for bulls and bears to monitor.

Will “see if the “third time be a charm” for Gold?

(Click on image to enlarge)

More By This Author:

Crude Oil Is About To Send Critical Message To Fed

Treasury Bonds Are Setting Up For A Big Move

Precious Metals Next Big Move Hinges On U.S. Dollar

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.