Gold And Silver Commitments Of Traders Update

Image Source: Unsplash

Last week we updated the bullish weekly chart views of gold and silver. This week we update an important sentiment indicator for the metals, the most recent Commitments of Traders (CoT) report.

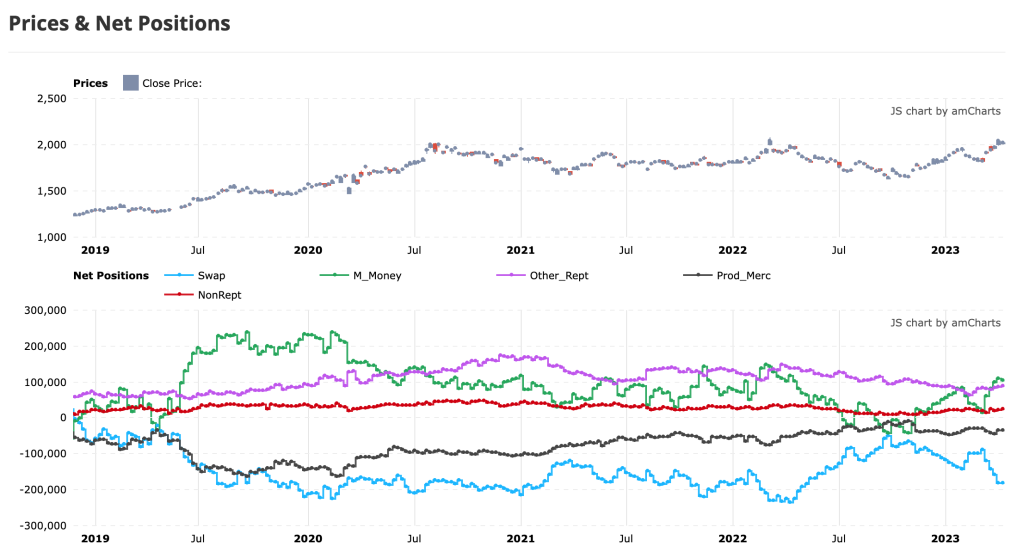

The CoT is a weekly reading of the positioning of traders in gold, silver, and commodities of all types. Its view at any time is an indicator of risk vs. reward with respect to the price of the metals. For our purposes, we will focus on the two most important readings, Commercial Hedgers (blue line) and large Speculators (green line). The less important readings are for metal producers, who would normally hedge their product to varying degrees (black line), and the ‘little guy’ or non-reporting retail (red line).

Gold’s CoT structure is not currently positive from a contrarian view. As you can see, the current gold price rally started from a very positive contrarian sentiment setup as both speculators and hedgers were near net zero positioning.

Hedgers are increasing their net short positions. This is normal and is usually the case during gold rallies within bull or bear markets. The same goes for the rise in net long positions by large Speculators. It is important to understand two concepts:

- Large Speculators will tend to be correct during the majority of the time the price is rallying (in other words, they ride the trend) and

- The Specs will be over-positioned at the next significant high in price.

Some call the Hedgers “smart money” and the Specs “dumb money”. But they are simply opposite sides of the trade. For our purposes, they are a sentiment indicator and in that regard risk/reward for the gold price is not appealing at the current time. It is also worth nothing that CoT is not yet at the extreme reading of the last price top in 2022 and CoT, like other market sentiment indicators, is not a good timer. It is a risk/reward gauge.

(Click on image to enlarge)

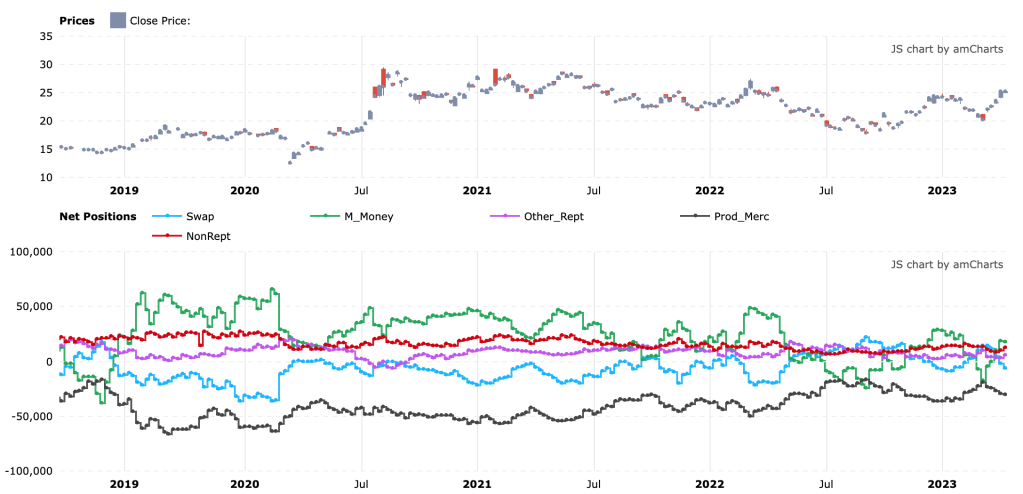

Turning to silver, we find a CoT situation in better shape than for gold. This is important because silver has been leading the rally. Despite this leadership within the precious metals complex and much of the broader markets as well, silver’s CoT situation is far from having reached an extreme.

As you can see, large Specs are nowhere near stretched net long to the degree that has ended other rallies since 2019. When we factor in the historical tendency of silver rallies to end in upside dynamics, there is a case in play that could see silver’s leadership remain intact and thus, the precious metals complex rally would have an important and intact underpinning.

(Click on image to enlarge)

There are many other factors in play for gold and silver that should be evaluated with respect to forward prospects. But from a CoT standpoint in a vacuum, the current phase of the larger bull move is not yet indicated to be over. CoT should be used in conjunction with other indicators, both technical and fundamental to build and maintain risk/reward propositions.

More By This Author:

Gold And Silver Weekly Charts Thru The Lens Of Technical Analysis

Gold Mining Stocks - The Power Of Leverage

Gold And Silver Weekly Chart - Technical Analysis

Catch last week's chart HERE