Gold: A Major Bottom Is Unfolding

Image Source: Pixabay

Gold Market Summary (September 4-8)

-

Gold Price Movement: Gold's value remained stable by the week's end. While there was a drop throughout the week, it seems a solid base is forming just above $1900.

-

Week's Synopsis: The week, shortened by the Labor Day holiday in the US, was expected to be quieter for gold and the US Dollar markets. Instead of abundant economic data, comments from Federal Reserve officials were predicted to guide the markets.

-

Key Economic Insights:

- There was limited impactful U.S. economic data related to potential Fed actions.

- After the Jackson Hole event, major FOMC figures made appearances, with their remarks considered pivotal for market movements.

- The ISM survey revealed that the U.S. service sector is recovering faster than predicted. This suggests the Fed might continue its anti-inflation measures, potentially hiking interest rates 1-2 more times in the year.

- Consequently, there was a notable rise in the yields of the U.S. Treasury, with the 10-year note hitting 4.3%. The U.S. dollar also increased, albeit moderately, due to prior gains.

- Gold's price dipped briefly but found a footing around $1915.

-

Gold's Behavior:

- Gold's price remained relatively unchanged on Thursday.

- Friday saw a brief spike in gold prices, attributed to the U.S. Dollar's minor decline. Gold peaked at $1930, but later pulled back.

-

Future Prospects:

- The week ended with a somewhat positive outlook for gold, consolidating near the $1920 mark.

- This week will be significant, as a potential decrease in core CPI to around +4.0% might boost the U.S. Dollar and challenge gold prices.

Let's take a look at the weekly standard deviation report for next week published in the Mean Reversion section of Market Place and see if we can identify any short-term trading opportunities.

GOLD: Weekly Standard Deviation Report

Sep. 09, 2023 10:59 AM ET

Summary

-

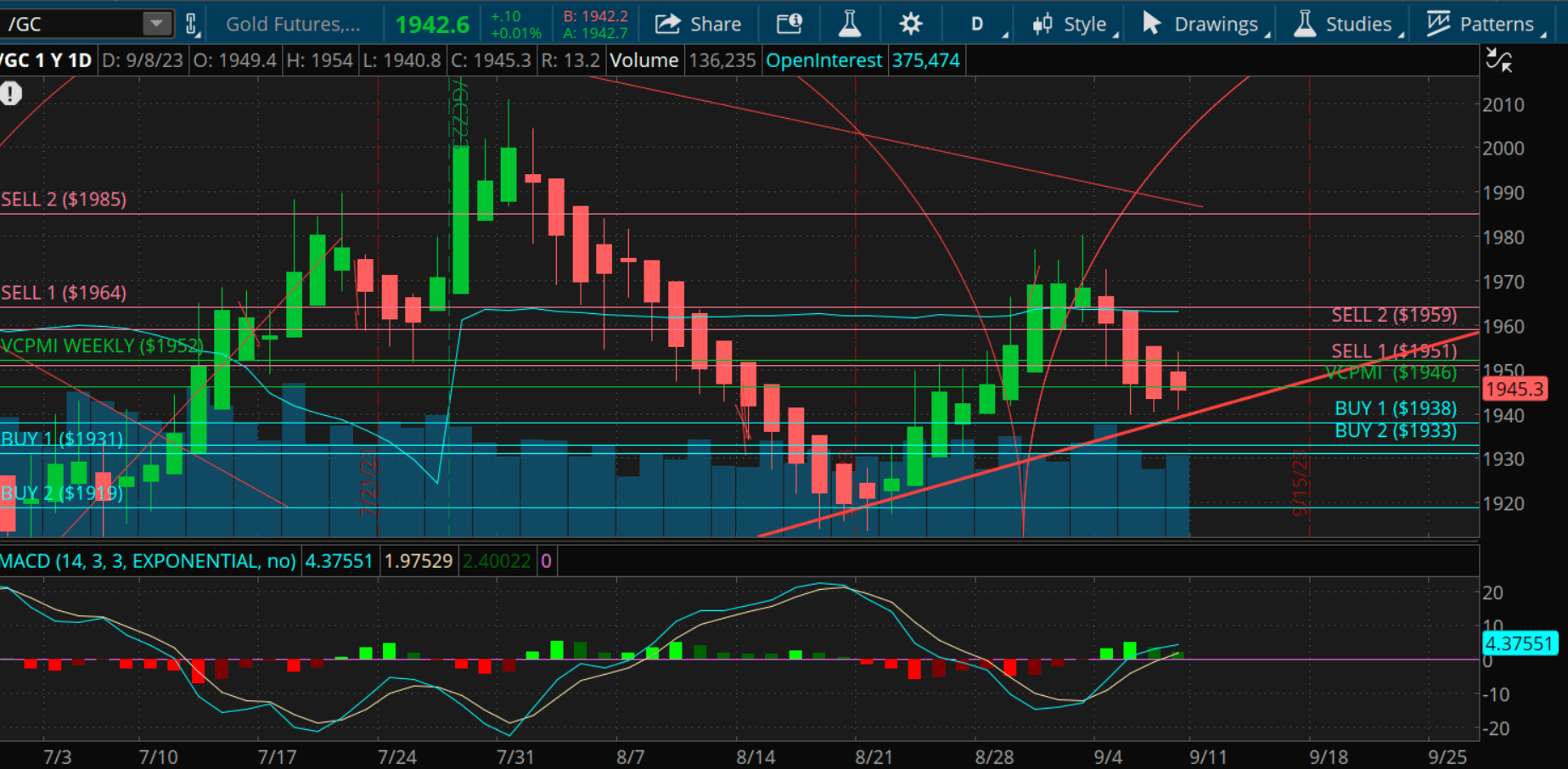

Gold futures contract ended the week with a bearish momentum, below the 9-day SMA and VC Weekly Price Momentum Indicator.

-

Short positions are advised to take profits within the range of 1938-1932, while long positions should implement a weekly reversal stop.

- Cycle analysis indicates a forthcoming cycle due date on 9.15.23. Traders positioned short should capitalize on profits within the range of 1938-1932.

(Click on image to enlarge)

gold weekly (TOS)

1. Weekly Trend Momentum: The gold futures contract concluded the week at a closing value of 1943. Observations indicate that the market's current position below the 9-day Simple Moving Average (SMA) of 1956 confirms a bearish momentum for the week. A subsequent closure above the 9-day SMA would shift this momentum from a bullish short-term trend to a neutral standpoint.

2. Weekly Price Momentum: The market's closure below the VC Weekly Price Momentum Indicator, positioned at 1952, corroborates the bearish price momentum identified this week. Any future closure above the VCPMI will negate the bearish sentiment and steer the short-term trend toward neutrality.

3. Weekly Price Indicator Recommendations:

- For short positions: It is advised to consider taking profits during corrections that fall within the Buy 1 and 2 levels, specifically 1938-1932.

- For potential long positions: A weekly reversal stop is recommended.

- For those with current long positions: Implement the 1932 level as a Stop Close Only (SCO) and maintain it as a Good Till Cancelled (GTC) order. Moreover, it is advisable to liquidate profits on long positions upon reaching the Sell 1 and 2 levels, projected between 1964-1985 over the week.

4. Cycle Analysis: It is noteworthy to mention that the forthcoming cycle due date is slated for 9.15.23.

Strategic Recommendation: For traders positioned short, it would be prudent to capitalize on profits within the range of 1938-1932.

More By This Author:

Slower Q2 Growth Fuels Fed's Inflation Fight: A Turning Point For The U.S. Economy?

Gold: A Relief Rally Coming Up

Forget The Fed And Load Up The Truck With Gold

Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives.

Disclaimer: The information in the Market Commentaries was ...

more