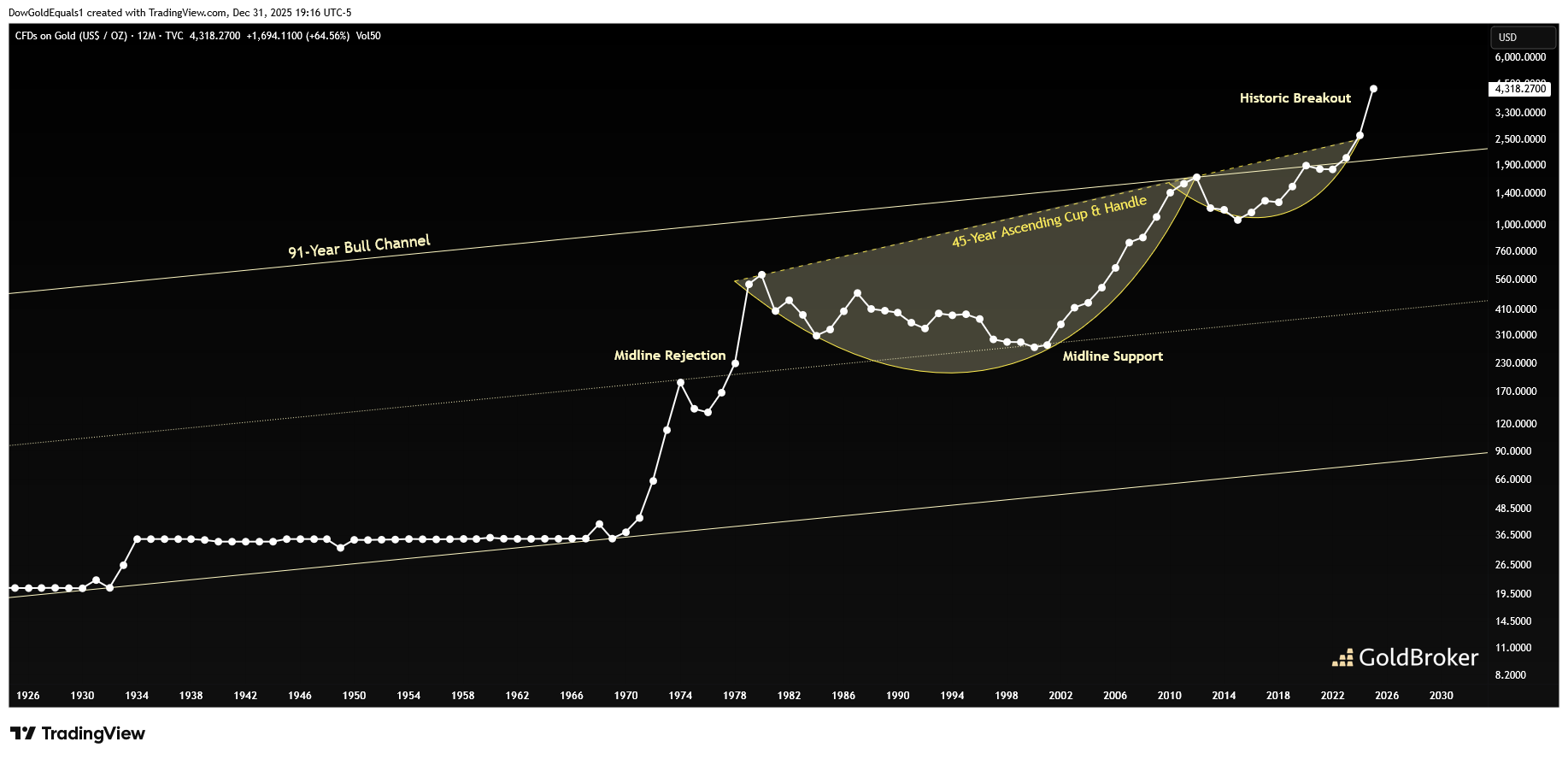

Gold & Silver Year-End Review: The Party Has Just Begun

2025 has drawn to a close, and precious metals bulls have plenty to be grateful for with gold closing the year at $4,325 and silver at $71.47. The significance of these annual closing values cannot be overstated — they are truly historic. And as we'll see in the following charts, the party has just begun!

We'll start with a near-century-long chart of gold, which I have defined as a broad bull channel that began at the lower rail in the days of America's Great Depression and FDR's confiscation of gold, which he soon after revalued. The gold price remained fixed until 1971, where we see price begin to drift upwards. I have said many times that a price channel's validity is often supported by what happens at its midline, and here we see a clear rejection in 1974 and support in 2001. More recently, we saw a strong rejection in 2012 at the upper rail and then a consolidation around the upper rail beginning in 2020 as price began to coil in preparation of an eventual breakout. Price finally broke out in 2023 around $2,000, and as you would expect when breaking out of a century-long channel, it has exploded higher with the price of gold more than doubling over the last two years. While a retest of the channel is still within the realm of possibility, the likelihood decreases as price continues to drift higher. The key point here is that a near-100 year breakout is just two years old. Expect price to increase dramatically over the coming years.

(Click on image to enlarge)

The next chart is a stunning look at silver going back to America's Civil War days in the mid-1800s. While both the United States and its concept of the Dollar has evolved dramatically over 160+ years, experience has taught me that the price action never lies, and a trend line never dies. Here, silver shows us a steep rising wedge with a mega ascending Cup & Handle forming within the wedge. The silver price currently finds itself very near the wedge upper rail and a handle breakout. Should price confirm such a breakout at the close of 2026, then we would expect silver to go absolutely ballistic. My long-standing target has been $500, but that may prove to be a conservative figure. Silver is going to shock the world in this analyst's humble opinion.

(Click on image to enlarge)

Our third chart is that of Silver/CPIAUCSL - the ratio of the price of silver to the US Consumer Price Index, a proxy for inflation. Here, we see that 2025 was the year price broke out strongly from a 45-year descending resistance that was tested in 2010, 2012, 2020 and 2024. Given how stiff this resistance had been, it is no surprise that price exploded higher once this line finally broke. The importance of the 15-year pennant should also be noted. The next target will be an assault on the 1979 high, another 65% higher from here, before we can expect any kind of meaningful resistance.

(Click on image to enlarge)

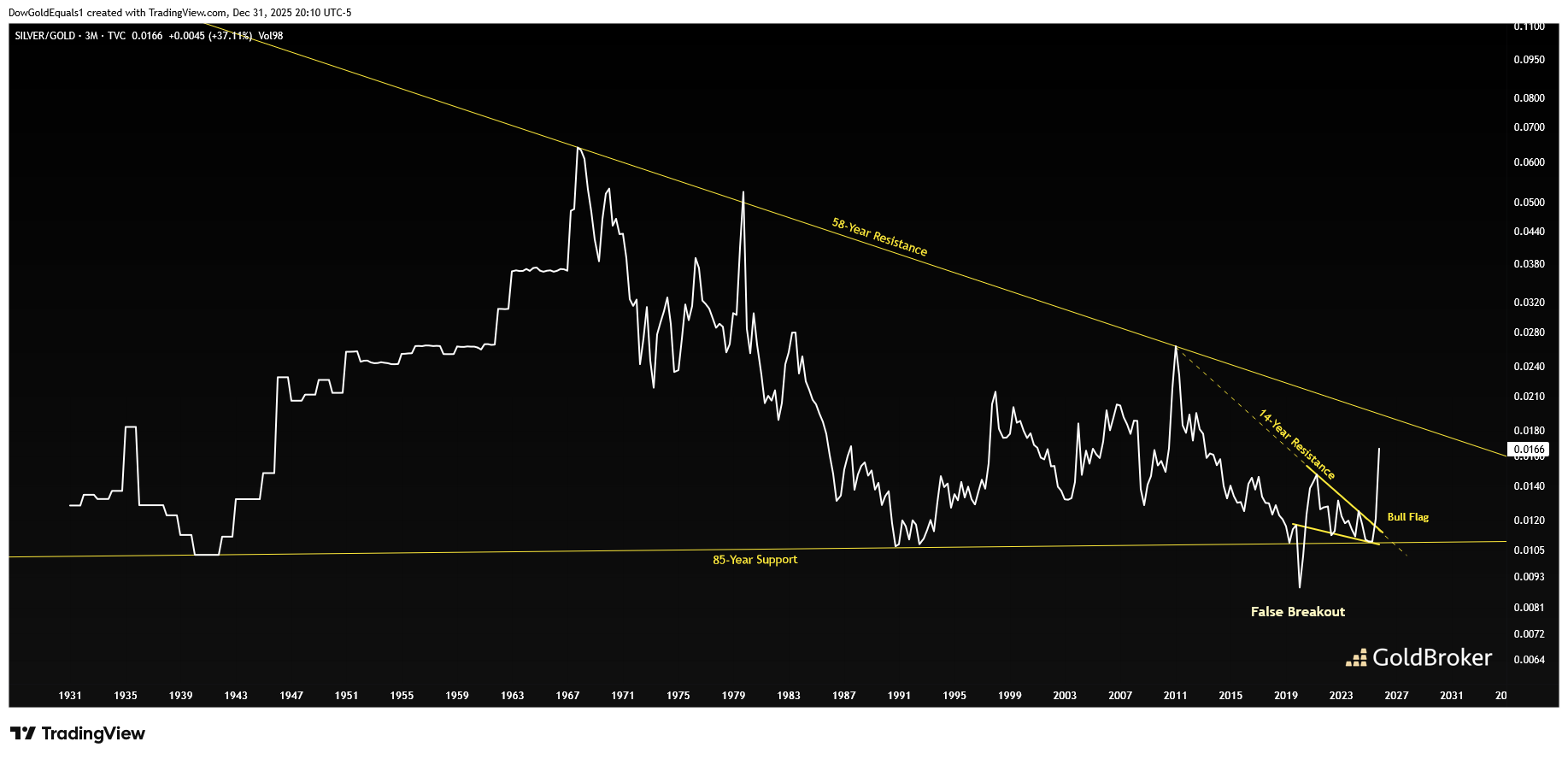

The final chart of 2025 is a quarterly look at the Silver/Gold ratio, which I have defined as a huge wedge with 85-year support below and 58-year resistance above. While price remains within the wedge, note the very strong breakout from 14-year descending resistance as well as a nice bull flag that formed out of a false breakout of the wedge at the 2020 Covid lows. Price appears to have strong momentum for an attempt to break out of the large wedge, which means silver would strongly outperform gold. Despite the remarkable gains in both gold and silver over the past couple of years, the bull market doesn't get going in earnest until this wedge breaks out.

(Click on image to enlarge)

Any way you look at it, the gold and (especially) silver party has just begun!

More By This Author:

Geopolitical Risk Dismissed By The Markets, Priced In By Precious Metals

Silver: A Broken Market Before A “Reset”?

2026: The Year Of True Capital Rotation