GDX: Gold Miners Are Cheap And Are Likely Headed Higher

Despite clear signs of higher inflation, robust technical setups, and other bullish elements, VanEck Vectors Gold Miners ETF (GDX) and gold miners in general, remain notably undervalued. Current revenue and EPS estimates appear conservative. Thus, future upward revisions could impact gold miners very favorably. Gold, GDX, and the broader gold mining sector have favorable fundamental tailwinds, bullish technical setups, and likely have substantial room to appreciate going forward.

Image Source: Pixabay

Where Gold Goes Gold Miners Follow

We recently discussed gold and the fundamental factors surrounding the yellow metal. Amongst the key elements are the U.S.'s perpetually increasing monetary base, remarkably high Federal debt as well as the U.S.'s debt to GDP ratio, dovish Fed policy, decreasing Treasury yields, rising inflation, and other elements.

The conclusion is that this is an attractive environment for gold, and the current bull market likely has notable upside. While gold miners often get overlooked, they are engaging investment vehicles. As the price of gold goes up the value of gold mining companies should grow as well. However, stock in gold mining companies typically rises more than the underlying asset. For instance, if gold is to appreciate by roughly 5%, we could see an increase of around 10-15% in a gold mining company's stock. Therefore, investing in gold miners is essentially like leveraging investment in gold, as you can see a move of 2-3X in a typical gold mining company relative to gold.

GDX: VanEck Vectors Gold Miners ETF

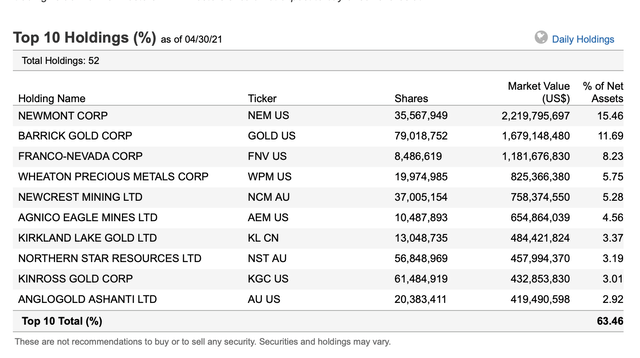

GDX is a well-diversified large and mid-cap-sized gold miner ETF. GDX has 52 holdings, and its top ten holdings account for roughly 63.5% of the ETF's weight. Top holdings include companies like Newmont (NEM), Barrick (GOLD), Franco-Nevada (FNV), Wheaton (WPM), Kirkland (KL), Kinross (KGC), AngloGold (AU), and others.

Source: vaneck.com

Technical Image

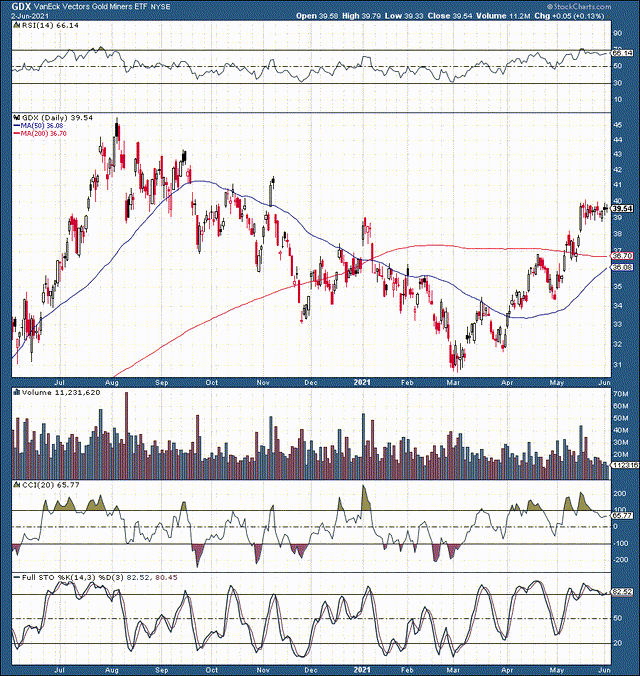

GDX

Source: stockcharts.com

From a technical standpoint, we see that the downward trend ended in early March. Since the March bottom, we've seen a series of higher lows and higher highs. Now GDX is going through a consolidation phase, after which a breakout above $40 should occur.

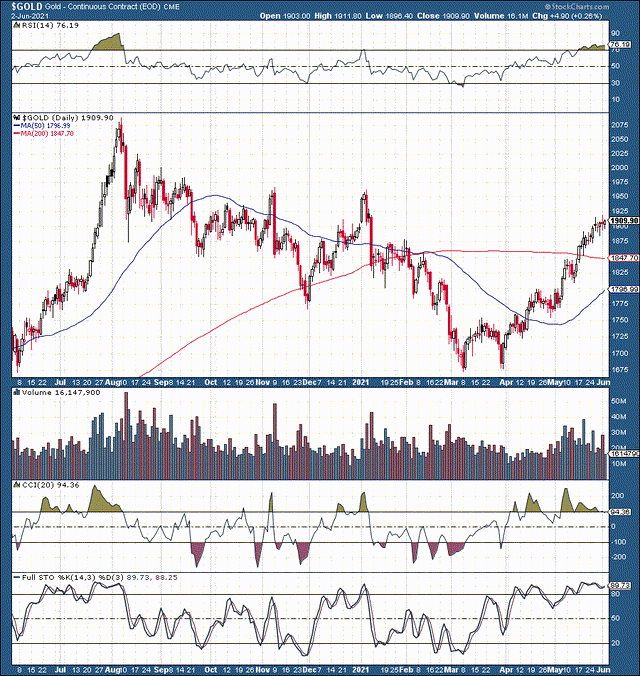

Gold

Source: stockcharts.com

Likewise, we see a clear double bottom in gold around critical $1,675 support. Since then, we see a series of higher lows and higher highs as well. With the relative strength index, RSI at about 76 gold is technically short-term overbought now. However, after a mild consolidation phase GDX, gold, and other gold miners should proceed higher once again.

Inflation

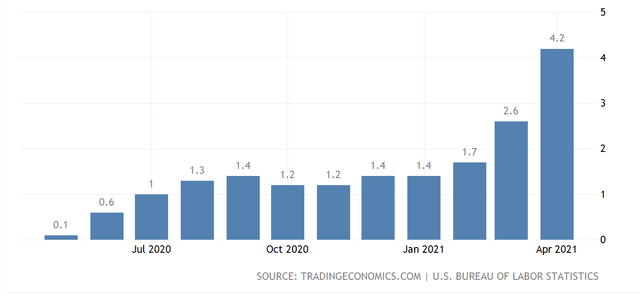

One of the reasons why we remain bullish on gold and gold miners is inflation. We see a trend of higher inflation along with a notable spike recently. In this current ultra-easy monetary environment, a higher inflation atmosphere could be the start of a new normal.

CPI Inflation

Source: tradingeconomics.com

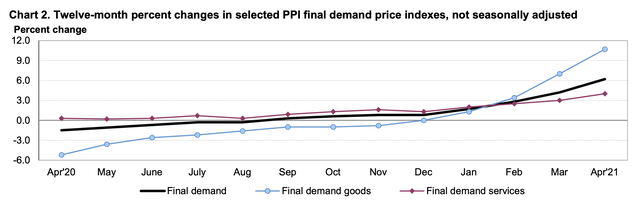

PPI Inflation

Source: bls.gov

CPI (consumer inflation) at 4.2% is a big number, something that hasn't occurred since before the financial crisis of 2008. PPI (producer inflation) is also heavily elevated, with the latest final demand goods reading at about 11%. Overall, we see a trend of higher goods, services, commodities, and asset class prices across the board.

The Fed could intervene when "necessary," but as I discussed in this analysis, interest rates essentially have a ceiling on how high they can go due to an extraordinarily high Federal debt load. Furthermore, prominent Fed members acknowledge that the economy is strong but claim that it is "way too early to intervene." The Fed will need to tighten policy eventually, but it is not likely to occur any time relatively soon (within the next 6-months). Moreover, the Fed's "lower for longer" policy could extend for at least another year and plausibly through 2022. Therefore, by the time the Fed gets around to fighting inflation, gold miners should be much higher. Additionally, there is no guarantee that the Fed will successfully combat inflation under current economic conditions, and a "new normal" economic atmosphere of higher inflation could emerge.

Gold Miners are Inexpensive Now

If we look at stocks in general, most are not cheap. In fact, with the DJIA trading at 29.50 earnings (trailing), the S&P 500 trading at around 37 times earnings, and the Nasdaq 100 trading at about 36 times earnings, one could argue that stocks are expensive right now. While most areas in the market appear overpriced, gold miners are one relatively cheap area.

P/E ratios of GDX's components:

Newmont - trailing P/E ratio: 20

Barrick - trailing P/E ratio: 20

Kinross - trailing P/E ratio: 13

Kirkland - trailing P/E ratio: 13

AngloGold - trailing P/E ratio: 10

We are essentially looking at trailing P/E ratios of 10-20 on traditional gold miners. These valuations are notably lower than the typical 30-40 valuation on your average large-cap Nasdaq or S&P 500 company valuation.

Estimates Likely to Increase

Another element worth considering is that many gold miners' forward estimates may be overly conservative. For instance, analysts have Newmont's and other gold miners' earnings peaking this year. It appears like analysts are attempting to time the top of the current bull market. Why should earnings top out this year? What if gold reaches even a higher level in 2023, 2024, 2025? What if the current bull market continues for several more years? How do we know that gold won't go to $3,000, $5,000, or higher? It doesn't seem practical to predict an earnings peak this year, as it is essentially the same as forecasting a top in gold's bull market. Therefore, forward earnings and revenue estimates could get revised higher. Higher stock prices are very likely going to follow higher earnings revisions.

The Bottom Line

Gold is in a bull market supported by favorable fundamental and technical factors. Gold miners trade alongside the yellow metal and should continue higher as gold's bull market continues. Elevated inflation is the primary source that is likely going to enable prices to drift higher. While inflation may be the key, it is not the only crucial fundamental factor in gold's favor. A perpetually increasing monetary base, high Federal debt, low-interest rates, dovish Fed policy, overly conservative earnings projections, and other favorable fundamental tailwinds should enable gold and gold mining stocks to move substantially higher from current levels.

Disclosure: I am/we are long GDX, NEM, KL, KGC, GOLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more