Gasoline Prices – Looking Forward

Nowcasts for tomorrow’s CPI print is 1.1% m/m (Cleveland Fed), and Bloomberg consensus is 1.2%. In contrast, core CPI nowcast is 0.52%, consensus at 0.5%. The large gap is in large part attributable to gasoline prices, which rose 20% in March (all grades), even though the CPI weight of gasoline is only 3.8%. What do gasoline prices look like in April? This will depend on oil prices.

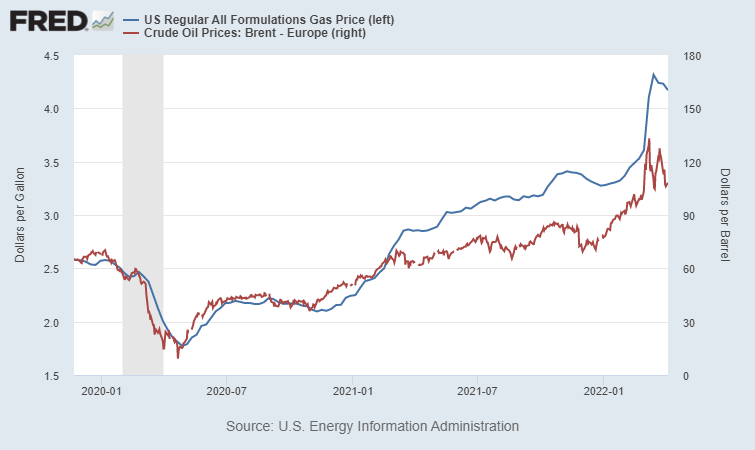

Figure 1: Price of gasoline, all formulations, $/gallon (blue, left scale), and price of oil (Brent), $/bbl (red, right scale). Source: FRED.

Gasoline prices are already falling.

A regression of gasoline prices on oil prices yields a coefficient of 0.027, implying each $1 change in the price of Brent implies a 2.7 cents increase in the price of gasoline — not too far off of Jim’s estimate of 2.5 cents.

The average price of Brent in March was $117.25, while the price today was about $100. If April price sticks at that level, then April gasoline prices will be about down about 47 cents from March’s $4.22/gallon.

Futures are backwardated, so that far futures are lower priced than near futures.

Disclosure: None.