Futures Flat As Tumbling Boeing Shares Offset Stellar JPM Earnings

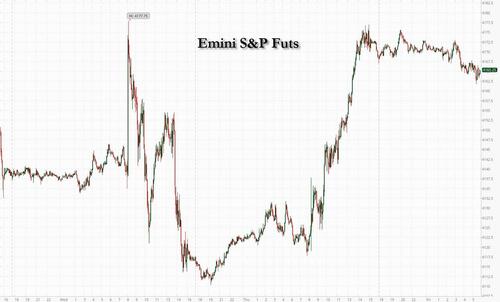

US stock futures were flat in yet another listless overnight session after Thursday’s bear-vexing rally as traders braced for a slew of earnings from major banks like JPMorgan Chase and Citigroup Inc. Contracts on the S&P 500 dipped 0.1% by 7:45am ET largely as a result of a big drop in Boeing shares, partially offset by solid JPM gains following stellar earnings, while those on the Nasdaq 100 fell by 0.5% after the underlying index added 2% in the last session.

(Click on image to enlarge)

In premarket trading, JPMorgan (JPM) jumps 5.9% after the bank boosted its net interest income forecast for the full year to $81 billion from about $73 billion. This was more than offset by a tumble in Boeing which fell after the aerospace company paused deliveries of some 737 Max jets over a parts issue, about which it was notified by Spirit AeroSystems a day earlier. Analysts said that the news was negative for Boeing and could result in a slowdown of deliveries, as well as impacting the broader sector. Boeing (BA) shares fall as much as 6.4%. Here are the other notable premarket movers:

- Cryptocurrency-exposed stocks gain as the Bitcoin rally gains momentum, with the digital token holding above the $30,000 level amid hopes that the Fed could eventually pause interest-rate hikes.

- Lucid (LCID) fell 6.3% on Friday after the EV maker reported preliminary-vehicle deliveries for the first quarter that missed the average analyst estimate.

- PNC Financial (PNC) rises as much as 8.2% after the firm reported earnings per share for the first quarter that were higher than consensus analyst estimates and reported deposits at end-period for that met the average analyst estimate.

- Rivian Automotive (RIVN) falls 3.5% after Piper Sandler downgraded the EV maker’s stock to neutral from overweight, saying the company’s capital intensive model may discourage investors in the current macro environment.

- A longtime bull on Rivian Automotive Inc. slashed his price target on the stock by three quarters, giving up on the electric-vehicle maker after a 92% wipeout in its shares.

- Tesla (TSLA) shares drop as much as 1.8% after the electric-car maker said it will cut prices for new Model 3 and Model Y vehicles by as much as 5% in Singapore.

- VF Corp. (VFC) gains 5.4% after Goldman Sachs upgrades the apparel and footwear company to buy from sell, saying strategic actions are starting to improve the profitability outlook.

- ViewRay (VRAY) falls as much as 7.1% after a pair of analysts downgrade their ratings on the medical-equipment company following its annual outlook cut and announcement of its plan to explore strategic alternatives. The stock had plunged 39% on Thursday in the biggest drop since August 2019.

- Wells Fargo (WFC) gains 3.1% after the firm reported net interest income and earnings per share for the first quarter that beat the average analyst estimate.

US equities have climbed this week ahead of the lenders’ results as traders assessed a key measure of US inflation, which showed hints of moderating in March, and minutes from the Federal Reserve’s last meeting. Investors will parse earnings statements for signs of an economic slowdown, while gauging how companies have managed to cope with headwinds like the banking system stress and higher rates.

“It’s going to be the outlook that investors are going to be fixated on,” Susannah Streeter, head of money and markets at Hargreaves Lansdown, said on Bloomberg Television. “Since the banking scare erupted, there are so many questions which have now been thrown in to the mix — not least a forecast of a mild recession from the Fed, but also this deposit flight.”

BofA’s Hartnett Prefers Global Stocks to Tech-Heavy US Market Bank of America Corp.’s Michael Hartnett said investors should avoid US stocks as expectations of a recession have become universal, specifically tech amid the backdrop of higher rates. For earnings, he said all lead indicators point to a deeper profit recession than expected

“What I see is that the market is seeing bad news as good news, so any sign of slowdown in the economy is expected to bring down inflation and force central banks to cut rates. That’s the narrative at the moment and hence the positive sentiment,” said Flavio Carpenzano, investment director at Capital Group in London.

“Investors will remain wary of any indication that the regional banking turmoil has translated into materially tighter lending standards throughout the system,” BMO strategists Ian Lyngen and Benjamin Jeffery wrote in a note.

Meanwhile, JPMorgan Chase and Well Fargo kicked off a busy earnings season. JPMorgan jumped about 8% in the premarket after reporting first-quarter deposits unexpectedly rose. Wells Fargo fell about 1% in the premarket after the lender increased provisions for credit losses for commercial real estate loans among others.

European stocks look set to finish the week on the front foot amid speculation that the global monetary tightening cycle is reaching its conclusion. The Stoxx 600 is up 0.4% and on course for a fifth consecutive gain with real estate, healthcare and food & beverages the strongest performing sectors. However, US equity futures are in the red with bank earnings in focus. Here are the most notable European movers:

- Hermes gained as much as 2% to a record after its quarterly sales leaped past estimates on the back of strong global demand, notably in China.

- 888 jumped as much as 17% after the British gambling company reported earnings and gave Middle East revenue guidance ahead of expectations after finishing an internal investigation on money-laundering claims.

- Comet Holding fell as much as 6.4%, the biggest intraday drop since November, after the Swiss tech firm’s 2023 sales guidance came in well below expectations.

- Alstom slid as much as 8.5% after Deutsche Bank downgraded to hold, saying the departure of the French train maker’s CFO brings additional uncertainties regarding financial targets and potential disruption in communications with Moody’s.

- Philips fell as much as 4.5% after the US drug regulator said the number of replacement and remediated devices that have been shipped to consumers in the US as a result of Philips’ sleep apnea device recall is considerably less than number of ‘new replacement devices and repair kits’ listed on the Dutch company’s website.

- National Grid declined as much as 1.5% as in- line results were overshadowed by the introduction of full expensing for capex, per the UK Spring Budget, which points to a broadly neutral cash and economic position for the British utility, according to Jefferies.

- Dechra Pharmaceuticals jumped as much as 40% to 3,882p after as the global veterinary supplies company confirmed talks with Swedish investment firm EQT about a possible all-cash takeover at a price of 4,070p/share.

- Superdry plunged as much as 20%, hitting the lowest since March 2020, as the clothing brand pulled full-year earnings guidance after retail sales for the first two months of the year failed to meet expectations. Additionally, the company said capital raise options were being considered.

Earlier in the session, Asian stocks reached the highest level in almost two months, as a slew of weaker-than-expected US economic data fueled bets that the Federal Reserve may soon pause its interest rate hikes. The MSCI Asia Pacific Index rose as much as 0.6% Friday, lifted by technology and industrial shares. Most markets in the region advanced, with Japanese stocks leading gains after Fast Retailing climbed the most in two years on higher profit guidance. India and Thailand were closed for holidays. A surprise decline in US producer prices and higher-than-expected jobless claims have anchored rate expectations, adding to earlier data that headline consumer prices were slowing. That, along with a retreat in the US dollar, are boding well for emerging market assets in Asia. Singapore’s central bank surprised the market by keeping its monetary policy settings unchanged, joining other central banks in Canada and Australia in pausing monetary tightening given rising global recession risks and ebbing inflation.

The Asian stock benchmark headed for a 1.6% gain this week, as the prospect of a peak in interest rates helped offset worries about the global economic outlook. China’s upbeat trade data also served to bolster investor confidence on the nation’s economic recovery. “Earnings growth for the region as a whole is really going to accelerate into 2024 and the market will start pricing that as we get deeper into the second half,” said Timothy Moe, chief Asia-Pacific equity strategist at Goldman Sachs, in a Bloomberg TV interview. He added that returns in China may be better than the rest of the region given “a much better near-term recovery.”

Japanese stocks were up for a sixth day, as Warren Buffett continues to ramp up excitement in the country’s shares and as weaker-than-expected US economic data boosted expectations of a cooling rate hiking cycle. The Topix Index rose 0.5% to 2,018.72 as of market close Tokyo time, while the Nikkei advanced 1.2% to 28,493.47. Earlier this week, Buffett, the billionaire investor, said he’s mulling a boost to his stock investments in Japan shortly after Berkshire Hathaway Inc. kicked off a yen bond sale. Sony Group Corp. contributed the most to the Topix Index gain, increasing 1.8%. Out of 2,158 stocks in the index, 1,404 rose and 645 fell, while 109 were unchanged. “Buffett’s comments continue to provide considerable tailwind to Japanese stocks, which are undervalued in terms of valuations, and are attracting more attention,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank.

In Australia, the S&P/ASX 200 index rose 0.5% to close at 7,361.60, its highest level in five weeks, boosted by a rebound in mining shares and banks. The benchmark gained 2% for the week, the third consecutive weekly advance. The rise comes as a gauge of global stocks headed for its highest close in 10 weeks on speculation the Federal Reserve and other central banks are nearing the end of their hiking cycles. In New Zealand, the S&P/NZX 50 index fell 0.4% to 11,880.57.

In FX, a gauge of the dollar extended its descent on Friday, heading for a fifth straight week of losses, its longest losing streak since 2020 on increasing market expectations that the Federal Reserve will cut interest rates later this year. The Swiss Franc hovered around a two-year high and the euro traded at the strongest in one year; the Swedish krona was also among the best G10 performers. The Bloomberg Dollar Spot Index eased 0.1%, helped by continued buying of the euro by macro and overlay funds to top the 12- month high hit in London on Thursday, according to an Asia-based FX trader. The index is down 0.8% this week, marking the longest weekly losing streak since July 2020. “We expect each condition for dollar weakness to fall into place in the weeks ahead,” Kit Juckes, chief FX strategist at Societe Generale wrote in a note

- USD/CHF fell as much as 0.3% to 0.8871, near the 0.8860 two-year low reached on Thursday. The rally on the Swiss franc has propelled it past the pound as the best performing G-10 currency this year

- EUR/USD rose as much as 0.3% to 1.1076, the highest since April 2022

- USD/CAD fell as much as 0.2% to 1.3317, the lowest in a month. o “Our preferred way to express dollar weakness is probably through USD/CAD, because that’s where long USD positioning is most evident,” SocGen’s Juckes wrote

- USD/JPY dropped 0.1% to 132.48; yen is the only G-10 currency to weaken against the dollar this week. USD/JPY two-week implied volatility is signaling that there is a 72% probability spot will trade in a 129.18-135.53 range during this period based off spot trading at 132.57; that means the pair would remain within the trading range it has been in since mid-March

- USD/SEK slipped as much as 0.4% to 10.2366 even as Swedish inflation slowed for the first time in more than a year. The Riksbank has said it expects to raise the key rate from 3% when the executive board gathers on April 25 and Governor Erik Thedeen has said that data published ahead of that meeting would be “more important than ever” for determining its course of action

In rates, treasuries were slightly cheaper from front-end out to intermediates, adding to Thursday’s selloff as stock futures rose after strong JPM earnings. US yields cheaper by up to 1bp across belly. 10-year yields around 3.46%, richer by 2bps vs. Thursday close with gilts lagging by additional 1bp in the sector and bunds trading broadly inline. IG issuance slate empty so far; volumes for the week sit at around $11b vs. projections of $10b to $15b. Three-month dollar Libor +0.14bp at 5.26171%.

In commodities, Crude futures edge up with WTI rising 0.2% to trade near $82.30. Spot gold falls 0.2% to around $2,036. Bitcoin adds 1.6% but has been overshadowed by Ethereum, which has jumped 5.2%.

To the day ahead now, and US data releases include retail sales, industrial production and capacity utilisation for March, along with the University of Michigan’s preliminary consumer sentiment index for April. From central banks, we’ll hear from the Fed’s Waller, the ECB’s Nagel and the BoE’s Tenreyro. Finally, today’s earnings releases will include JPMorgan, Citigroup, Wells Fargo, BlackRock and UnitedHealth.

Market Snapshot

- S&P 500 futures down 0.1% to 4,166.50

- STOXX Europe 600 up 0.4% to 466.10

- MXAP up 0.5% to 163.91

- MXAPJ up 0.5% to 529.15

- Nikkei up 1.2% to 28,493.47

- Topix up 0.5% to 2,018.72

- Hang Seng Index up 0.5% to 20,438.81

- Shanghai Composite up 0.6% to 3,338.15

- Sensex little changed at 60,431.00

- Australia S&P/ASX 200 up 0.5% to 7,361.58

- Kospi up 0.4% to 2,571.49

- German 10Y yield little changed at 2.38%

- Euro up 0.1% to $1.1058

- Brent Futures little changed at $86.12/bbl

- Gold spot down 0.3% to $2,033.91

- US Dollar Index little changed at 100.93

Top Overnight News

- Singapore’s central bank kept its monetary policy settings unchanged after five straight tightening moves since October 2021, joining a growing list of central banks that have opted to pause amid global growth risks and ebbing inflation. BBG

- China approved “provision of lethal aid” to Russia in its war in Ukraine earlier this year and planned to disguise military equipment as civilian items, according to a U.S. intercept of Russian intelligence revealed in leaked secret documents. WaPo

- Sweden’s underlying inflation slowed for the first time in more than a year, raising hopes of a turnaround for the Nordic nation’s households and its central bank, which remains under pressure to raise borrowing costs. BBG

- Hopes for a deal to end some of the rail strikes that have hit UK passengers rose on Friday after train companies made another offer to transport unions. The Rail Delivery Group, which represents train operators, said its latest proposal to the RMT union added “important clarifications and reassurances” around job terms and conditions to its longstanding offer of a 9 per cent pay rise over two years. FT

- The cost of buying insurance against a US government default has shot to its highest level in more than a decade, in an early sign of market concerns about the political impasse in Washington over the debt ceiling. FT

- House Speaker Kevin McCarthy is preparing to unveil next week a plan that would suspend the nation’s debt ceiling for a year in return for spending concessions, according to people familiar with the talks. BBG

- Boeing said on Thursday that a production issue will affect its ability to deliver a “significant” number of 737 Max jets, potentially exacerbating aircraft shortages for airlines around the world. FT

- Russian oil exports in March soared to the highest since April 2020 thanks to surging product flows that returned to levels last seen before Russia invaded Ukraine. IEA

- BlackRock beat consensus with net inflows of $110.32 billion and AUM of $9.09 trillion, which was a decline year on year but topped estimates. The firm's also been selling off asset-backed securities for Credit Suisse over the last two weeks including at least $300 million of bonds, people familiar said. BBG

- A weakening outlook for corporate spending coupled with emergent concerns about the lending environment represent downside risks to dividends. According to Bloomberg bottom-up consensus forecasts, regional banks and office REITs are expected to contribute less than $1 to S&P 500 DPS in 2023. This would represent just 6 bp of the index-level growth implied by Bloomberg bottom-up forecasts. If these groups were to simply maintain their current dividend policy for the rest of the year, the index would be on track to realize 5% year/year growth.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with modest and cautious gains with upside momentum somewhat waning in what was a catalyst-light session. ASX 200 was indecisive and moved between gains and losses in early trade, with the heavy outperformance of gold miners cushioning losses for the index. Nikkei 225 outperformed and was propped up by almost all of its sectors at one point in the aftermath of Warren Buffett’s bullish comments on Japanese stocks earlier this week, whilst Fast Retailing shares gained over 8% post-earnings after upping its earnings forecasts. Hang Seng and Shanghai Comp saw mild gains for most of the session, but ranges were contained with traders cautious ahead of next week’s key economic data including GDP, whilst PBoC Governor Yi Gang said he expects China's 2023 GDP growth at "around 5%" - in line with the government target.

Top Asian News

- PBoC Governor Yi Gang and Fed Chair Powell discussed the economic and financial situations of the US and China on Tuesday, according to Bloomberg.

- PBoC Governor Yi Gang expects China's 2023 GDP growth at around 5% (in line with the government target), and China's economy is stabilising and rebounding, according to the statement from the G20 meeting. He said China's inflation stays at low levels and China's property market is showing positive changes.

- China's top banks reportedly plan USD 5.8bln of bond sales to plug the capital hole, according to Bloomberg.

- "The scale of [Chinese] special bond issuance in the second quarter may continue to remain high. If the subsequent economic recovery falls short of expectations", according to Securities Times.

- BoJ Governor Ueda said the BoJ will maintain current monetary easing; Japan's core CPI, which is now above 3%, will likely slow back below 2% towards the latter half of this FY. He added they expect wages in Japan to continue rising, based on their view that the global economy will recover, according to Reuters.

- RBNZ Finance Minister Robertson says New Zealand has headroom on the balance sheet with borrowing below 20% of GDP, and the inflation impact from rebuild may be less than feared, according to Reuters.

- BoK Governor Rhee says not worried about a specific USD/KRW rate, according to Reuters.

- The Monetary Authority of Singapore (MAS) maintains the slope, width, and centre of the currency band; and said core inflation is expected to ease materially by end-2023.

- Taiwan's leading tech companies suffered the biggest drop in revenue in at least a decade last month, according to Nikkei data.

- China's Commerce Ministry says it is reviewing anti-dumping/anti-subsidy tariff on Australian barley.

European bourses are almost entirely firmer, Euro Stoxx 50 +0.3%, with catalysts ex-earnings lights and the Stoxx 600 on track to see the week out with gains of circa. 1.5%. Earnings from Hermes initially bolstered Consumer Products & Services, though now off best, with Real Estate leading while Energy and Insurance names lag. Stateside, futures are modestly in the red with action tentative ahead of US bank earnings and retail sales thereafter, ES -0.3%. UnitedHealth Group Inc (UNH) Q1 2023 (USD): EPS 6.26 (exp. 6.13), Revenue 91.9bln (exp. 89.78bln) +1.5% in pre-market trade. BlackRock Inc (BLK) Q1 2023 (USD): Adj. EPS 7.93 (exp. 7.76), Revenue 4.24bln (exp. 4.24bln)

Top European News

- ECB's Kazaks said the risk of recession is non-trivial and rates will need to go up more to tame inflation, according to CNBC. He added the key issue is still very high inflation, and he wouldn't exclude a 50bps hike in May.

- ECB's Holzmann said that a 50bps rate hike is in the ballpark for May, according to CNBC.

- ECB's Nagel said he doesn't expect a recession, according to Reuters.

- ECB's Wunsch says ECB could fully stop APP reinvestments this year; market pricing of terminal rate reasonable, but no quick rate cut likely thereafter.

- Spain's Economy Minister Calviño said GDP at the start of the year has been very strong, according to Reuters.

- German Economy Ministry: Q1 GDP growth likely to have increased slightly QQ, as such a technical recession can be avoided.

- UK Chancellor Hunt said the latest GDP numbers show there's absolutely no room for complacency. He noted confidence in the resilience of the UK economy among global finance officials, according to Reuters.

- UK Chancellor Hunt to "look at" raising deposit guarantees in wake of SVB collapse after recent turmoil showed banks could fail more rapidly than in the 2008 crisis, according to FT.

FX

- DXY dangling off minor new 2023 low within 101.010-100.780 range ahead of US retail sales, ip, UoM survey and dove/hawk Fed speakers.

- Majors narrowly mixed vs Greenback, but near peaks and big figure levels.

- Yen capped by decent option expiry interest at 132.00, Aussie and Kiwi straddle 100 DMAs at 0.6800 and 0.6302.

- PBoC sets USD/CNY mid-point at 6.8606 vs exp. 6.8614 (prev. 6.8658)

Fixed Income

- USTs flat-line awaiting busy agenda, as 10 year yield holds below 3.5% and T-note drift within 115-20+/114+ range.

- Bunds and Gilts underperform after brief bounces above 135.00 and towards 103.00, as w-t-d lows remain magnetic.

- Modest bounce in the space following Fed's Bostic (2024 Voter), who said after one more interest rate hike the Fed can pause to assess.

- Berkshire Hathaway (BRK/B) has established the terms of five yen-denominated bonds, amounting to JPY 164.4bln, according to dealwatch.

Commodities

- Once again, a fairly contained session for the commodity space with crude little changed overall and metals just off Thursday’s best in limited newsflow.

- Crude specifically has been slightly choppy but is yet to meaningfully stray for the neutral mark with parameters particularly thin. Amidst this, the complex is on track to see the week out with upside just shy of USD 2.0/bbl.

- Angola expects its oil production to temporarily increase next year on the back of recent private investments, but will remain under 1.5mln BPD (vs current 1.12mln BPD); the budget assumes oil at USD 75/bbl; oil under USD 70/bbl becomes uncomfortable, according to Reuters.

- The Biden admin reportedly approved LNG exports from the proposed Alaska LNG project, according to a document cited by Reuters.

- IEA Monthly Oil Market Report: oil demand is set to increase by 2mln BPD in 2023 to a record of 101.9mln BPD (vs. March view of 101.9mln BPD)

- Chilean mining minister expects the current production slump in the local copper industry to rebound in the coming years; sees no large variation in copper price from Cochilco forecast of USD 3.85/lb this year; dialogue with industry is helping ease concerns, according to Reuters.

- Yellow metal has dipped by around USD 10/oz from the overnight USD 2047oz peak, which is around USD 1/oz shy of the WTD best; base metals firmer, though off best as the USD attempts to recover.

Geopolitics

- North Korean leader Kim guided Thursday's solid-fuel ICBM test, according to local media KCNA - the new ICBM called Hwasong-18.

- China carried out missile launch drills in the Xinjiang region, according to Chinese state media.

- Russian Defence Ministry says the Pacific Fleet has been put on high alert in a surprise inspection, via Tass.

- US and South Korea are to stage air drills involving US B-52 bomber, according to Yonhap.

US Event Calendar

- 08:30: March Import Price Index YoY, est. -4.0%, prior -1.1%

- 08:30: March Import Price Index MoM, est. -0.1%, prior -0.1%

- 08:30: March Export Price Index YoY, prior -0.8%

- 08:30: March Export Price Index MoM, est. 0%, prior 0.2%

- 08:30: March Retail Sales Control Group, est. -0.5%, prior 0.5%

- 08:30: March Retail Sales Ex Auto and Gas, est. -0.6%, prior 0%

- 08:30: March Retail Sales Ex Auto MoM, est. -0.4%, prior -0.1%

- 08:30: March Retail Sales Advance MoM, est. -0.4%, prior -0.4%

- 09:15: March Industrial Production MoM, est. 0.2%, prior 0%

- 09:15: March Manufacturing (SIC) Production, est. -0.1%, prior 0.1%

- 09:15: March Capacity Utilization, est. 79.1%, prior 78.0%, revised 79.1%

- 10:00: Feb. Business Inventories, est. 0.3%, prior -0.1%

- 10:00: April U. of Mich. Sentiment, est. 62.1, prior 62.0

- 10:00: April U. of Mich. Expectations, est. 58.5, prior 59.2

- 10:00: April U. of Mich. Current Conditions, est. 66.0, prior 66.3

- 10:00: April U. of Mich. 1 Yr Inflation, est. 3.7%, prior 3.6%

- 10:00: April U. of Mich. 5-10 Yr Inflation, est. 2.9%, prior 2.9%

DB's Henry Allen concludes the overnight wrap

Risk appetite returned to markets over the last 24 hours, aided by some weak US data that supported expectations the Fed might soon call it a day on their rate hikes. In particular, investors welcomed the news that US producer price inflation had surprised on the downside, with both headline and core PPI coming in at their slowest monthly pace since 2020. But even as markets were rallying, concerns about an economic slowdown remained prominent after Wednesday’s Fed minutes showed that the staff were now projecting a mild recession. Those fears then got some added support from other data yesterday, since the weekly initial jobless claims came in above expectations for a third week running.

The problem for many investors right now is that it’s still possible to construct fairly divergent narratives about the economy depending on which series you look at. On the one hand, an array of leading indicators are pointing to a US recession over the coming year, in line with our own House View at DB Research. For instance, yield curves have inverted, temporary jobs are declining, and on previous occasions when the Fed have hiked this fast and this quickly, a recession has followed shortly afterwards. But if you wanted to take the opposite view, you could point to unemployment around its lowest in decades, a high level of vacancies by historic standards, financial markets that have mostly shrugged off the SVB-related turmoil by now, along with growing signs that inflation is softening and the Fed are nearing a pause in their rate hikes.

For the time being at least, investors took hope in the soft PPI release, where the details were more positive for investors relative to the CPI release the previous day. That’s because the PPI reading saw both headline and core surprise on the downside, unlike for the CPI reading where core inflation was still resilient and in line with expectations. For instance, monthly headline PPI came in at -0.5% (vs. 0.0% expected), taking the year-on-year measure down to +2.7% (vs. +3.0% expected). In the meantime, core PPI which excludes food, energy and trade services came in at +0.1% (vs. +0.3% expected), taking the year-on-year measure down to +3.6% (vs. +3.8% expected).

This positive backdrop on the inflation side led to a strong equity performance, and the S&P 500 (+1.33%) posted its biggest advance of April so far with 78% of the index finishing the day higher. Those gains were led by the more rates-sensitive sectors like tech, and the NASDAQ had its best day in nearly a month (+1.99%), whilst the FANG+ index was up +2.44%. At the same time, equity volatility remained subdued as the VIX index (-1.3pts) closed at its lowest level since January 2022, at just 17.80pts, which is striking when you consider how tumultuous markets were only a month earlier. The next thing to look out for will be earnings season now, with several US financials reporting today, including JPMorgan, Citigroup, Wells Fargo and BlackRock.

With softer inflation than previously expected, investors moved to slightly dial back how much they expected the Fed to keep hiking. For instance, the chances of a hike at the May meeting have fallen marginally to 69% overnight, having been above 70% for much of the last week. On the other hand, growing bullishness meant that longer-term rates moved a bit higher, and the rate priced in by the December meeting actually rose +2.1bps to 4.34%. In turn, shorter-dated Treasury yields were rather flat on the day, with the 2yr yield closing +1.1bps higher at 3.97%, and the 10yr yield saw a +5.4bps increase to 3.44%.

Another factor driving a modest selloff in shorter-dated US treasuries yesterday was the news that House Republicans were set to release a proposal to suspend the debt ceiling for a year in return for short-term spending concessions. This proposal is just the opening of GOP negotiations with the White House and congressional Democrats, and follows the release of the Biden administration’s budget proposal a few weeks back. The plan, as reported by Bloomberg, would suspend the debt ceiling until May 2024, which would also have political ramifications as it would be just 6 months before the 2024 presidential elections.

Over in Europe, there was also a reasonable dose of optimism, with the Euro itself closing above $1.10 for the first time since April 2022, just over a year ago. And overnight it’s seen a further increase that leaves it at $1.1072 right now. That optimism was echoed among equities, as the STOXX 600 (+0.40%) advanced for a 4th consecutive session to reach its highest level in over a month. This more positive backdrop came amidst growing expectations that the ECB might pursue another 50bp hike at their next meeting in May, rather than stepping down to 25bps like the Fed did earlier this year. Indeed, yesterday saw Belgium’s Wunsch and Slovenia’s Vasle say that the next decision would be between doing 25bps or 50bps, so explicitly opening the door to that option. Then Latvia’s Kazaks said “I don’t see any reason to slow down any time soon in terms of interest-rate increases, because inflation does remain very high”. That comes on the heels of Austria’s Holzmann endorsing a 50bp move the previous day, and yields on 10yr bunds (+0.2bps), OATs (+0.4bps) and BTPs (+0.7bps) all saw a modest increase.

Overnight in Asia, risk assets across the region have been supported by the strong handover from Wall Street overnight. Most of the major equity indices are trading higher, including the Nikkei (+1.07%), the KOSPI (+0.69%), the CSI 300 (+0.39%) and the Shanghai Composite (+0.33%). The only exception is the Hang Seng (-0.00%) which is almost unchanged. However, US stocks futures are struggling to gain traction this morning, with those on the S&P 500 (-0.05%) and NASDAQ 100 (-0.09%) both slightly lower. Another trend overnight has been the continued decline in the US dollar index (-0.20%), which has weakened for a fourth consecutive day and is currently trading close to a one-year low this morning.

Elsewhere yesterday, another asset class that benefited from the prospect of a pause in the Fed’s rate hikes were precious metals. For instance, gold prices (+1.26%) climbed to their highest level in over a year, closing at $2,040/oz, which leaves it just short of its all-time high in nominal terms, when it hit an intraday level of $2,075/oz back in August 2020. Overnight it’s risen a further +0.13% to $2,043/oz. In the meantime, silver (+1.28%) was also at its highest level in nearly a year, hitting $25.82/oz by the close, and overnight it’s risen a further +0.63% to $25.99/oz, which would leave it at a one-year closing high.

Looking at yesterday’s other data, the US weekly initial jobless claims came in at 239k in the week ending April 8 (vs. 235k expected). And here in the UK, monthly GDP growth in February was flat (vs. +0.1% expected), although the overall picture was a bit better than that implied, since the January figure was revised up a tenth to +0.4%.

To the day ahead now, and US data releases include retail sales, industrial production and capacity utilisation for March, along with the University of Michigan’s preliminary consumer sentiment index for April. From central banks, we’ll hear from the Fed’s Waller, the ECB’s Nagel and the BoE’s Tenreyro. Finally, today’s earnings releases will include JPMorgan, Citigroup, Wells Fargo, BlackRock and UnitedHealth.

More By This Author:

Musk: Twitter Users Can Now Monetize 'Any Material' - And Keep All Profits For 12 MonthsFed Balance Sheet Shrinks For 3rd Straight Week, Bank Bailout Facility Usage Eases

JPM Shrinks Base Metals Business, Fires Dozens Of Traders, Slashes Bonuses Following Series Of Nickel Scandals

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more