Futures Flat As Silver Soars To 11 Year High

Image Source: Unsplash

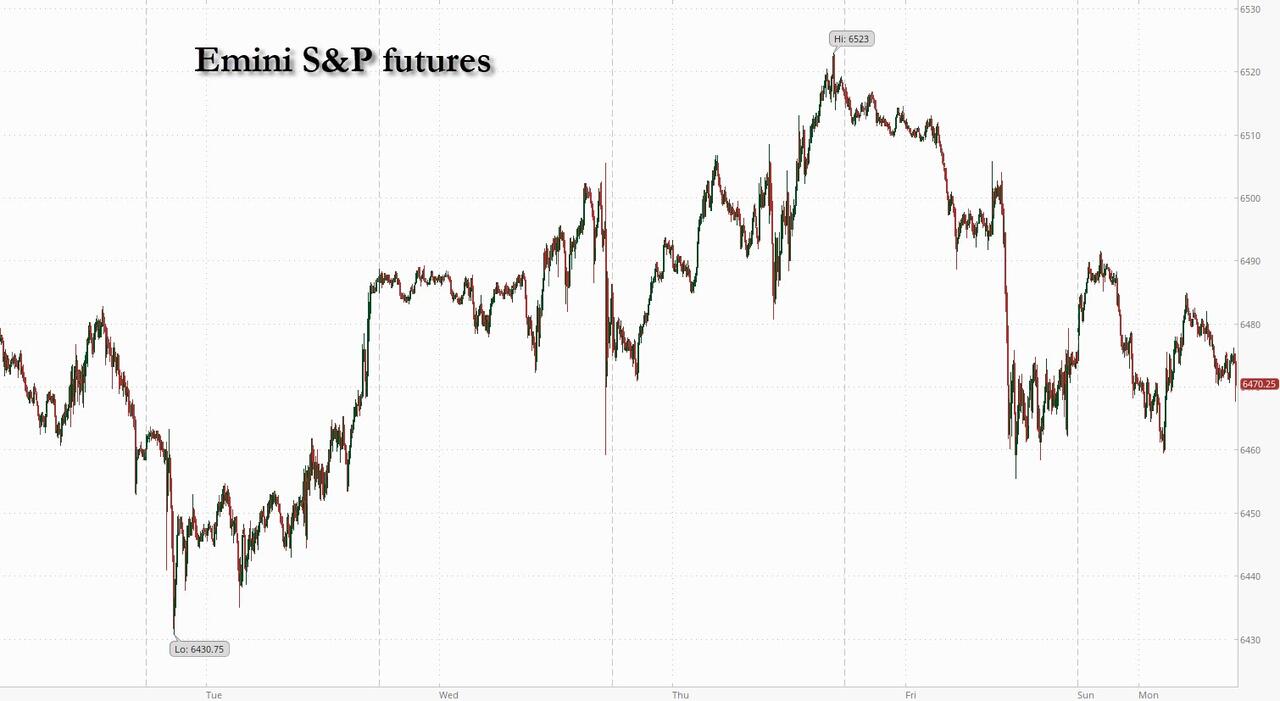

US equity futures are flat, with cash markets of course closed for Labor Day holiday, stabilizing after Friday's selloff in tech stocks amid renewed Nvidia (NVDA) jitters, and setting a steadier tone at the start of a month that could bring plenty of tests to markets trading near record highs. S&P futures were unchanged with Nasdaq futures rising 0.1% to start a traditionally brutal month for markets.

The stock rally to all-time highs faces a crucial stretch, with jobs numbers, inflation data and the Fed’s rate call all landing within the next three weeks, while September is notorious for hosting some of the worst market selloffs. The flurry of events will help determine whether stocks can extend gains or lose momentum.

Tariff tensions and questions over the Fed’s independence are compounding the risks.

“The bar to derail a Fed Rate cut on Sept. 17 appears high,” Deutsche Bank AG economist Peter Sidorov wrote. “But with Fed funds futures now pricing over 140 basis points of easing by the end of 2026, markets are expecting an amount of easing that since the 1980s has only occurred around recessions.”

Europe’s Stoxx 600 edged 0.1% higher with BAE Systems and Rheinmetall AG leading the advances in defense shares after the Financial Times reported that Europe is working on detailed plans for potential post-conflict deployments in Ukraine. Novo Nordisk lead a rally in health care shares after positive results from a real-world cardiovascular study for Wegovy. A regional gauge for tech stocks eked out a small gain. Here are some of the biggest movers on Monday:

- Rolls Royce shares climb as much as 2.4% amid reports it has held exploratory talks with advisers over funding options for its small-scale nuclear reactor unit.

- European defense stocks, including BAE Systems and Rheinmetall, gained after the Financial Times reported that European capitals are working on “pretty precise plans” for potential military deployments to Ukraine as part of post-conflict security guarantees, citing an interview with Ursula von der Leyen.

- Novo Nordisk shares rise as much as 3.6% after the Danish drugmaker said a real-world study of people with overweight or obesity and established cardiovascular disease showed Wegovy cut the risk of heart attack, stroke or death by 57% compared with Eli Lilly’s tirzepatide.

- Konecranes shares rise as much as 6.3% after the Finnish company was upgraded to buy by Goldman Sachs, which cites US port upgrades and a potential increase in shareholder returns as catalysts for the stock.

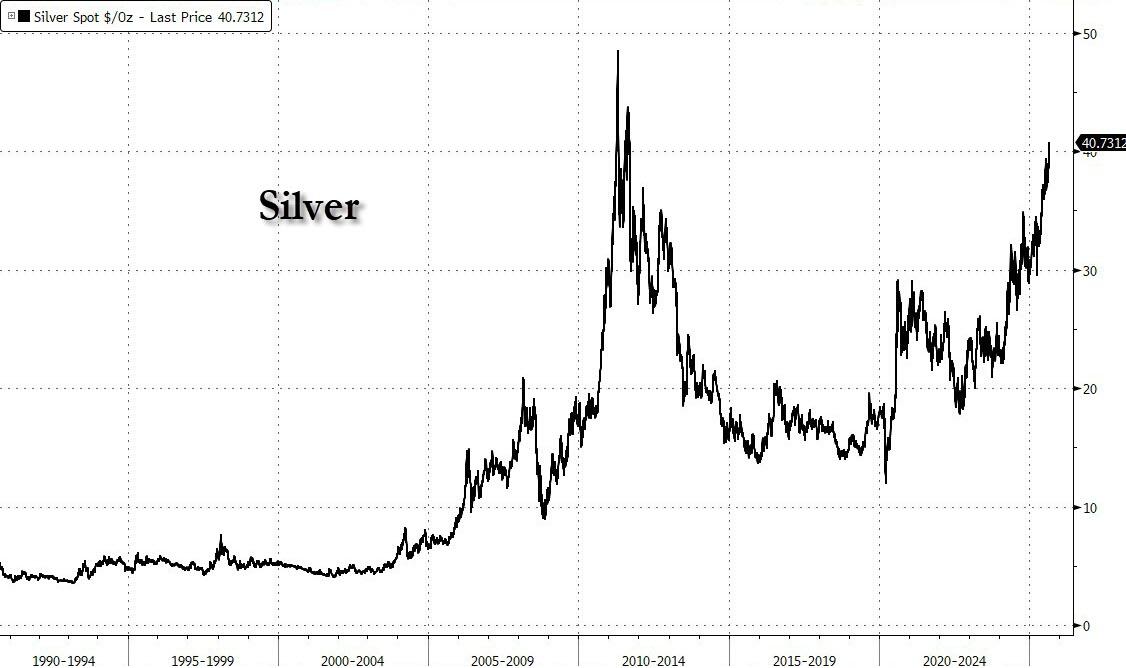

- European precious metal miners, including Hochschild Mining and Fresnillo, rise as silver surges above $40 an ounce for the first time since 2011 and gold closes in on an all-time high.

- TeamViewer gains as much as 11% following a double-upgrade to buy from underperform at BofA, which takes a more constructive stance on the German software company based on its “differentiated offering.”

- SocGen gains as much as 1.9% on Monday as Deutsche Bank upgrades the lender to buy from hold, saying that impact from the ongoing political volatility in France “should be contained.”

- Kainos shares soar as much as 20% after the IT services company said it expects annual revenue to be at the upper-end of expectations. Shore Capital said the update has revived sentiment by offering a more constructive tone and signs of momentum.

- BioArctic shares rise as much as 5.6% to the highest since September 2023 after Eisai and Biogen received US regulatory approval for a new self-injected form of their Alzheimer’s drug Leqembi.

A stronger economic outlook is set to help European equities escape their narrow trading range, according to top Wall Street strategists. Goldman expects the Stoxx 600 to climb about 2% to 560 by year-end, supported by improving growth prospects, light positioning, and relatively attractive valuations. JPMorgan strategist Mislav Matejka sees the recent loss of momentum as a “healthy” development.

Asian equities were mixed, with a 19% surge in Alibaba Group (BABA) contrasting with a slump in chipmaking shares. Elsewhere, Indonesian stocks tumbled the most in nearly five months as political risks flared, with President Prabowo Subianto canceling a China trip after deadly unrest over living costs and inequality. Stress also was evident in the bond market, with yields on the nation’s 10-year government note rising to the highest in almost three weeks.

In FX, the Bloomberg Dollar Spot Index falls 0.1%. The Swedish krona and Norwegian krone lead gains against the greenback, rising 0.6% each.

In rates, US cash bond markets are closed, while European bonds weakened broadly, with a week to go before a confidence vote that could topple France’s government. The French-German 10-year spread, a key measure of risk, was little changed at 78 basis points. The gauge closed at 82 on Aug. 27, the highest since January.

In commodities, silver rose above $40 an ounce for the first time since 2011...

... while gold inched closer to an all-time high after last week's breakout, as optimism grew for an interest rate cut by the Federal Reserve this month.

Gold surging after last week's breakout, just shy of April' all time high https://t.co/QMtcOw6gIv pic.twitter.com/3rXTOqbucR

— zerohedge (@zerohedge) September 1, 2025

WTI crude futures rise 1% to near $64.70 a barrel.

There is nothing on the US macro calendar because the US is closed for Labor Day holiday.

DB's Peter Sidorov concludes the overnight wrap

As it’s the start of the month, Henry will shortly be releasing our monthly asset performance review. August began with a risk-off tone after the underwhelming July US jobs report, but markets soon recovered and the S&P 500 hit fresh records, in part thanks to a dovish pivot by Fed Chair Powell at Jackson Hole. Nevertheless, there were several headwinds, including concerns about the Fed’s independence that led to higher inflation expectations and steeper yield curves. Meanwhile in France, the upcoming confidence vote saw the country’s 10yr yields move closer to Italy’s than at any time since 2003. See the full report in your inboxes shortly, while a rundown of last week’s moves is at the end of this text as usual.

After a strong August, risk assets are starting September on a more tentative footing as Friday’s tech-led sell off on Wall Street has continued across most of Asia this morning. With rising Fed rate cut pricing supporting markets of late, investors will be keenly watching whether this is validated by the upcoming US payrolls release on Friday. The bar to derail a Fed rate cut on September 17 appears high, but with fed funds futures now pricing over 140bps of easing by the end of 2026, markets are expecting an amount of easing that since the 1980s has only occurred around recessions.

Before we preview payrolls and the Fed in more detail, the major story of the weekend came as late on Friday a US federal appeals court ruled that tariffs introduced under International Economist Emergency Powers Act (IEEPA) were illegal, upholding an earlier ruling by the Court of International Trade. However, in its 7-4 ruling the court left the tariffs in place until October 14 giving the administration time to appeal the case to the Supreme Court. And while a majority of judges in the appeals court ruling were nominated by Democrat Presidents, there is a 6-3 Republican-appointed majority on the Supreme Court. Were IEEPA tariffs to be stuck down, this would invalidate most levies introduced this year, including the “reciprocal” country rates and the “fentanyl” tariffs on China, Mexico and Canada, though the administration could look to implement more levies via other statutes.

Turning to the US payrolls print on Friday, our US economists expect a modest pick up in both headline (DBe +100k vs. 73k previously) and private (+100k vs. 83k) payrolls. They see the unemployment rate holding steady at 4.2%, with a risk that it rounds down to 4.1%. With Powell leaning towards a near-term rate cut at Jackson Hole and markets now pricing an 87% chance of a September cut, it would likely take a huge payrolls outperformance to dissuade a September cut. However, a stable unemployment rate could alleviate fears of a material downshift in the labor market, keeping the Fed cautious on further rate cuts.

The payrolls release will be preceded by the JOLTS survey on Wednesday and the ADP report on Thursday, two labour market indicators that have been namechecked by Governor Waller, who last week suggested that a weak payrolls print could bring a 50bp September cut in play. Other Fed officials have been less dovish but have also noted labour market risks. We will see a few Fed speakers before the blackout window starts next weekend, including St. Louis Fed President Musalem (Wednesday), NY Fed President Williams (Thursday) and Chicago Fed President Goolsbee (Thursday).

Beyond the Fedspeak, markets will be glued to the latest newsflow around President Trump’s attempted removal of Fed Governor Cook. Friday’s court hearing on the injunction to block Trump from firing her yielded no decision with further filings expected this Tuesday. In a note last week (see here Fed Notes: What the announcement of Cook’s removal means for the Fed) our US economists discussed the possible implications if Governor Cook were to be removed and Trump were to achieve a majority on the Federal Reserve Board. This Thursday, the Senate Banking Committee will also hold a hearing on Stephen Miran’s confirmation for the vacant Fed Board seat as the White House looks to have him confirmed in time for the September FOMC.

While US markets will be closed today for Labor Day, other US data highlights this week will include ISM manufacturing (Tuesday) and services (Thu) prints, with the employment components of the two series, which have slipped over the past couple of months, likely to draw attention. In Europe, the main data release will be the euro area flash August CPI print tomorrow. Following the major country prints on Friday, our European economists see headline inflation rising marginally to +2.06% YoY (vs 2.0% prev.) with core falling to +2.22% (vs 2.3% prev.).

The political situation in France will remain in focus ahead of the confidence vote scheduled on September 8. Prime Minister Bayrou’s minority government looks likely to lose this with major opposition parties repeating their intent to vote against the government over the weekend. In a note published on Friday (see here), our European economists outline the next key steps and likely paths forward and discuss the ECB’s likely reaction function to the situation in France.

Staying with geopolitics, the focus yesterday and today is on China hosting the annual Shanghai Cooperation Organisation summit. Yesterday China’s Xi Jinping met with India’s Narendra Modi, with the two sides pledging to “remain partners rather than rivals”. The summit has received extra attention amid Trump’s tariff pressure on Asian countries, and Modi will also meet with Russia’s Vladimir Putin today, shortly after the US raised tariffs on India to 50% last week in response to its purchases of Russian oil.

Most Asian equity markets have started the new month on a weaker footing overnight following on Friday’s tech sell-off on Wall Street. The Nikkei (-1.60%) is leading the declines across the region, with tech stocks coming under pressure, including a -4.99% decline for Softbank. The KOSPI (-1.36%) is also struggling following US government's decision on Friday to revoke waivers on shipping chipmaking equipment to China for Samsung Electronics (-2.58%) and SK Hynix (-4.93%), with the S&P/ASX 200 (-0.53%) also lower. Meanwhile, US equity futures on both the S&P 500 (-0.09%) and the Nasdaq (-0.19%) are slightly lower after initially opening higher this morning.

However, Chinese stocks are defying the trend, with the Hang Seng (+1.77%) powering ahead as Alibaba Group’s stock surged by +17% after reporting a substantial triple-digit percentage increase in AI-related product revenue in its results on Friday. The CSI (+0.11%) and the Shanghai Composite (+0.42%) are inching higher as the RatingDog China Manufacturing PMI rose to a 5-month high of 50.5 in August (49.8 expected) from 49.5 in July. This comes in contrast to the official PMI figures on Sunday, which saw the manufacturing PMI (49.4 vs 49.5 exp, 49.3 prev) stay below 50. That said, China’s official non-manufacturing PMI rose from 50.1 to 50.3 (50.2 expected).

Recapping last week, the S&P 500 reached new all-time highs on Wednesday and Thursday but ended the week -0.10% lower after a -0.64% decline on Friday, which was its biggest since August 1. Tech stocks led the decline, with the Nasdaq and Mag-7 down by -1.15% and -1.38% respectively on Friday. Nvidia (-3.32% on Friday) was a major driver of this softness, losing ground after Marvell Technology’s outlook raised doubts over demand for data-centre equipment and as China’s Alibaba unveiled a new AI Chip. Last Wednesday Nvidia’s results had delivered a modest quarterly beat but saw slowing revenue growth for the data centre division, in part due to a pause in sales of AI chips to China.

Earlier in the week, markets had been buoyed by solid US data, including an upwardly revised Q2 GDP print (3.3% vs. 3.0% flash) and solid July durable goods orders. Friday saw a more mixed set of US releases. Core PCE inflation for August came largely in line with expectations at +0.27% MoM and +2.9% YoY, while the University of Michigan consumer sentiment saw an unexpected decline in the final August reading, with median 5-10 year inflation expectations also seeing a downward revision from 3.9% to 3.5%.

This data reinforced rising expectations of Fed rate cuts that were also boosted by Trump’s move against Fed Governor Cook. Fed funds futures ended the week pricing 109bps of easing by next June (+2.6bps on the week), with the 2yr Treasury yield falling -7.9bps to 3.62% (-1.3bps Friday), its lowest weekly close since September 2024. At the same time, concerns about Fed independence led to a sizable steepening in the yield curve, with the 10yr yield down a modest -2.5bps to 4.23% (+2.5bps Friday) but the 30yr yield up +5.2bps to 4.93%, leaving the 2s30s slope at its steepest since November 2021.

In Europe, French assets saw significant losses after PM Bayrou’s call for a confidence vote. The CAC 40 was down -3.34% (-0.76% Friday), while the Stoxx 600 fell -1.99% (-0.64% Friday) with all major European indices declining. 10yr OAT yields rose +9.1bps, as the Franco-German 10yr spread ended the week at 79bps after hitting a 7-month high of 82bps on Wednesday. Other government bonds saw more muted moves, with 10yr bund yields +0.3bps higher (+3.0bps Friday), while BTP yields rose +6.1bps (+4.9bps Friday) suffering some contagion from the France story.

More By This Author:

Australia's Largest Rare Earth Miner Plans US Expansion To Compete With China

Fed's Favorite Inflation Indicator Shows No Signs Of Runaway Tariff Costs

Initial Jobless Claims Refuse To Show Any Signs Of Cracking

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more