Fed's Favorite Inflation Indicator Shows No Signs Of Runaway Tariff Costs

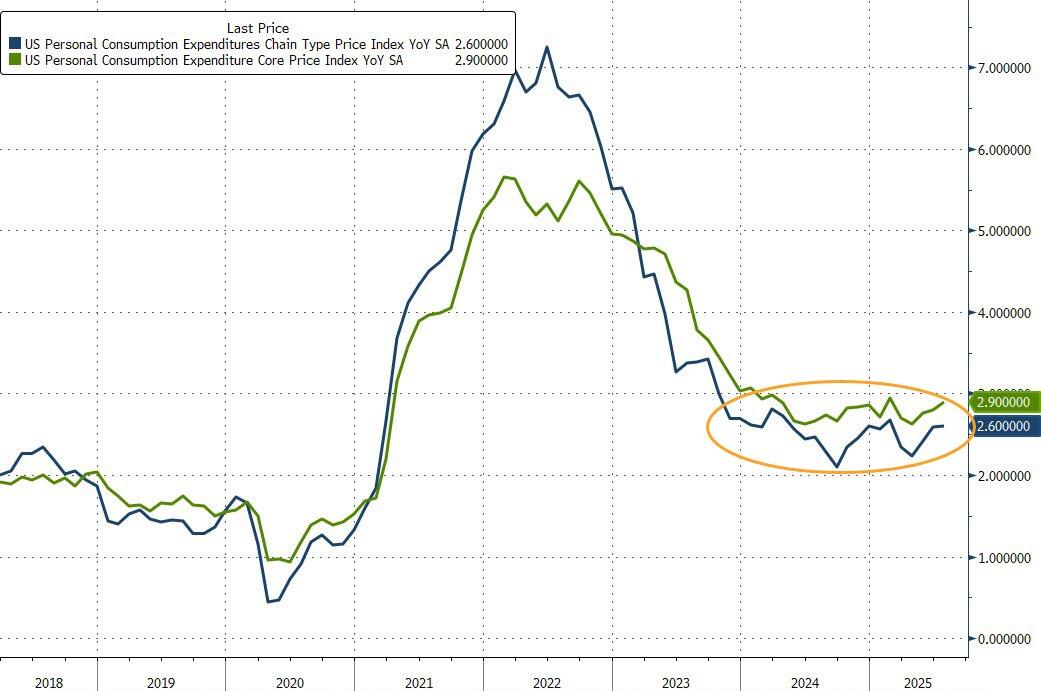

Having ticked higher in June, analysts expected headline PCE to be steady at +2.6% YoY in July and Core PCE - The Fed's favorite indicator - to rise from +2.8% to +2.9% YoY... and the numbers all came in right in line with expectations.

'As Expected' is the them of this morning's data with headline and Core PCE both matching expectations and staying in the same range they have been in for two years... not exactly the Trump Tariff terror future that was predicted...

Source: Bloomberg

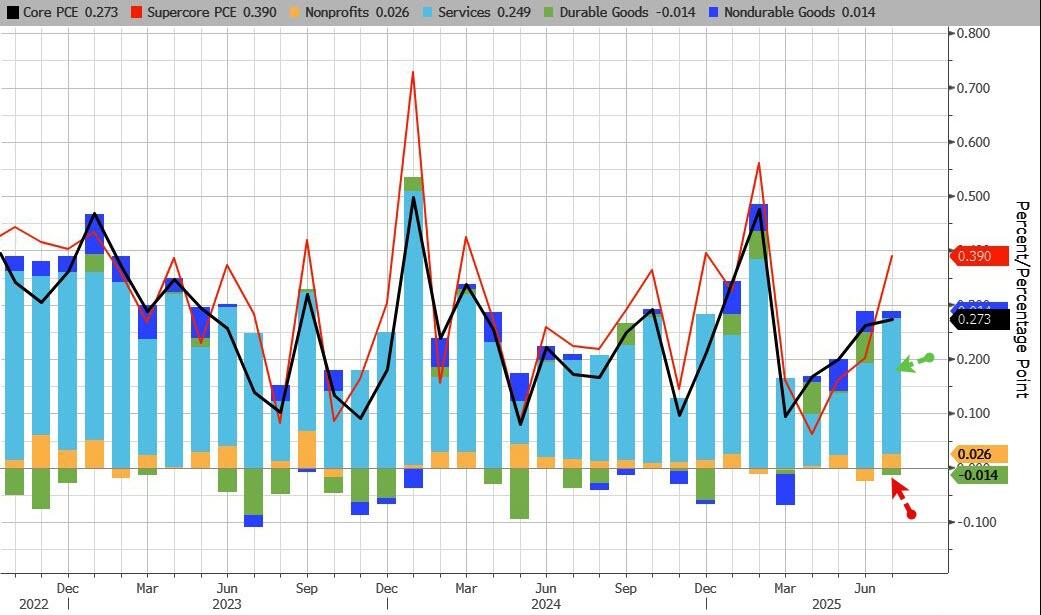

Durable Goods prices decline MoM while Services costs increased the most...

Source: Bloomberg

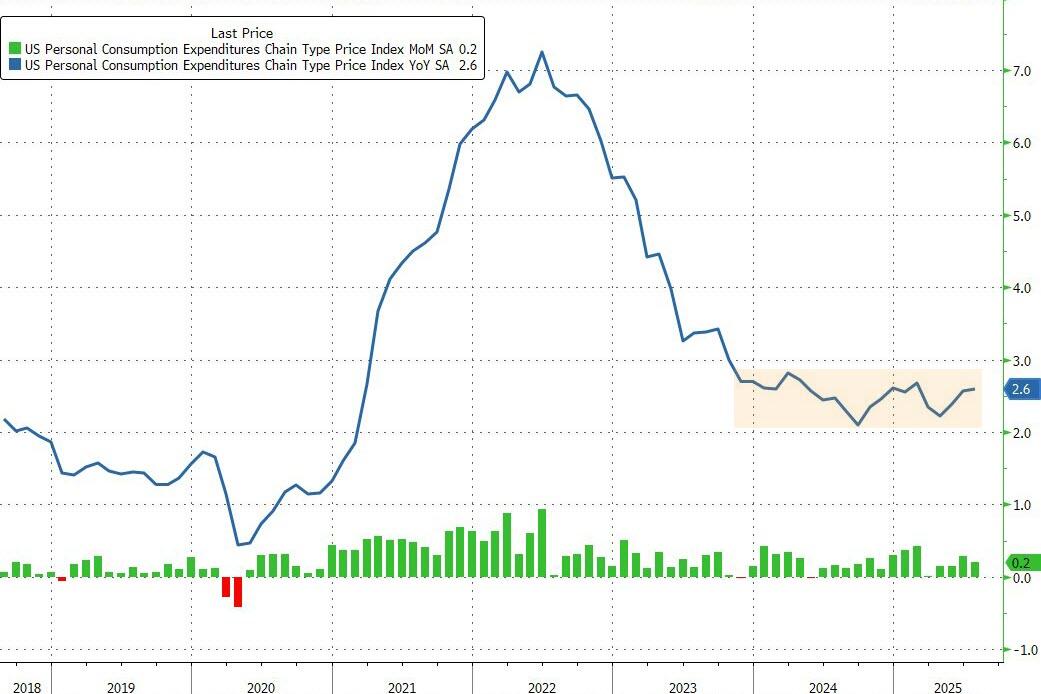

Headline PCE rose 0.2% MoM (as expected) and +2.6% YoY (as expected)...

Source: Bloomberg

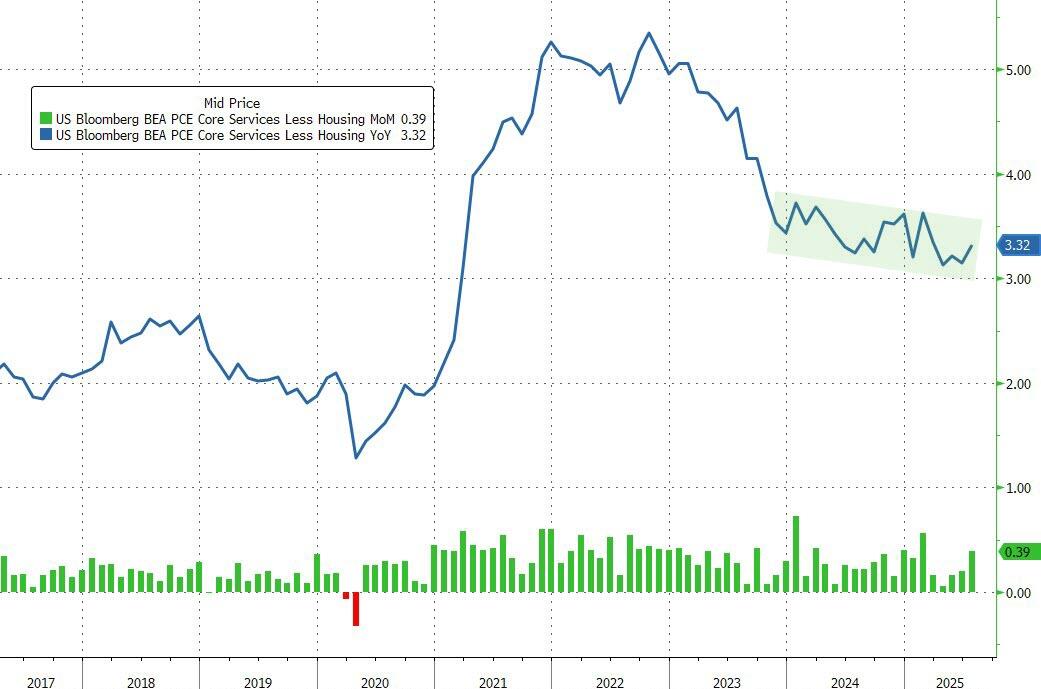

Super Core PCE - Services Ex-Shelter - rose to +3.32% YoY in July - the same level it was at in July 2024...

Source: Bloomberg

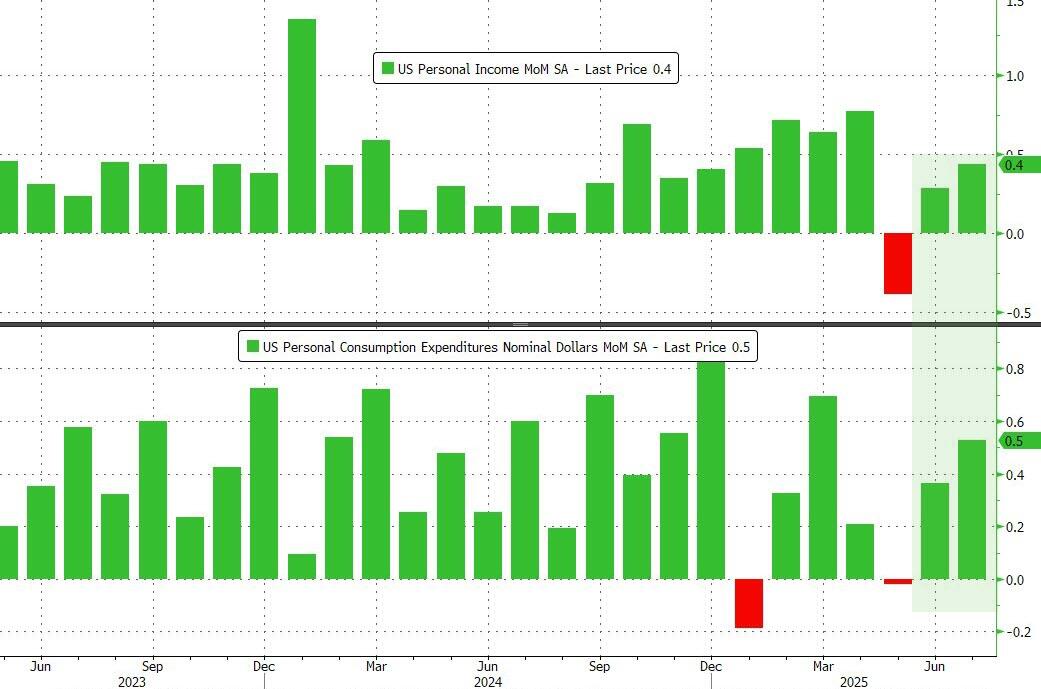

So while prices are rising but in their recent normal range, income and spending rose just 'as expected', up 0.4% MoM and 0.5% MoM respectively...

Source: Bloomberg

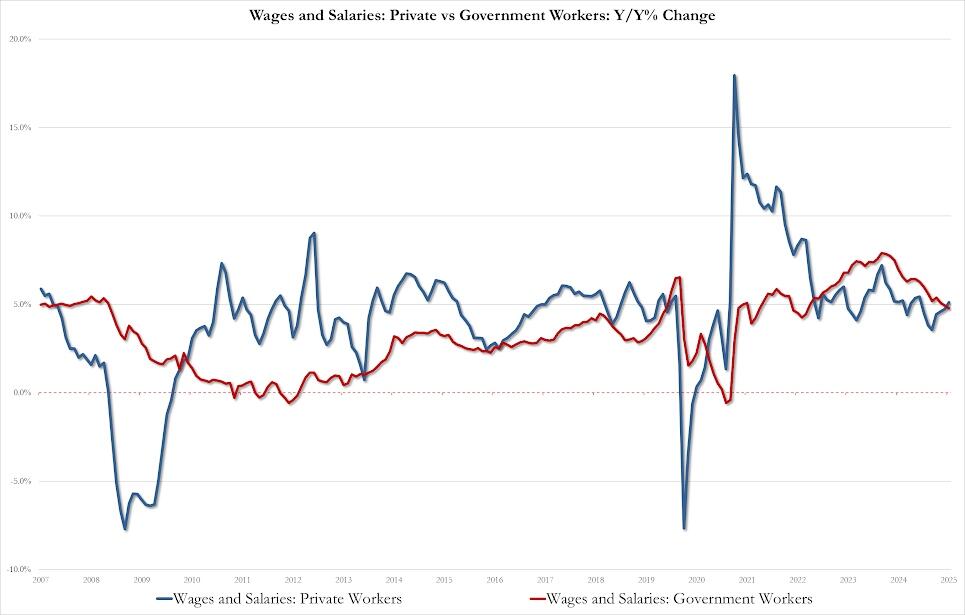

On the income side, for the first time since Dec 2022, wages of private workers (5.1% YoY) are rising faster than government workers (4.8%)

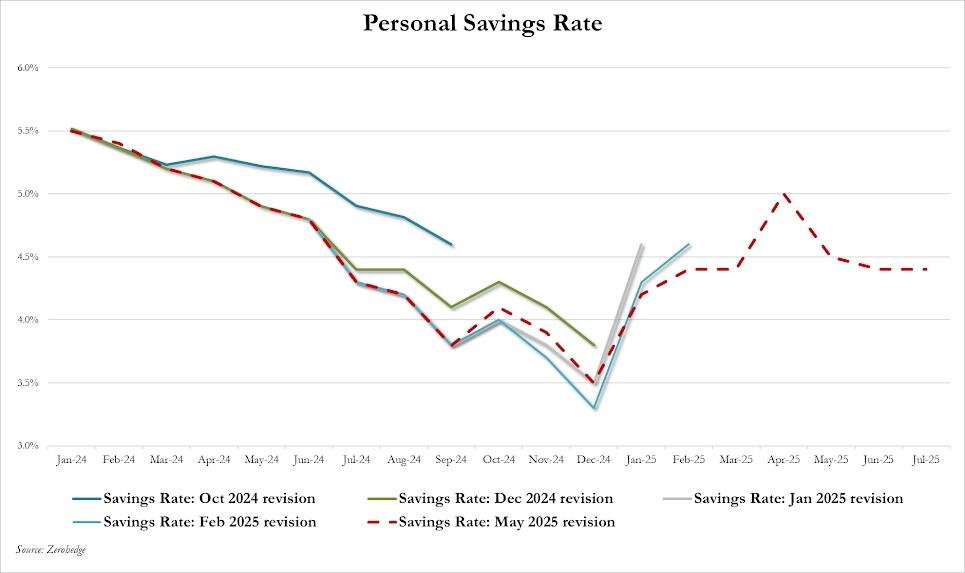

Not exactly screaming that the consumer is struggling with the savings rate flat at 4.4% of DPI...

...the lack of inflationary impact from tariffs is 'transitory'?

More By This Author:

Initial Jobless Claims Refuse To Show Any Signs Of CrackingNvidia Slides After Data Center Revenues Miss, Solid Guidance Fails To Wow Bulls

Core Durable Goods Orders Rise At Fastest Annual Rate In 3 Years

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more