February COMEX Silver Deliveries Surge To 10,119 Contracts (50.6 Million Ounces)

Image Source: Pixabay

Gold and silver prices continued their selloff today, with both metals ending the week significantly lower.

The gold price is now down to $2,860 after being over $2,970 back on February 19.

(Click on image to enlarge)

Meanwhile, silver was above $34 back on February 14, and is now down to $31.36.

(Click on image to enlarge)

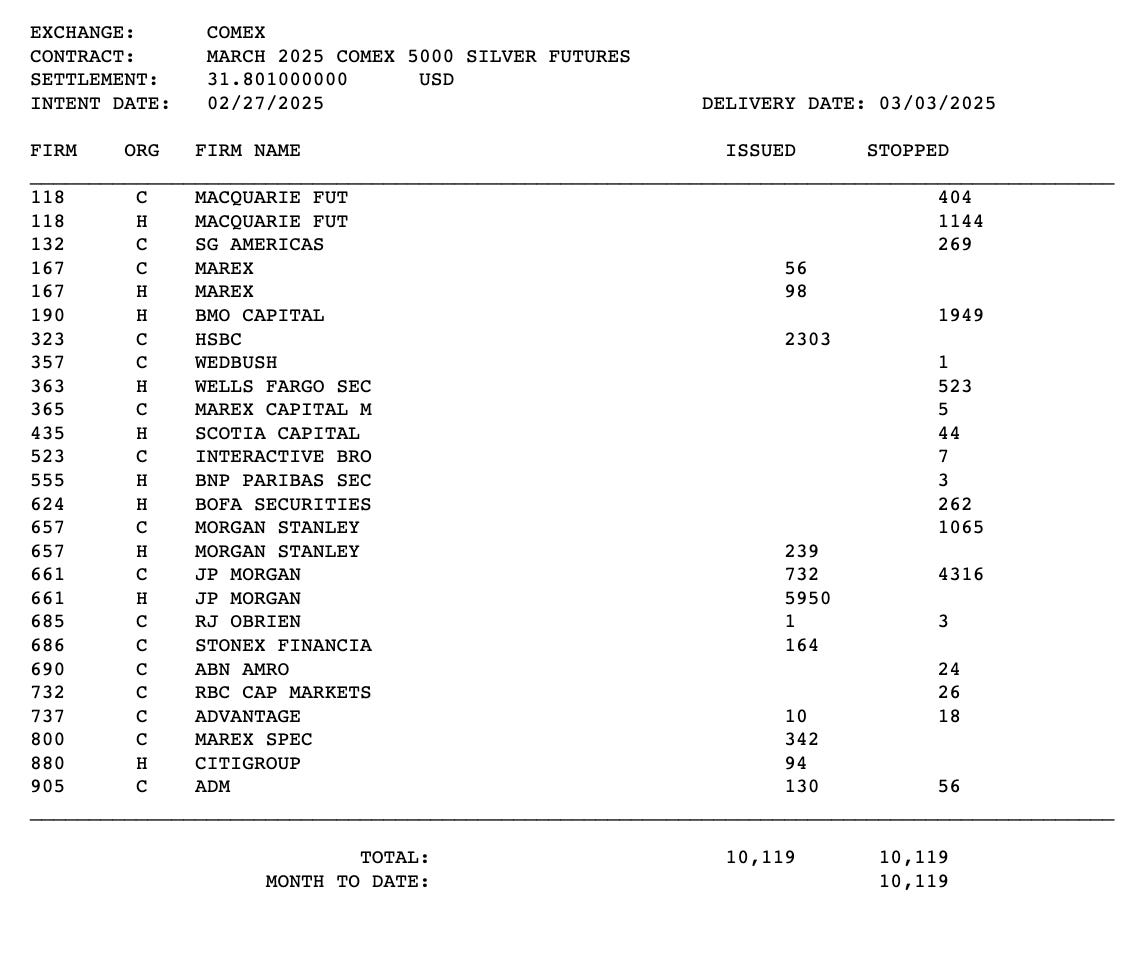

Although while that's been happening, we did just see COMEX gold deliveries set a new record during the February contract. And now that deliveries have begun for the March silver contract, we've already seen 10,119 contracts delivered (50.6 million ounces).

The record is the 16,384 contracts delivered back in July of 2020, when JP Morgan delivered 30,000 contracts on first notice day.

As Michael Lynch writes in his highly recommended COMEX substack:

So we could well see a record set for the largest amount of silver deliveries ever before it’s over. Although while that is certainly worthy of attention, remember that there is a difference between contracts being delivered, and metal actually leaving the COMEX warehouses.

Of course at this point you’ve probably heard plenty about how large amounts of gold and silver have been coming from London to New York. Resulting in the somewhat frequent blowouts in the EFP spreads (the difference between the London spot price and the COMEX futures).

(Click on image to enlarge)

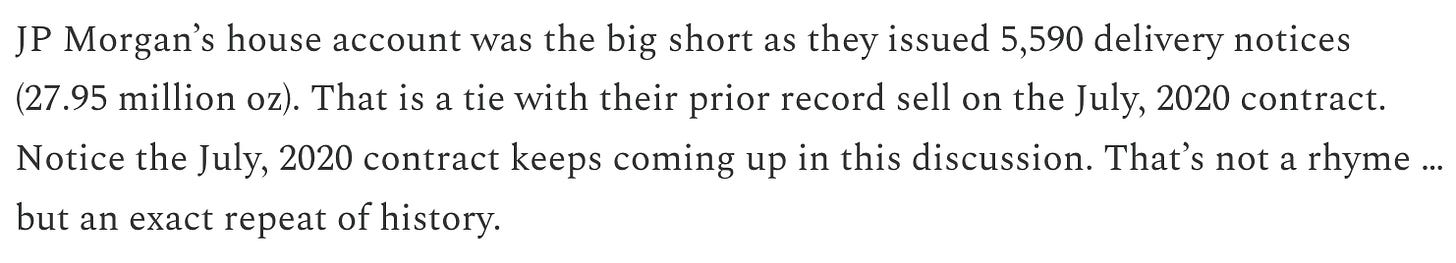

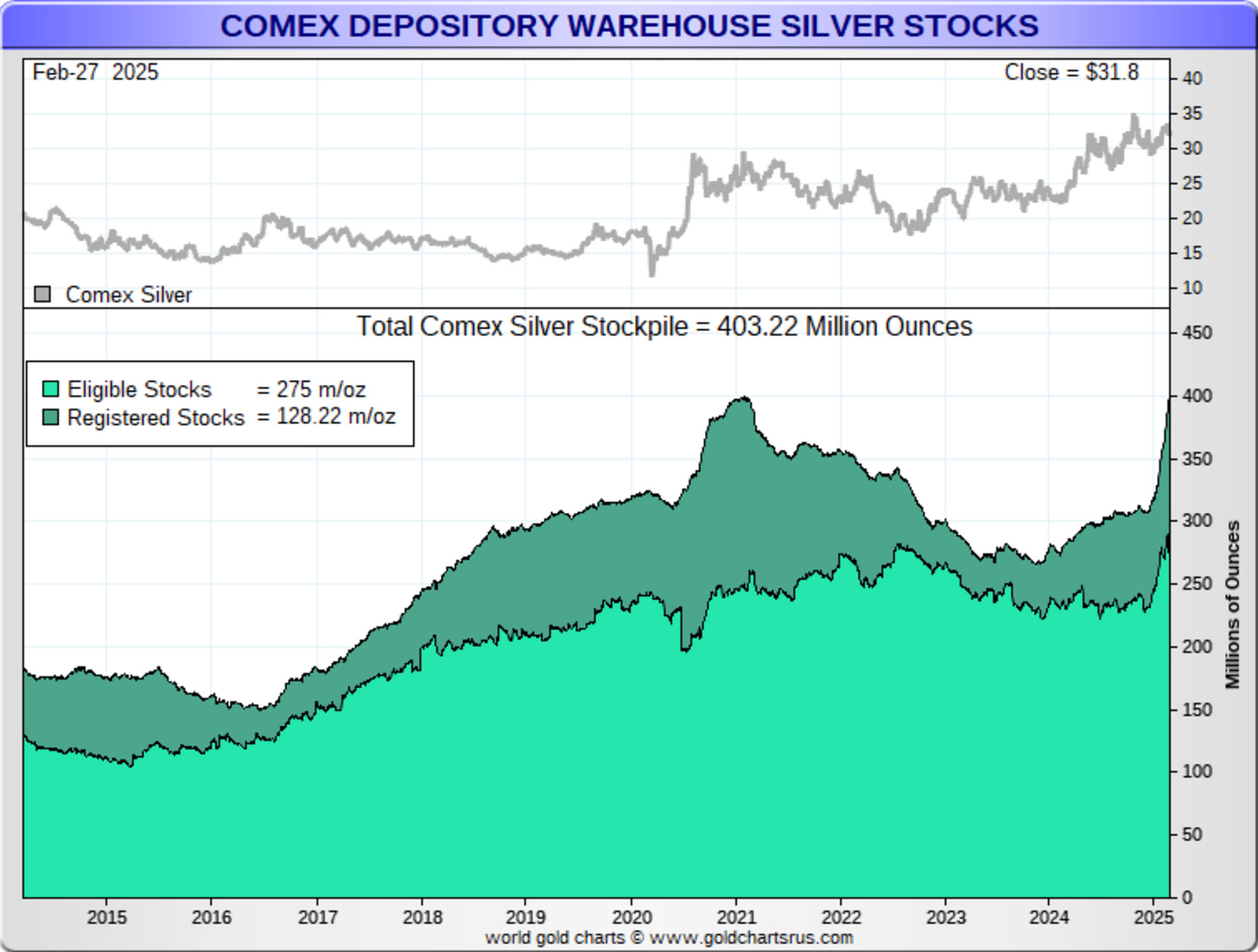

So we're actually going into this delivery cycle with more metal than has been in the COMEX warehouses since 2021.

(Click on image to enlarge)

(In 2023, the COMEX registered stockpile dipped below 30 million ounces. Now it’s over 128 million ounces)

Again, for a great detailed analysis of the mechanics of the COMEX delivery cycles, I highly recommend Michael Lynch's substack. And my colleague and dear friend Dave Kranzler also shared this piece regarding the March silver deliveries earlier this week, that I would recommend you read if you have not already done so.

Of course this is also ahead of what Trump is saying will now be an implementation of the tariffs after all. Which means all of the uncertainty that had built a month ago is now about to return.

Josh Phair of Scottsdale Mint (whose interview I shared earlier this week) had mentioned back in the beginning of February that they were going to be getting hit with 25% increases on Canadian silver Maple Leafs. And in this piece I talked about how much of the silver that comes to the US is actually from Mexico or Canada.

So even though the prices are down a bit this week, there’s a lot of volatility about to come back into the market. And it's also worth taking a step back and realizing where these prices were a year or two ago.

(Click on image to enlarge)

In that context, the selloff we've seen this week seems more common than not, even in a bull market.

(Click on image to enlarge)

And with the Fed potentially now shifting back to a more accommodative monetary stance, I’m not seeing anything yet that leads me to believe that the rally we’ve witnessed for the last year is now definitively over.

More By This Author:

Gold And Silver Stress Isn't Limited To Just New York And London

Wall Street Talk Of Gold Revaluation Is Drawing Attention

Gold & Silver: The State Of Sound Money In The US

Disclosure: None.