Gold And Silver Stress Isn't Limited To Just New York And London

Given everything that's happened in the past month since Donald Trump was inaugurated, today was a rather quiet day price-wise for gold and silver, with gold flat on the day, and silver down 20 cents.

However there's still plenty of interest happening, and today I'll share a few new bullets that I think you would appreciate seeing if you have not already.

Here we can see Reuters reporting on how gold leasing rates in India have doubled in the past month to a record high, ‘due to a supply crunch as global banks divert the precious metal to the United States.’

The article mentions:

“Higher leasing rates are driving up jewellery production costs in the world's second-largest gold consumer and could squeeze margins of jewellers such as Titan, Kalyan Jewellers, and Tribhovandas Bhimji Zaveri.”

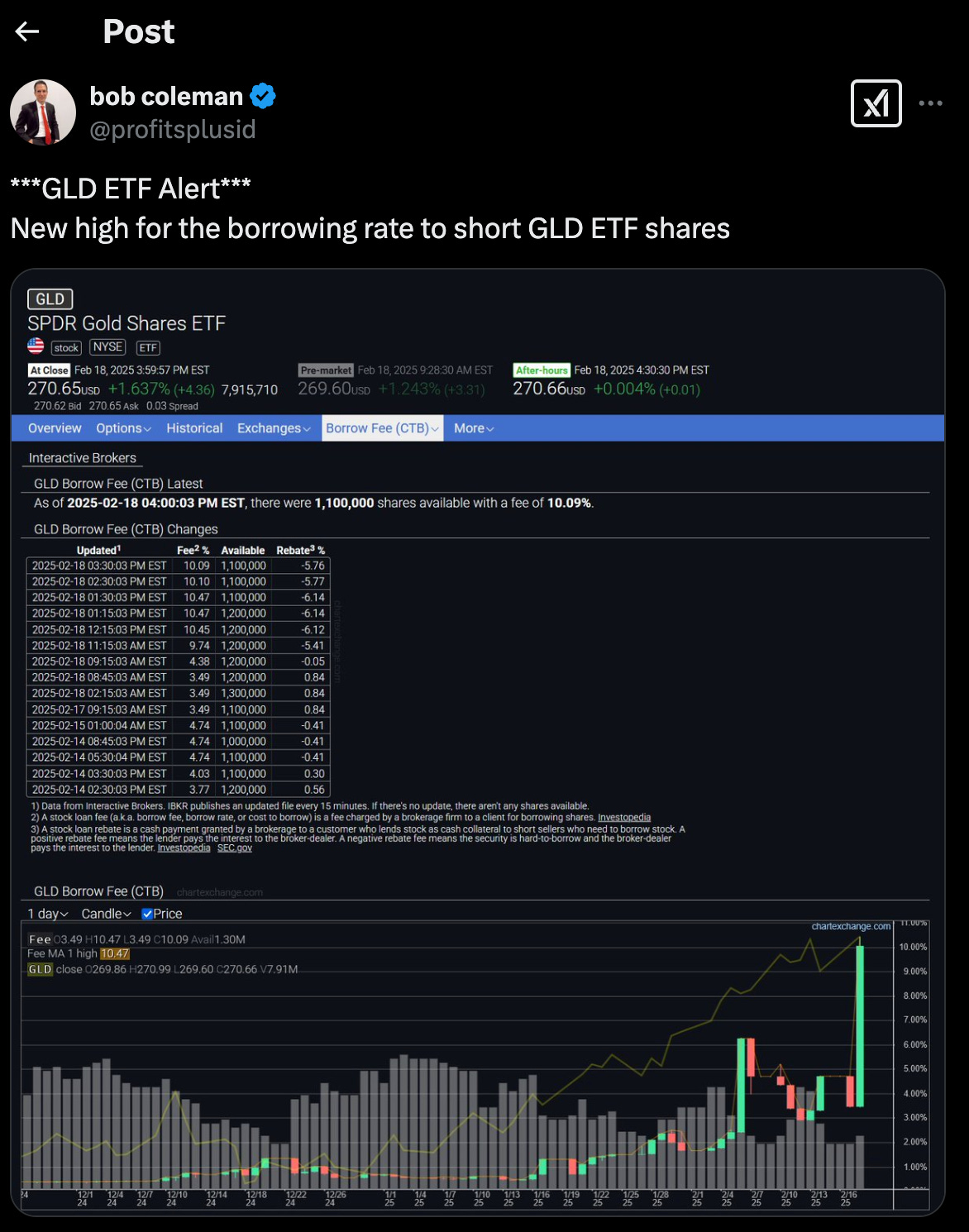

Meanwhile, as Bob Coleman reports, lease rates to short GLD have spiked to a new high as well.

Also, as you may have heard last week, according to the Korea Times, ‘banks halted the sales of silver bars amid surging demand, driven by increasing global uncertainties brought by U.S. President Donald Trump’s tariff threats, according to industry officials.’

Now I would suggest that there’s some room for debate as to whether the recent gold and silver market stress is truly and solely being driven by the tariff impact, and who these industry officials are.

Yet if what's being reported by the Korea Times is accurate, it's an interesting contrast to what we've seen so far in the west, where there's been no surge in demand, even as the price has risen in the past year.

“Due to the surge in gold and silver prices and the resulting spike in demand, which has outpaced supply, the Korea Minting and Security Printing Corp. halted its supply of gold bars to banks on Wednesday.”

I'm keeping in mind that this article was probably written by a reporter rather than a sophisticated bullion trader. But at least to the way I'm interpreting what’s there, if the demand was so large that the supply was halted, that sure would seem to at least on some level qualify as some form of shortage, even if it's just in the short-term.

We don't know if they resume sales next week (or at least I don't know), and this is also specific to just the Korean gold market, not the entire global gold market.

Yet it's still fascinating nonetheless just to see the different rippling implications that are now being set into effect, some of which conceivably might not be able to be reversed so easily.

“The Korea Gold Exchange, for its part, had already suspended bank sales of 10-gram and 100-gram gold bars since October while continuing to sell 1-kilogram bars.

However, with silver bar prices also soaring, the exchange notified banks of the suspension of silver bar supply on Thursday. It also noted that the remaining stock of 1-kilogram gold bars would no longer be available.”

So it sounds like Korea just had their own ‘Silver Thursday’ of sorts.

Now, if you’re not already familiar with that phrase ‘Silver Thursday,’ here’s a short bit of throwback history describing the day the Hunt brothers finally missed a margin call and the silver price plunged under $11 from its high of $50.42.

Hopefully you enjoy that, as it seems like we’re at least in an environment where those types of events aren’t entirely out of the realm of possibility.

Which means the weeks and months ahead will likely be exciting ones, so rest up now.

More By This Author:

Wall Street Talk Of Gold Revaluation Is Drawing Attention

Gold & Silver: The State Of Sound Money In The US

Silver Surges Above $34, As Bank Of America Primes The Mainstream For The Metals

Disclosure: None.