Factors Behind The Recent Collapse In Natural Gas. La Nina, Solar Cycles And Commodities

The recent price spike and subsequent collapse in natural gas prices

Following the incredible and historic late January price spike in natural gas (UNG) due to frequent snowstorms and cold weather that hit much of Texas and the Northeast U.S., the demise in natural gas prices since early February has been nothing short of astounding. However, the 20% sell-off in a matter of three trading days is not unusual, even in the face of a cold mid-late winter. The same thing happened in 2014.

What are the factors that have been affecting natural gas trading and how will La Nina play a role in influencing late winter temperatures, and for that matter, global agricultural commodities in the weeks and months ahead?

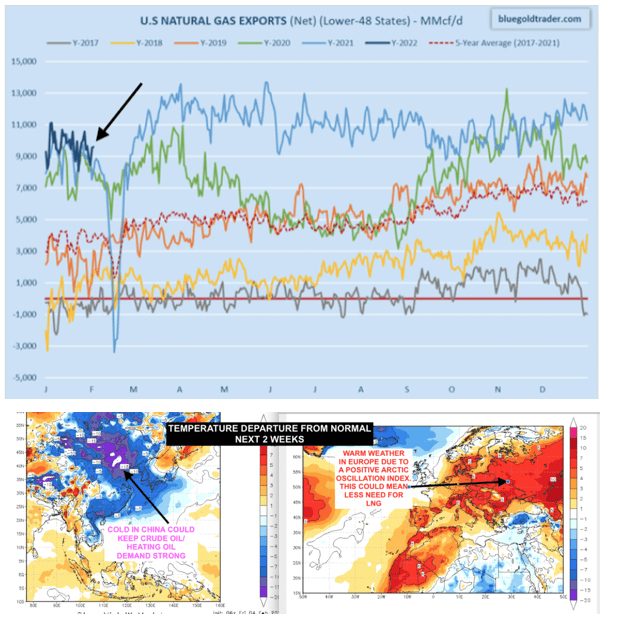

1) Ukraine Tensions and LNG Exports: Exports of LNG are well above the 5-year average (see chart below). However, there will likely be warmer weather in Europe well through February. In addition, there is the potential concern that Russia is “only bluffing” with Ukraine and will continue to flow natural gas into Europe. The key point here is that while solid LNG exports played a big role in some of the summer, 2021 up move in natural gas and recent price spike, we need to see colder than normal European weather to create more of a short term "overseas" panic in the natural gas market.

LNG exports are above average but Europe is turning warm (Blogtrader & Stormvista Models)

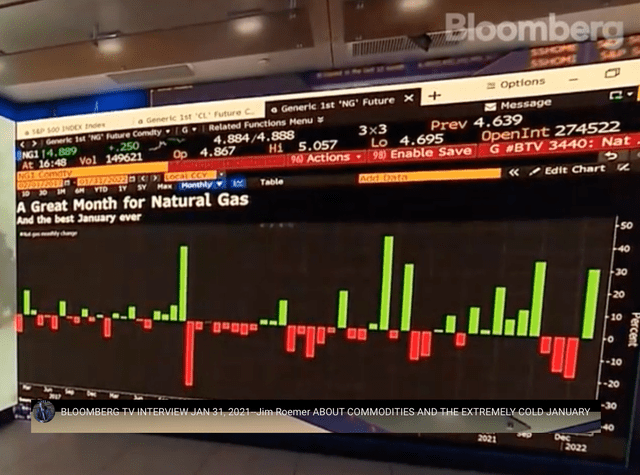

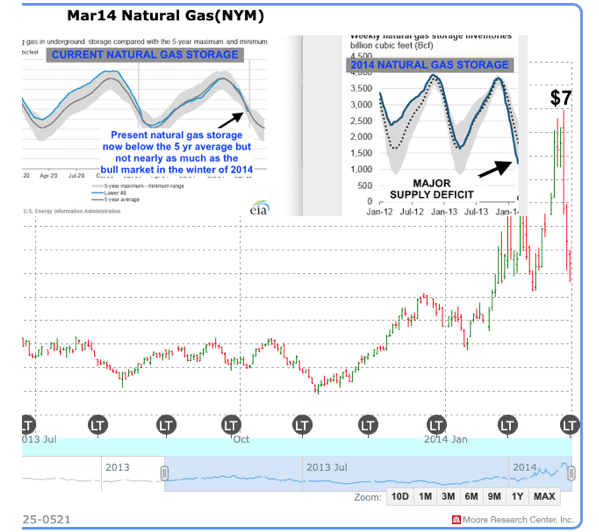

2) “Buy on Rumor, Sell on Fact”: Prices got to $5.40 in natural gas on the extreme cold last week. However, over the years, I have quite often seen a certain scenario. When over-leveraged shorts get squeezed out and specs go long near the highs, it can trigger a major washout. One of the reasons was that the major 50% move in natural gas prices was “already built into” the cold weather. Case in point: Notice that during the similar winter of January-February, 2014 how volatile the natural gas market was. Prices did top out around $7, but we had much more of a storage deficit back then, versus today.

Jim Roemer predicted the January spike in natural gas quite early (Bloomberg.com)

NATURAL GAS PRICES MIMICKING 2014 (BESTWEATHERINC.COM)

Above, look at how natural gas collapsed in late February of 2014. Even in the face of cold weather, it tumbled an incredible 35% in less than a week. The bottom line is that this is often commercial selling and a “buy on rumor sell on fact situation” on cold weather. The same thing just happened in the last few days.

One has to be nimble in commodity trading and book profits when you have them.

3) No major supply disruptions: Remember, in markets such as soybeans, for example, in which we are dealing with a raging bull market: “supply” is being affected. South American crops are being hurt. However, for the natural gas market, the extreme Texas cold last week did little to hurt wells nor supplies.

Natural gas supplies are often not impacted like crops often are. However, last summer's historic western drought and low water levels caused a switch from Hydropower for millions of people to natural gas. In that one in 50-year summer scenarios, less "supplies", not only strong demand created a trending bullish natural gas market.

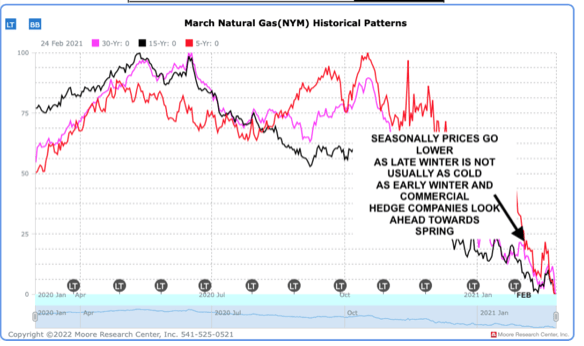

4) Seasonally: The historic reality is that natural gas prices often go lower into February and March. However, there are exceptions. If we have a cold late winter and early spring and the European warm spell was to change, a potential "contra-seasonal" could occur in the natural gas (KOLD) market

The seasonality of natural gas prices (Moore Research Center, Inc.)

Will late winter and early spring be cold?

La Nina may not weaken nearly as quickly as many other weather forecast services have been suggesting based on standard computer models. The recent Tongo volcano and something we call a negative Pacific Decadal Oscillation Index (cool ocean temps off the coast of California and warm near Asia) could help to keep the equatorial Pacific cooler than normal into at least May or June.

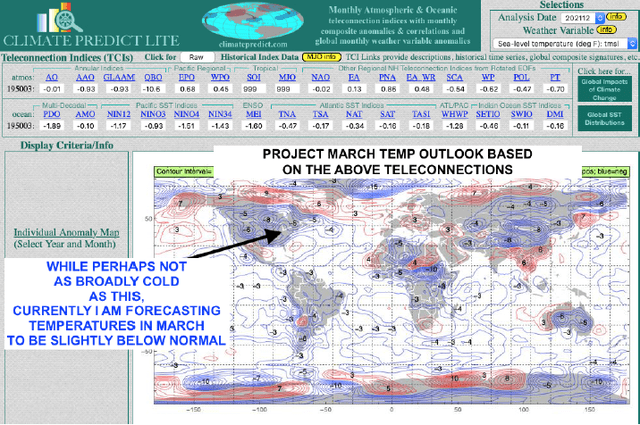

I was lucky enough to call the major late January cold wave and short-term spike in natural gas several weeks ago based on the climatic variables listed below. These same teleconnections imply to me a potential shift back to cold late winter and/or March weather pattern.

Please feel free to play around with the "lite" version of my in house software in order to see the relationship of over 28 different climatic variables on global rainfall, temperature, and more (climatepredict.com)

A colder than normal late U.S. winter is likely (Weather Wealth Newsletter)

La Nina, Solar Cycles and Commodities

The one caveat that would ease La Nina conditions and create a more stable atmosphere that may limit weather extremes for the natural gas (UNG), corn (CORN), soybeans (SOYB), coffee (JO), and other commodities would be the low solar activity. Otherwise, I expect La Nina to remain well into the early summer and disrupt some global crop growing areas, and potentially result in a cold later and early spring, increasing demand for natural gas (BOIL)

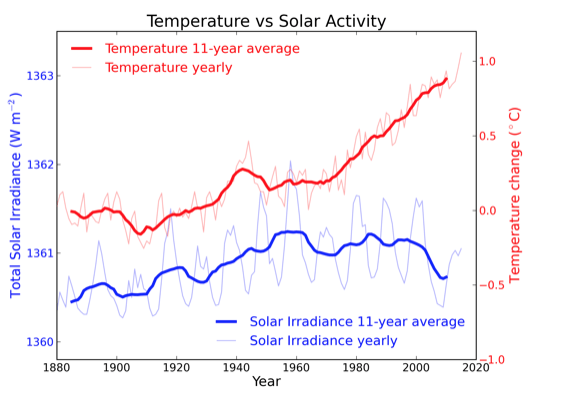

Over the past few hundred years, there has been a steady increase in the numbers of sunspots, at the time when the Earth has been getting warmer. Obviously, over the last few years, we have in the lower end of the 11 and 22-year sunspot cycle with less sunspots and solar flares.

Most of the "top level" academic scientific research I have studied, suggests that low solar activity is "not" influencing the global climate to cool.

Over the last 40+ years, the sun has shown a cooling trend. However global temperatures continue to increase. If the sun's energy is decreasing while the Earth is warming, then the sun can't be the main control of the temperature!

The sun's energy fluctuates on a cycle that's about 11 years long. The energy changes by about 0.1% on each cycle. If the Earth's temperature was controlled mainly by the sun, then it should have cooled between 2000 and 2022.

When it comes to influencing Earth’s climate, the Sun’s variability pales in recent decades compared to greenhouse gases, in my humble opinion.

Solar radiation and global temp relationship (WORLD RADIATION CENTER)

If we were in an active solar phase (frequent sunspots) not only would we be observing many more of colorful, breath-taking Northern Lights, but the chances of La Nina getting even stronger and potentially lasting the entire year would be higher.

Why? In a paper written several years ago by Dr. Theodor Landscheidt at the "Schroeter Institute of Research in Cycles of Solar Activity" in Nova Scotia, Canada, he says:

"When the sun’s output reaches a peak, the small amount of extra sunshine over several years causes a slight increase in local atmospheric heating, especially across parts of the tropical and subtropical Pacific where Sun-blocking clouds are normally scarce.

That small amount of extra heat leads to more evaporation, producing extra water vapor. In turn, the moisture is carried by trade winds to the normally rainy areas of the western tropical Pacific, fueling heavier rains.

As this climatic loop intensifies, the trade winds strengthen. That keeps the eastern Pacific even cooler and drier than usual, producing La Niña-like conditions."

Conclusion:

While low solar activity could well prevent La Nina growing stronger in the months ahead, I still expect at least weak La Nina conditions to exist into at least April and May.

Currently, it is the (SOYB) market that has seen the biggest beneficiary of La Nina conditions with no less than a consistent 20-25% rally in prices due to major weather problems in South America. Droughts are hitting southern Brazil and Argentina, while too much rain in northern Brazil threatens the soybean harvest. In addition, La Nina may also compromise some of the northern Brazil and Colombia coffee (JO) crop with too much rain. This is one reason why coffee prices have rallied back to close to their previous high prices.

While it will be very hard to see a sudden, incredible $1.50 price spike in natural gas (like we saw in January) with the brunt of the climatological winter well behind it, I feel it is risky getting caught up in all of the recent bearishness in the natural gas market.

For your interest, you are more than welcome to listen to a recent podcast, interview by the firm Financial Sense more