Energy Stocks To Oil Ratio Below Average

Oil has had a strong start to the year thus far, and Energy has been the best performing equity-market sector on a year-to-date basis by a wide margin. This is due to the fact that the performance of the Energy sector (XLE) tends to be highly correlated to the price of oil, holding a correlation coefficient of 0.81. Currently, the ratio of the price of XLE versus oil is below historical averages. The current level is 0.77 and the average since XLE began trading is 0.99, suggesting there may be upside in the energy sector should oil hold its current levels. However, the ratio is still in a ‘normal’ range, as it is less than one standard deviation away from the historical average.

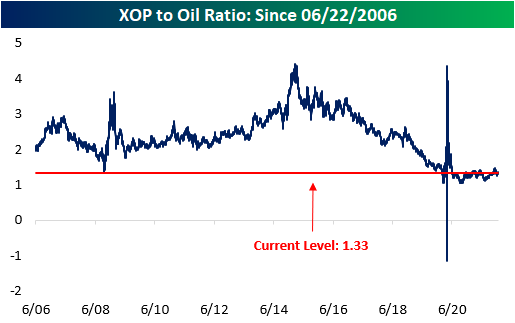

The Oil and Gas Exploration and Production industry (XOP) tends to be correlated with the price of oil as well (coefficient of 0.80). Historically, the ratio of XOP versus Oil has an average of 2.36, but the current level is far lower at 1.33. Additionally, the ratio is 1.7 standard deviations away from the average, which may imply that there is an opportunity to capitalize on a mispricing of XPO relative to the price of oil. However, since the start of 2020, the ratio has been suppressed and there is little evidence to suggest that this will change any time soon. Stay tuned as we will be releasing a deeper dive into oil tomorrow!

As always, past performance is not a guarantee of future results. This is for informational purposes only and is not a recommendation to buy or sell a specific security.

Stay on top of market trends by becoming a Bespoke subscriber today. Click here to view ...

more