Downward Reversal In Oil Is Knocking On The Door

Crude oil hasn't closed higher yesterday and the previous series of rallies appears to face stiff headwinds. Is this it, or can the oil bulls pull a rabbit out of their hats? After all, they've reversed Monday's downswing already. Or does the prospect of wide spectrum U.S. - China uncertainties have the upper hand? It's making itself heard across the board and crude oil is no exception. Let's assess the technical picture now.

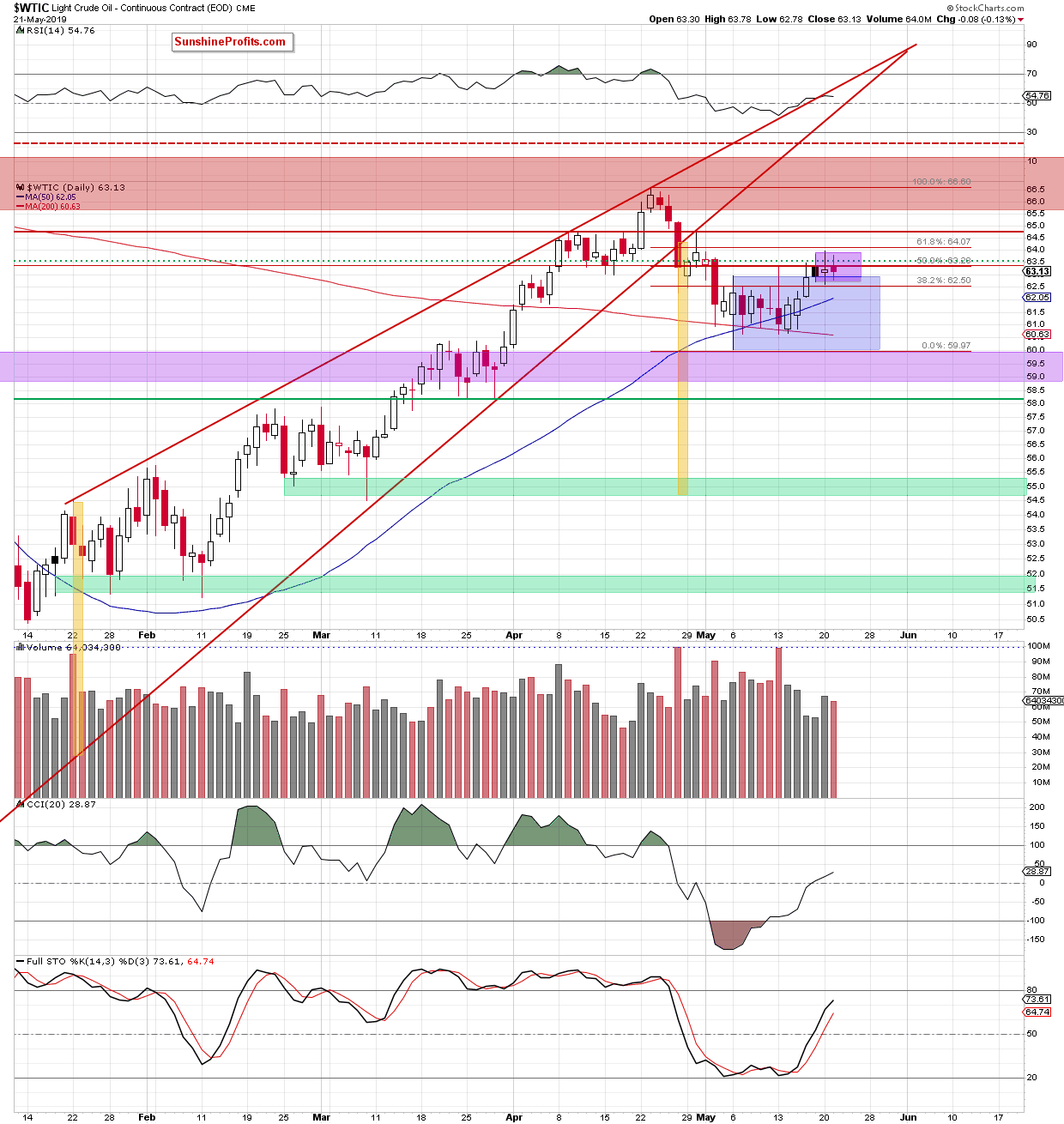

We'll take a closer look at the chart below (chart courtesy of StockCharts).

Yesterday's crude oil trading was almost a mirror image of Monday's session. While the bulls eked out minor gains on Monday, it was the bears who was stronger yesterday. The price closed down below the 50% Fibonacci retracement yet again. This has been the fourth unsuccessful attempt to overcome it in a row.

As we have pointed to in our yesterday Alert's title ("The Shifting Sands in the Oil Arena"), this suggests a bearish reversal of fortunes ahead. Indeed, at the moment of writing these words, black gold changes hands at around $62.20 which is back inside the blue consolidation.

Should the commodity keep moving lower from current levels, we're likely to see at least a test of the lower border of the blue consolidation. Such a move lower is supported by the unconvincingly low volume of the preceding upswing days.

Summing up, the outlook for oil remains bearish. Oil is still trading below the previously-broken red horizontal line and has had trouble overcoming the 50% Fibonacci retracement. Today, it appears to be rolling over and heading south. The weekly indicators still supports the downside move. The short position continues to be justified.

Actually drawn out longer this is merely a stopping of a run up that is quite natural. Once can't expect the trend line drawn here to continue on forever. That, doesn't mean oil is set for a collapse. I also think that the oil build in the US is more a US issue as will a gas build up as Trump makes the trade war with China worse. Economically a fast decoupling of the US and China is and will be bad for both countries.