Don’t Worry, That’s A Reversal - Gold Is On Its Way To $1,800

After the USD dropped in 2021, there was a price increase in both gold and mining stocks. If the situation repeats, gold is likely to continue rising.

And, of course - that was a reversal, folks!

Bullish Implications

Let’s start today’s analysis with what I wrote yesterday about the general stock market:

Would a 4-index point decline in the USD Index be likely to trigger a rally in gold and junior mining stocks? Yes, and as far as the latter are concerned, if the general stock market moves higher, the rally in them could be quite visible.

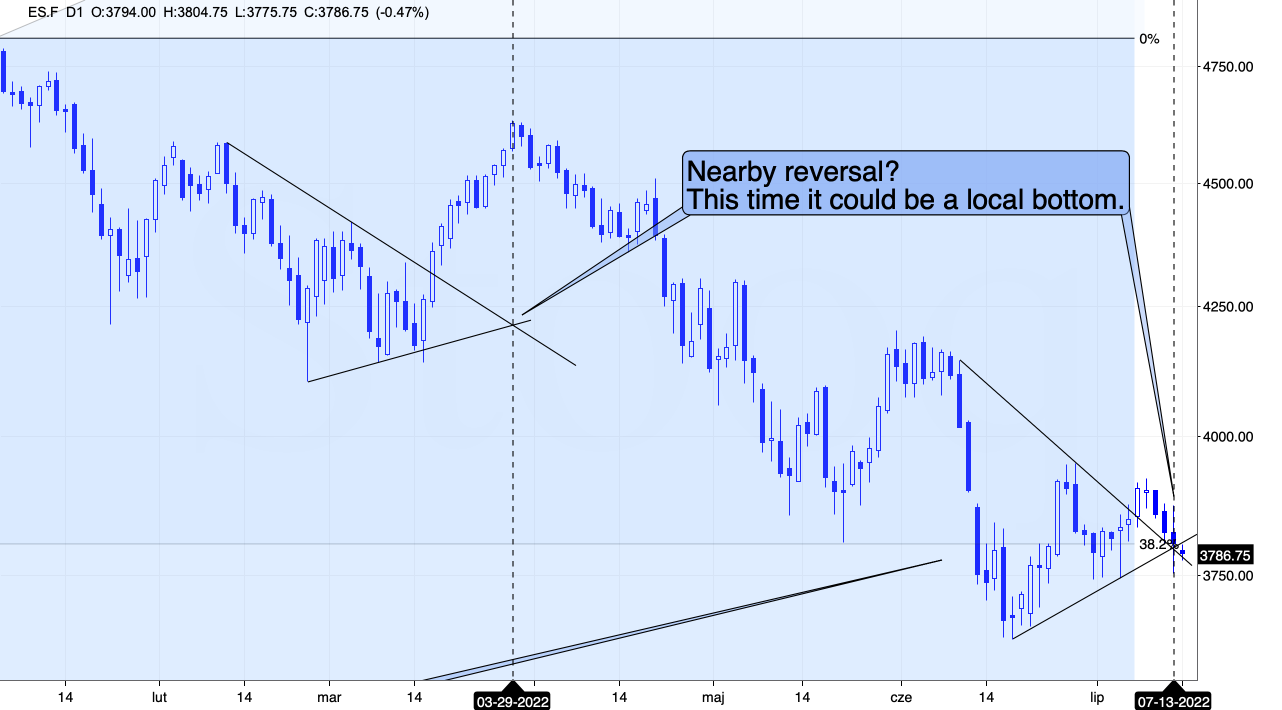

Interestingly, the stock market is right above the combination of short-term support levels.

What’s even more interesting is that we have a triangle-vertex-based reversal there today. To show that this technique is useful also in the case of the S&P 500 futures, I marked the previous similar triangle and the reversal that it triggered. Back then it was a local top, but since we’re seeing declines now, it’s much more likely that the reversal will actually be a short-term bottom.

It could be the case that markets rally based on today’s CPI statistics, or that they decline first, reverse, and then rally. Either way, today’s CPI numbers release corresponds quite well to the technical indication that we have about today (that we’re likely to see a reversal).

In short, that’s exactly what happened. I’ll discuss the CPI itself in the following part of the analysis, but for now, let’s focus on what happened on the technical front.

The S&P 500 futures declined substantially, moving very close to their previous July lows (at about 3,750), and then they moved back up. They still ended the day lower, but the reversal was quite profound.

Stock futures are down in today’s pre-market trading but not significantly so, and given the fact that yesterday’s reversal took place at the triangle-vertex-based reversal, today’s move lower is likely to turn into a short-term rally shortly. If it doesn’t happen today, it’s likely to happen soon.

We also see something similar in gold’s pre-market trading, and the implications are just as bullish. Gold futures are down by about $20, but they are well above yesterday’s intraday low of $1,704.50.

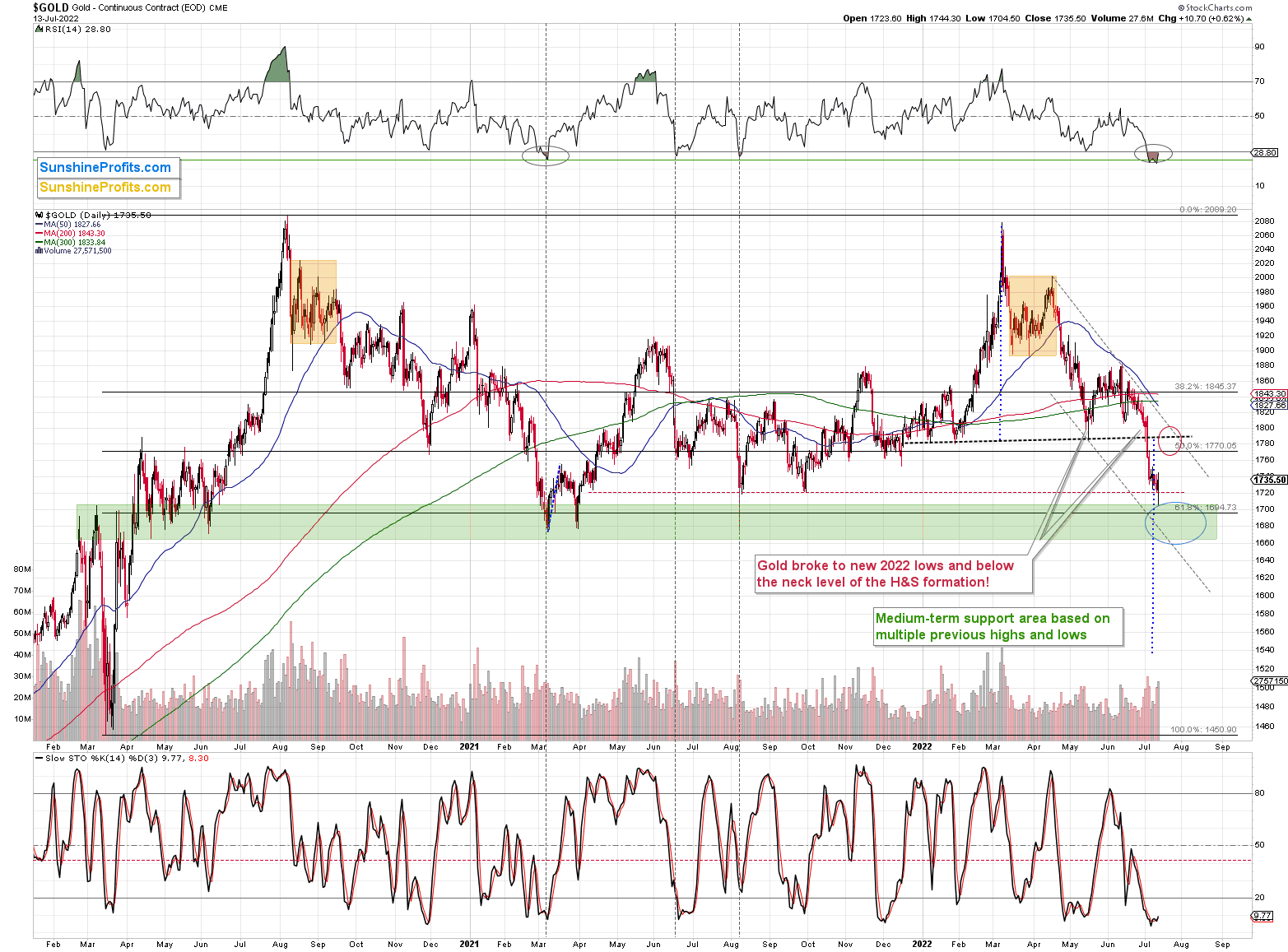

(Click on image to enlarge)

On the above gold chart, you can see that gold just touched the upper border of my original target area for this short-term decline, and then moved back up, closing above the red dashed line. This way, both targets were reached, and we saw a big-volume reversal that confirmed that the short-term trend has just most likely changed.

Gold on the Rise?

How high is gold likely to rally from here?

To about $1,770-1,800. That’s where we have several resistance levels, including the neck level of the previously broken head-and-shoulders pattern. The silver price is likely to rally too – in the near term, that is.

Additionally, please note the situation in the RSI in the upper part of the chart. What we saw recently is very similar to what we saw in March 2021, only this time the RSI indicated slightly more oversold conditions.

How high did gold rally back then? Well, it bottomed and kept on rallying for months, but it doesn’t mean that exactly the same thing is likely to happen now. You see, the further price moves from the “signal”, the less likely the price performance is likely to be repeated. So, while the initial several days are quite likely to be similar, the following few weeks might also be similar, but it’s a rather weak indication. The following months might develop completely differently.

Let’s focus on the short-term indications that are most likely to be meaningful.

After bottoming in March 2021, gold moved up rather quickly, and it stopped only after it moved close to the previous lows that provided resistance. That’s exactly what I expect to see this time too. Gold could move visibly higher in the near term, topping close to its resistance levels or between them.

More By This Author:

A Momentary Selling Respite Can Help Gold Miners JumpThe USD Equals The Euro, Gold Is Not Willing To React

These Signs May Indicate A Short-Term Reversal In Gold Miners

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more