Degenerates, Delinquents, 'Soaring Demand,' And Dollar Devaluation

Image Source: Pexels

First ramp the US dollar to record strength. Drive it up against commodities (falling commodity prices, like today across the board). Then, in a controlled currency demolition, devalue the dollar to boost US exports and ‘reset’ the economic system of the world.

But only after the strong dollar has wrecked overseas trading partners to the point they’re willing to ink new trade deals for lower tariffs and less pain!

Is that about right?

Is this what the Mar-a-Lago Accords might look like? A new world currency order where the dollar is still King but government debt is lower, the economic pie is higher, and the value of the currency sounder?

Let’s back up. The Mount Vernon neighborhood of BPR’s headquarters was devoid of people last week when I had a series of meetings with Bill. But there were big fat dots all over the place. Just waiting to be connected. Dots falling like the snowflakes here in Laramie when I got back mid-week.

What dots? Is Trump deflationary for the economy? For stocks? If so, is that bullish for bonds? And if so, what (if anything) should we do about it? Those are some of the dots I’ll try and connect this week. But let’s begin, as is tradition, with a chart.

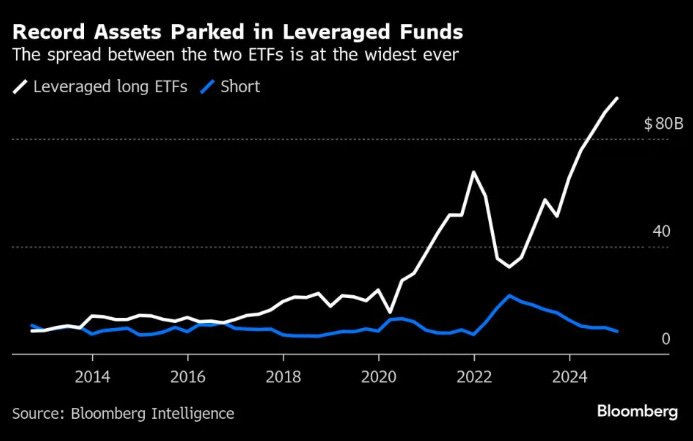

This was from Monday. I saved it for you. It’s from Bloomberg Intelligence and it shows that ‘leveraged long’ Exchange Traded Funds (ETFs) have nearly $100 billion in assets under management. These are traders who are not content with making index sized returns. They’re not even content with owning only the best-performing sectors like crypto, AI, or chips.

No. These traders want more. They want it all, plus some. And they want it now.

To get it, they pile into exotically constructed instruments which are designed to double or triple the return of a given sector or asset class. You can call it FOMO (fear of missing out), or euphoria, or degenerate gambling. But it’s a real thing, this kind of speculative fever. And it’s raging.

What the chart also shows is that the spread between ‘leveraged long’ ETFs and ‘leveraged short’ ETFs is as wide as it’s ever been. There are ‘only’ about $9 billion invested in ‘leveraged short’ ETFs, which work the same way but are bets in the other direction (bearish).

The last time the spread between degenerate bulls and degenerate bears was THIS wide was in late 2021 (when BPR launched, and when stocks peaked before crashing, only to be resurrected by the magic waters of AI). Wide spreads like this don’t last. They slam shut like a crocodile’s mouth. Now another chart.

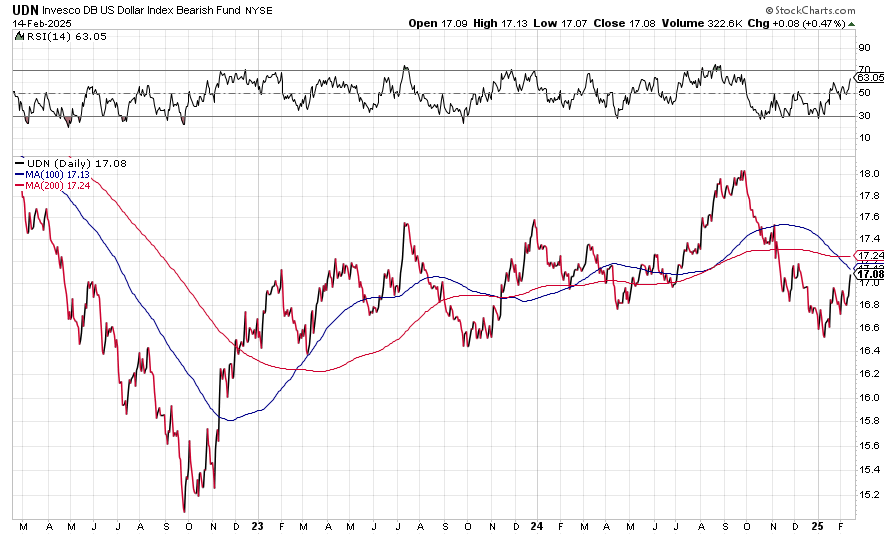

This chart connects two dots. It’s the Invesco US Dollar Bearish Index Fund [UDN]. I WAS going to show you another chart of the Dollar Index [DXY], which is now down 1.58% year-to-date. But UDN is worth analyzing because it’s what some speculators are actually doing with their money to try and make money on a falling dollar (with leverage).

To make a long story short, UDN is constructed to give you the inverse performance of the Dollar Index. That index measures the performance of the dollar against the six currencies: the Euro, the Yen, the Canadian dollar, the Swiss franc, the British Pound, and the Swedish Krona. When UDN goes up, it means DXY is going down.

UDN peaked on September 27th of 2024. Donald Trump was in Michigan at a rally on that day. Kamala Harris was (belatedly) visiting the southern border in Arizona. Nothing earth shattering happened in the campaign that day. But that was the day the markets decided Trump was going to win the election on November 5th. They began ‘pricing in’ his victory.

That’s what you see on the chart. UDN went down until early January. It’s now begun to move back up. For a more bullish signal, you’d want the 1000-day moving average (the blue line) to cross over the 200-day moving average (the red line). The RSI is moving up to 70 that could happen soon.

Major point: The Trump Trades are fully mature and may have already begun reversing this week. This is a point Jules Bonner made last week when he joined Bill and I for the latest Private Briefing (look for that on Sunday). What next?

No one expected Trump to be deflationary for stocks. But there are good reasons that might be the case (I’ll get to them shortly…it involves shrinking M2 and a new version of the old Chicago Plan). But aside from policy and a controlled demolition/devaluation of the dollar, there is also what a collapse in leverage does to asset prices.

Check out the latest margin statistics from FINRA. Margin debt has hit a new record of $937 billion dollars. The previous record was $935 billion in October of 2021. This is old fashioned leverage, borrowing against the rising value of your portfolio to buy more even more stocks. All up, then, you have at least $2 trillion leveraged bets on higher stock prices.

Yes, it’s true that records were made to be broken. And there’s nothing in the laws of physics or the Ten Commandments that says people can’t become even more degenerate (financially speaking) from here. But since I can’t send you flowers or chocolates on Valentine’s Day, I’ll remind you that leverage in reverse is a cruel lover.

Around this time last week I was having dinner with my old friend Addison Wiggin at Nick’s Fish House in Baltimore (I had the fish and chips and they were as advertised, very good…better, even, than Laramie seafood). You may recall that Addison sat down for a Private Briefing with me last summer to discuss, among other things, the weakness in consumer finances.

Those finances are not strong, according to a raft of data we saw this week. January retail sales fell by almost 1%. Inflation is high and the holiday hangover was real for many Americans (real physically and real financially). A couple more months like this and we’ll be looking at a full blown recession. But is it really that bad?

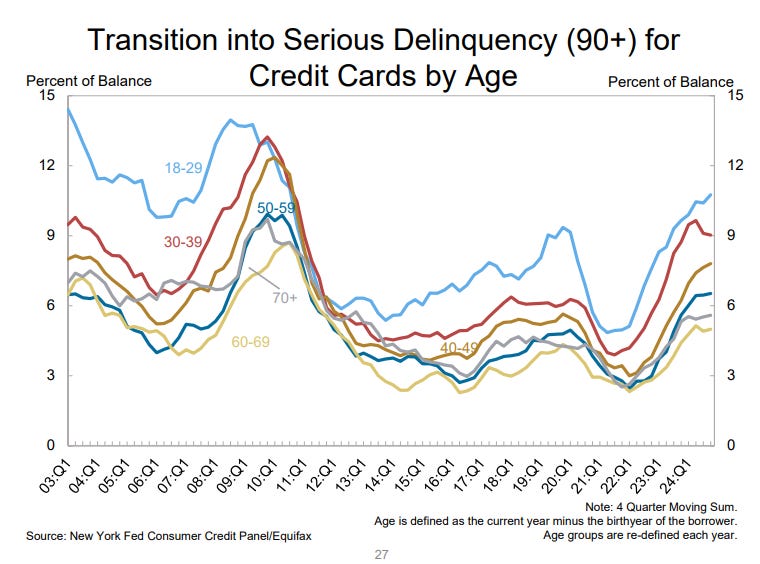

Yes. Household debt as a percentage of disposable income increased to 87% in the fourth quarter of last year, according to the Fed’s most recent quarterly report on the subject, published earlier this week. Credit card balances are now over $1.2 trillion in the aggregate (at an average interest rate over 20%) and more Americans under the age of 40 are seeing their accounts ‘transition’ into ‘serious delinquency.’

Americans need higher wages, lower inflation, lower taxes, and less debt. The President can’t wave a magic wand and make all that happen. But there may be a path to falling prices and lower inflation and ESPECIALLY lower taxes. I’ll get to that in a second—first, another important chart.

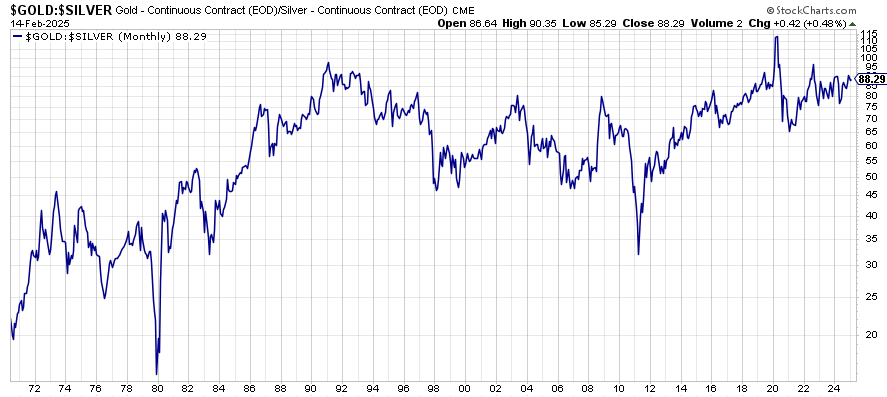

This is the gold/silver ratio going back to 1970. Silver is historically cheap compared to gold right now. That’s odd when you consider that silver is in a supply deficit (and has been for the last four years) AND that there are more industrial uses for silver than there are for gold. It’s less odd when you consider there is a lot of above-ground silver in private hands that would come into the market at the right price (much higher).

Thanks, by the way, for all the great suggestions on who to talk to about whether the silver price is being manipulated and suppressed. I’m on the case and how to conduct a new Private Briefing next week (to be published next weekend). Early take: Highly likely.

In the meantime, two interesting things happened in the Far East this week. First, banks in South Korea have halted the sale of silver bars due to ‘soaring demand’ (the Korean Gold Exchange halted sales of 10-gram and 100-gram gold bars in October.)

It’s unclear if these actions are due to the high demand for gold and silver as safe-haven assets in a world of trade wars. Or, perhaps, related to the demand for physical delivery on Comex that’s been draining London vaults (for now). These are dots without an obvious connection.

Second, Chinese regulators debuted a pilot program that will allow ten large insurance companies to invest up to 1% of their assets in gold bullion. That could unlock billions of new investments in gold. But not leveraged paper products. Actual, real, physical gold. Novel concept. Only about 5,000 years old.

Chicago and Mar-a-Lago

Finally, we need to revisit the Chicago Plan. Long-time readers will recall that Bill and I wrote about the Chicago Plan in 2018 (although Jules had done a lot of the research in the background). This was right around the time the ‘plumbing’ in Wall Street’s financial system began to back up (a collapse in trust between banks for overnight lending manifested as a spike in the use of the Fed’s overnight reverse repurchase, or repo, window). The Dow/Gold ratio was on the move.

At risk was a deflationary depression that would lead to lower stock prices, lower credit growth, lower money supply growth, and a recession. The fiscal and monetary responses to those risks–which accelerated under the Covid lockdowns–were massive money printing and quantitative easing (QE).

Here we are today with chronic inflation, record debt, and the great grandmammy of all asset bubbles.

The original Chicago Plan put forward in 1933, was an attempt to reverse the deflation of the Great Depression. The collapse in private banks collapsed credit for businesses. Money supply shrank and the economy cratered. Unemployment soared.

Early versions of the plan called for 100% reserve banking, or an end to private money creation through fractional reserve lending. Each dollar lent by banks would have to be fully backed by deposits or assets (government bonds, for example). Banking would effectively be separated into two functions done by different institutions: paying interest on savings and credit creation through loans.

The final version of the plan wasn’t that drastic. Fractional reserve banking persisted. The private banks survived. More importantly, the early versions of the plan which would transfer money creation from the Fed to the Treasury Department were ditched. The role of money and credit creation was left largely to the private banks that own the Fed.

Why does this matter?

My talks with Bill and Jules last week made me wonder if Donald Trump may have bigger plans for the Fed than we expected. It’s not that he’ll fire Jerome Powell.

It’s that Trump and his Treasury Secretary Scott Bessent want to what Ron Paul and Bill Bonner have been asking for years. End the Fed altogether. Why?

Let me count the ways. It would…

-

Reduce structural inflation by controlling the money supply from the Treasury (part of the executive branch and not politically independent or accountable directly to Congress).

-

Use stealth yield curve control to cap long-term interest rates and reduce the interest cost on the national debt.

-

Monetize the Treasury balance sheet by revaluing gold reserves (which Treasury leases to the Fed) and reducing anxiety about another US debt default

-

Reduce government spending by several trillion–back to pre-Covid levels–and cut the defense budget by 50%.

-

Spur GDP growth with dollar devaluation to boost exports and compensate for lower government spending (which contributes to nominal GDP figures)

There’s a lot going on there. A lot of dots that it may not be possible to connect, even with the best laid plans. But is it possible?

Well, yes. Anything is possible.

At least it seems like it these days, where the Trump team has turned the 24-hour news cycle into a 4-hour news cycle and is running rings around the mainstream media, the Democrats in Congress, and the lackeys of the Administrative State (who are finding out how precarious full time employment and fully funded pensions are in the private sector).

Heady days, indeed.

But you can’t make $36 trillion in debt disappear overnight. Well, you could if you blew up an EMP and erased all the Treasury’s records of how much it owes and to whom. But short of that–and all the associated drawbacks of using a nuclear weapon to solve a debt problem–it’s going to take a real plan to reduce the debt, get the dollar back on safe ground, and turn around 40 years of negative economic trends.

More By This Author:

Myth of EmpireWarren to the Rescue

Last Bear Standing