Crude Oil Finds Support After Gap Down, Eyes Gap Fill Amid Downside HTF Bias And Mixed Macro Signals

Image Source: Unsplash

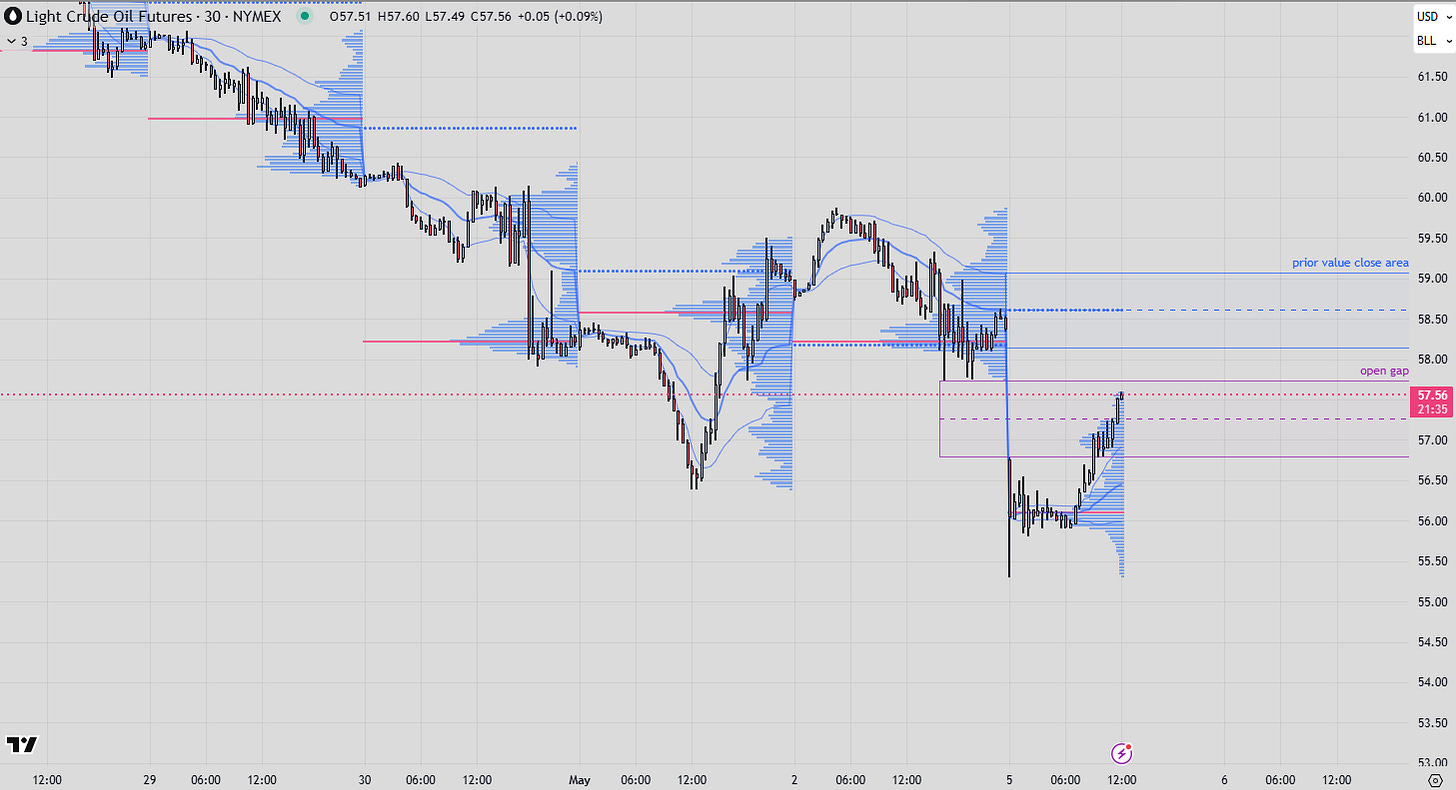

Crude oil opened with a gap down, but initial absorption led to a pullback higher, supported by the prior session’s b-shaped profile structure—suggesting a bullish bias in the short term.

A weaker dollar is currently providing an additional supportive tailwind. Given the profile, a gap-fill scenario appears likely, with upside targets around the previous VWAP close at $58.54.

Buyers may emerge around the developing VWAP, currently near $56.50, and near the lower developing value area low (DVAL) around $56. If the gap fills—reaching at least $57.75 or even $58.17—selling pressure could return, prompting a rotation back toward session lows during RTH.

(Click on image to enlarge)

On the daily interval, crude remains below the Quarter's developing value area, which maintains a downward slope—indicating a broader high time frame (HTF) bearish bias. However, repeated lower wicks signal potential absorption at the lows, which could set the stage for higher prices in the coming days, depending on how fundamental headlines evolve.

More By This Author:

Gold Pulls Back From Rally Highs As Technicals Signal Near-Term Bearish Repositioning

Equities Hover Near Highs Ahead Of Jobs Data As Market Balances Breakout Potential With Tariff Uncertainty

Crude Crashes To Multi-Year Lows As Supply Surges And Global Demand Weakens Ahead Of OPEC Meet

Enjoyed this article? Invest in a subscription to expand your horizon towards advanced wealth creation.

Visit our more