Equities Hover Near Highs Ahead Of Jobs Data As Market Balances Breakout Potential With Tariff Uncertainty

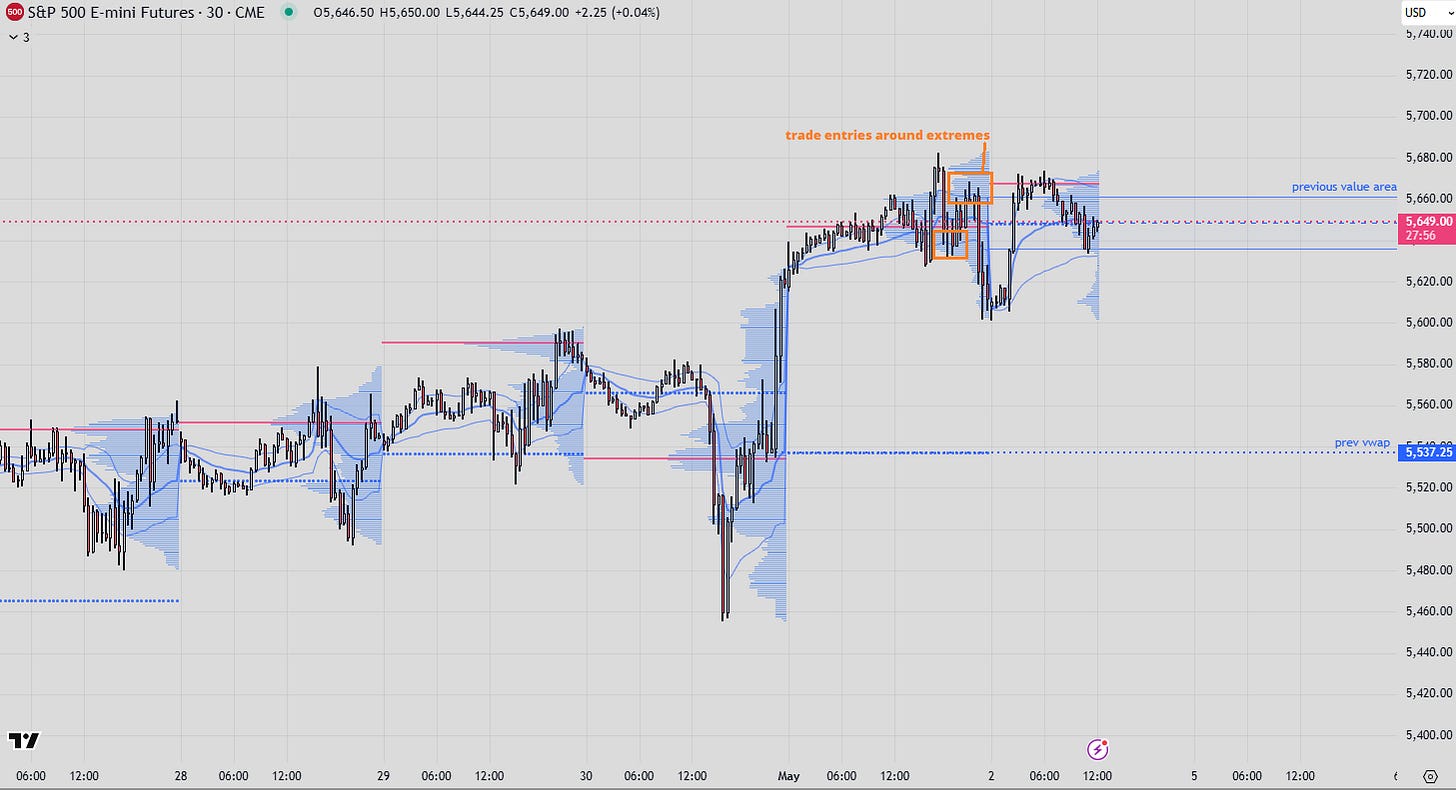

The prior session showed clear rotational behavior, with traders leaning on the developing value extremes to execute balanced scenarios above previous highs. This formed a balanced to p-shaped profile structure. The key level is the POC at 5646 — treat the structure as balanced, using 5634 as support and 5662 as resistance until a breakout occurs. If a breakout follows, align with the direction by adding near the developing VWAP.

(Click on image to enlarge)

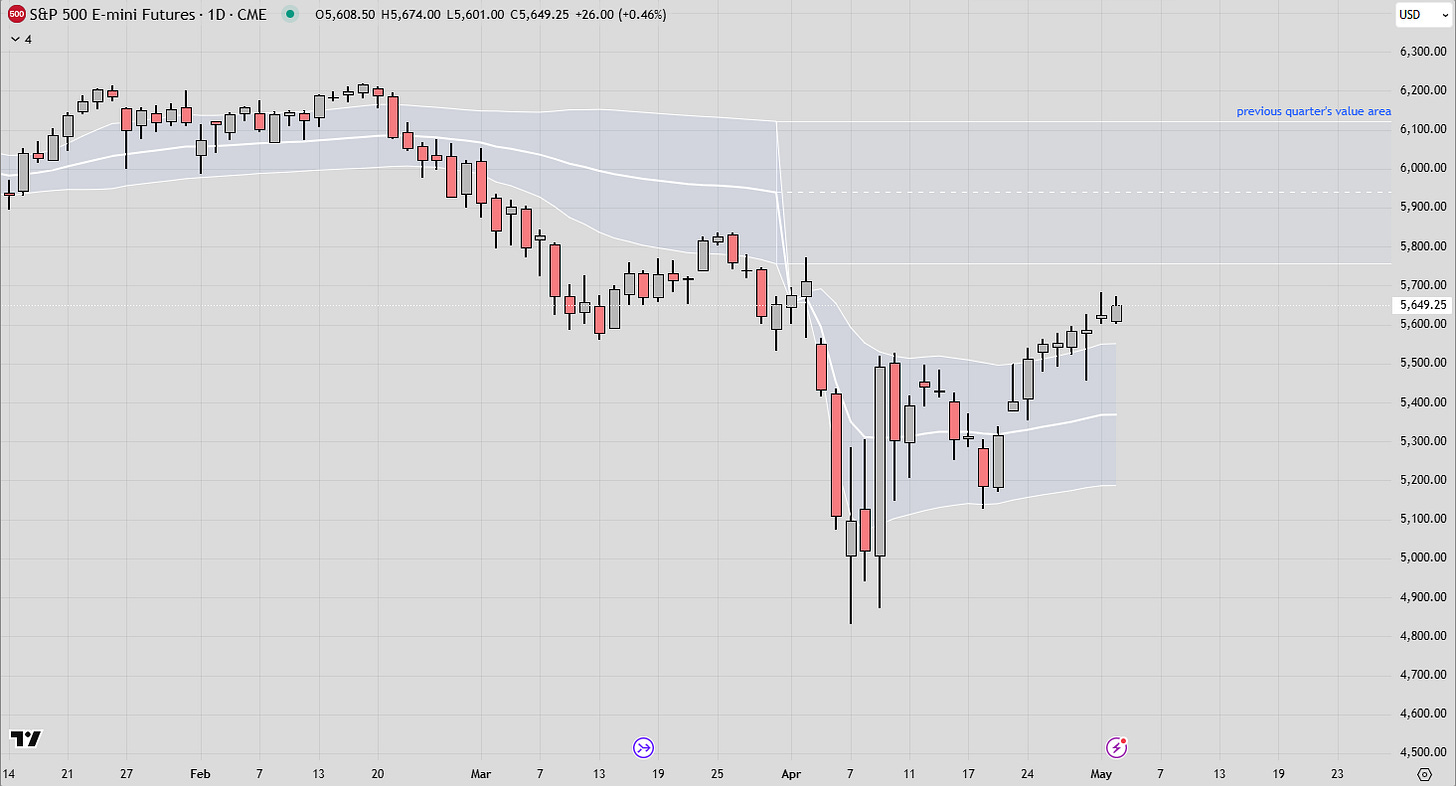

On the daily interval, the /ES is trading above the Quarter’s developing value area, suggesting the path of least resistance remains to the upside, potentially targeting the previous Quarter’s VAL close around 5759. However, Wednesday’s outside bar may signal a shift in market context from bullish rotation to a more bearish stance if sellers or absorption emerge near the highs.

(Click on image to enlarge)

All eyes are on Friday’s jobs report, which could provide fresh insight into the economic impact of current trade policies — a key catalyst for a breakout from this balanced range.

More By This Author:

Zweig Breadth Thrust Signal Sparks Bottom-Calling Buzz Amid Cautious Market Backdrop

Opinion: The Fracturing Global Trade Order - Why I’m Worried, Yet Hopeful

Global Outlook 2025: Navigating Multipolarity, Trade Wars, And Tech Disruption

Enjoyed this article? Invest in a subscription to expand your horizon towards advanced wealth creation.

Visit our more