Copper Prices Steady As Refining Constraints And Tariff Fears Persist

Image Source: Pixabay

Copper futures are trading near $5.50 per pound on Friday, slipping from Tuesday’s high of $5.70 on the daily timeframe. Despite the modest decline, prices remain 10% higher than Monday’s close, underscoring persistent concerns over supply disruptions tied to incoming United States (US) trade tariffs.

The 50% tariff on Copper imports, announced on Wednesday and set to take effect on August 1, is aimed at consolidating the US Copper industry and reducing reliance on imported refined products.

The tariff announcement has driven the premium between US Copper futures and London Metal Exchange (LME) prices to a record 25%, as foreign benchmarks weakened and US prices surged.

This divergence reflected market expectations that Copper inflows into the US would slow after threats initially emerged in February.

Traders accelerated shipments in recent months to get ahead of the August enforcement window. The front-loading of imports temporarily increased US stockpiles but is now expected to fade, potentially leading to domestic shortages later this quarter.

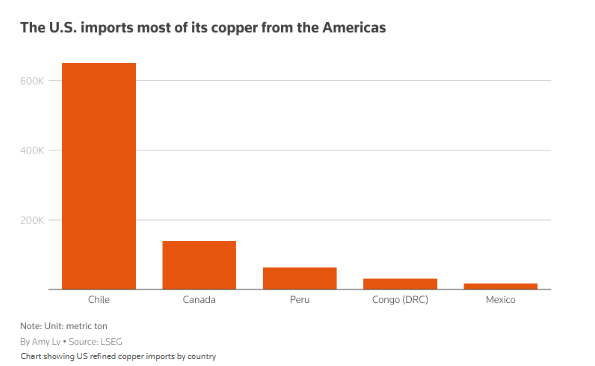

According to a Reuters report on Thursday, the United States imports nearly 50% of its Copper consumption, with Chile accounting for the bulk of refined Copper shipments.

Analysts warn that the US lacks sufficient refining infrastructure to absorb the supply gap. New capacity could take years to develop, suggesting that downstream industries, particularly construction and electronics, may face rising input costs and delivery lags.

The daily chart below shows Copper trading within a long-term ascending channel, with strong volume supporting the recent breakout.

(Click on image to enlarge)

The Relative Strength Index (RSI) has eased from overbought levels but remains elevated, signaling continued bullish bias.

Immediate support lies at $5.03, followed by deeper support at $4.62 (78.6% Fib) and $4.29 (61.8% Fib), where prior consolidation zones could act as buffers in the event of a pullback.

As the August 1 deadline approaches, Copper markets are likely to remain volatile.

More By This Author:

WTI Stabilizes Above $67 As EIA cuts U.S. Output Forecast, Geopolitical Risks Persist

Gold Spikes As Safe-Haven Demand Surges On Trump's Tariff Threats

Gold Rises For Second Consecutive Day As Trade Tensions Intensify

Disclosure: The data contained in this article is not necessarily real-time nor accurate, and analyses are the opinions of the author and do not represent the recommendations of ...

more