It turns out copper, not data, is the new oil:

This prompted us to dust off an old Insider Weekly issue from March 2020, where we highlighted the asymmetry that copper — and a host of other resource markets — offered at the time.

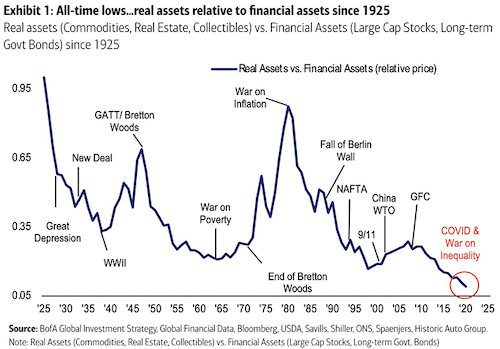

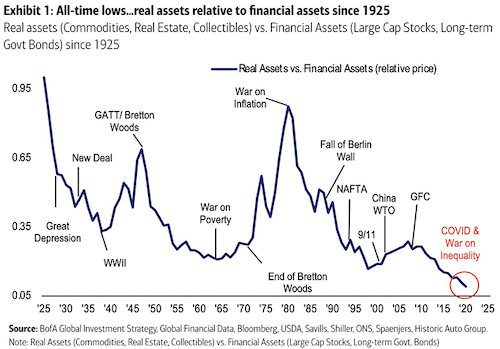

Energy, copper, broad commodities, industrial metals and agriculture – all these sectors have been locked in vicious bear markets over the last 5 years or so. These sectors are the most under owned in at least a generation. As I pointed out last week, we need to go all the way back past the days of bell bottoms, and to 1941 to find energy so cheap on a relative basis. When buyers come back into this market, they will get the shock of their lives as they find there isn’t the liquidity in the stocks that there once was. This will translate to huge bull markets in these sectors.

At the time of writing, copper was at just over $5,000 per tonne, and few were crazy enough to even consider having some exposure to copper. Oh, how the times have changed. Copper has been on a tear since then. So much so that it’s now being touted as the new oil.

Don’t get us wrong. We’re not suddenly turning bearish on copper. The world is only now waking up to the fact that the “green new world” we’re being promised is going to need an isht ton of copper (and then some).

NOT THE ONION

What you’re about to read comes from The Wall Street Journal, although it very much sounds like The Onion or any other purveyor of satire:

A top Federal Reserve official said on Wednesday he was surprised by a larger-than-expected jump in inflation last month, but stressed that more data would be necessary for the central bank to begin scaling back its easy-money policies.

As we said a few weeks back, you would have to be a central banker not to see inflation picking up. But then again, these are the same guys that got completely blindsided by the global financial crisis emerging in 2005… 2006… 2007. Being completely clueless about the real world is surely part of their job description.

CATHIE WOOD: OUT WITH OLD, IN WITH NEW

Speaking of being out of touch with reality…

ARK Invest’s Cathie Wood is weighing in on the energy market, saying that electric vehicles will keep crude from breaking out.

Speaking at ARK’s monthly webinar, Wood predicts “a very serious correction in commodity prices” and says that she would be “surprised” if oil prices hit $70 again, according to Bloomberg.

Let’s ignore the fact that electric vehicles currently make up 1.8% of the US car market. But when measured against the overinflated financial assets that have been breading her butter — the same commodities that are supposedly due for a major crash are actually the cheapest they’ve ever been.

️BIDEN GOING NUCLEAR

It’s been a while since we last touched on uranium in these missives. We note the recent move by the Biden administration to subsidize nuclear power to meet climate goals:

The Biden administration is backing federal subsidies to keep U.S. nuclear power plants in operation as part of its infrastructure proposal, a move that is sure to set up a clash with environmentalists who have qualms with the carbon-free fuel source.

We can’t help but wonder how high uranium miners will go if just a teensy tiny bit of the capital that has piled into renewables/ESG goes looking for a home in uranium stocks?

Disclaimer: This is not intended to render investment advice. None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed as financial professionals, brokers, bankers or even ...

more

Disclaimer: This is not intended to render investment advice. None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed as financial professionals, brokers, bankers or even candlestick makers in any jurisdiction, anywhere on this big ball of dirt.We do NOT know your individual situation, and you should always consult with your attorneys, accountants, financial planners, and those that are sanctioned to provide you with advice. DO YOUR OWN DUE DILIGENCE.

But seriously, all investments carry risk. Some of what I discuss arguably carries great risk. Investments which can lead to you losing 100% of your capital and maybe more if you are stupid and use margin.If you invest more than you can afford to lose, or borrow money from Joey down at the tavern, Master Card or Visa to make your investments, then you need to go and read a different website.

But really seriously…

Capex Administrative LTD – parent company of CapitalistExploits.at is not a a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Neither CapitalistExploits.at, Capex Administrative LTD purport to tell or suggest which investment securities members or readers should buy or sell for themselves. Readers, subscribers, site users and anyone reading material published by the above mentioned entities should always conduct their own research and due diligence and obtain professional advice before making any investment decision. Capex Administrative LTD, it’s principles and employees cannot and will not be liable for any loss or damage caused by a reader’s reliance on information obtained in any of our posts, newsletters, special reports, email correspondence, memberships or on this website. Like us, our readers are solely responsible for their own investment decisions.

The information contained herein does not constitute a representation by Capex Administrative LTD or CapitalistExploits.at or a solicitation for the purchase or sale of securities. Our opinions and analyses are based on sources believed to be reliable and are written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. All information contained in our newsletters or on our website should be independently verified with the companies and individuals mentioned. The editor and publisher are not responsible for errors or omissions.

Capex Administrative LTD may receive compensation from time to time from the companies or individuals that may be mentioned in our newsletters, special reports or on our web site. If compensation is received we will indicate that compensation in the post or the content, or on this website within this “disclaimer.” You should assume a conflict of interest when compensation is received and proceed accordingly.

Any opinions expressed are subject to change without notice. Owners, employees and writers may hold positions in the securities that are discussed in our newsletters, reports or on our website.Owners, employees and writers reserve the right to buy and sell securities mentioned on this website without providing notice of such purchases and sales. You should assume that if a company is discussed on this website, in a special report or in a newsletter or alert, that the principals of Capex Administrative LTD have purchased shares, or will make an investment in the future in said company.

If you have a question as to what we own and when, we are happy to fully-disclose any and all interests to our readers.

less

How did you like this article? Let us know so we can better customize your reading experience.