Commodities In 2024: Big Moves, Greater Opportunities

As we approach the back half of 2024, the commodities market continues to be a hotbed of activity, offering both challenges and opportunities for investors.

The commodities market has been anything but predictable, from the wild swings in natural gas to the unprecedented surge in cocoa and the steady climb in orange juice.

Since the pandemic, commodities have drawn significant interest from investors. Inflation has been a key driver, but other factors like supply shortages and energy demand from artificial intelligence (AI) developments also play a significant role.

This article will look closely at commodities and their dramatic moves. We will examine the factors driving them and speculate on where the next big opportunities might lie.

The Case for Commodities

1) Inflationary Pressures

If you follow the markets, you know the staggering year-over-year inflation numbers that followed the pandemic. Unfortunately, Economic stimulus measures enacted to fight the COVID pandemic led to the 7-9% inflation.

Consumer prices have not moved like that in 40 years, so many investors were unfamiliar with a high inflationary atmosphere.

Inflation is a significant driver for commodity prices, and one of the best places to be when inflation hits is hard assets. Your house is one way to hide from inflation, but many other goods you use daily also give you exposure. Oil, gas, wheat, lumber, and steel are just a few examples.

If inflation remains sticky, commodities like gold and silver are often seen as hedges, driving up demand and prices. Additionally, general price increases can elevate the cost of production for commodities, indirectly pushing their prices higher.

2) Interest Rates

While the fear of inflation was a driver after the pandemic, the narrative has shifted to increase prices. Now, investors view the potential of lower rates as the main reason to buy commodities.

A shift in monetary policies, such as rate cuts or continued low interest rates by major central banks, can weaken fiat currencies and enhance the attractiveness of commodities like gold and silver. Lower interest rates also reduce the opportunity cost of holding non-yielding assets like precious metals.

Lower rates also create economic demand, increasing the demand for commodities.

Collectively, the potential for lower rates helps commodity prices move higher.

3) Supply Chain Disruptions

The pandemic prevented a significant percentage of the global population from living normally. Global commodity demand was turned off in the early stages, and prices tumbled.

Producers adjusted by lowering their output as commodity prices dropped. However, as global demand returned, commodity producers were slow to adjust, unsure if COVID would not return.

The shutdowns clogged supply chains, and as the demand for goods returned, it created an environment where consumers drove prices higher for goods that were not immediately available.

Ongoing supply chain disruptions can create supply shortages in various commodities.

4) Geopolitical Tensions

Geopolitical tensions can be one factor that can cause these supply disruptions discussed above, especially when it comes to energy markets. Tension involving major oil-producing regions can lead to spikes in oil prices.

Recent examples of this were the Russia/Ukraine conflict, which sped oil prices to $120 and helped natural gas prices explode to $10. Additionally, with the recent conflict in the Middle East with Israel, Gaza, Iran, and the Red Sea, energy markets have been on edge.

Volatility in oil has calmed, but a geopolitical premium will likely hold in the energy markets until these risks subside.

5) Energy Transition, Green Technologies, and AI Demand

The shift towards renewable energy and green technologies requires significant amounts of metals like lithium, cobalt, nickel, and copper. The increased demand for these materials, driven by the growth in electric vehicles and renewable energy infrastructure, can raise prices.

A fresh narrative has been set from the rapid growth of artificial intelligence and the need to power AI. This new technology needs substantial computational power, primarily provided by data centers. These facilities consume vast amounts of electricity to operate servers, cooling systems, and other infrastructure.

Because of this AI demand for power, utility stocks have taken off, helping utility ETF XLU outperform the S&P 500.

Image Source: TradingView

Data centers and servers are traditionally powered by electricity, which can be generated from various sources, including fossil fuels such as coal, natural gas, and oil.

This new demand collectively brings new investment into these commodities and alternatives like solar, wind, hydroelectric, geothermal, and nuclear power.

6) Weather-Related Supply Shocks

Agricultural commodities are primarily susceptible to weather-related disruptions. Extreme weather events such as droughts, floods, and hurricanes can severely impact crop yields, leading to higher prices for grains, coffee, sugar, and other agricultural products.

A commodity's supply/demand aspect kicks in when the supply side is taken out. The best commodity performer of the year is up nearly 100%, mostly because of a failed crop due to weather.

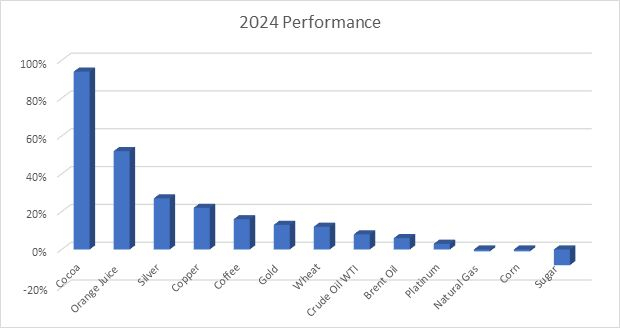

Huge Moves in Commodities

The biggest story in 2024 has been cocoa, which more than doubled this year before pulling back. Production concerns in West Africa were the primary catalyst, and the commodity outperformed the rest of its peers by a wide margin.

Image Source: TradingView

The increase in cocoa was not just due to a mix of supply concerns; the robust demand for chocolate products worldwide has driven the bullishness. West Africa is the most essential cocoa-producing region in the world, and when both political instability and unfavorable weather conditions arose, crop yields were hurt, and prices shot higher.

The future of cocoa prices will depend on weather trends in Côte d'Ivoire and Ghana and political stability in the region.

Weather and the effect on crops are tough to predict, but cocoa investors were rewarded by getting in on the trend early. Let us go over some other high-flying commodities that have outperformed this year.

Image Source: Zacks Investment Research

Orange juice is starting to accelerate, and prices have been up almost 300% since the pandemic started. While the higher momentum started in 2021 along with commodities, OJ prices have been squeezed mainly because of the citrus greening disease that has devastated Florida orange supplies.

Diseases, hurricanes, and other weather disruptions have lowered crop yields, increasing prices.

Image Source: TradingView

Silver, gold, and copper have all shined this year, with the latter two hitting record highs in 2024.

This year, the 13% move higher in gold can mostly be attributed to lower interest rates and foreign government buying. However, there is also fear from retail investors about everything from US debt to more geopolitical conflicts.

Both silver and copper are up over 20% this year as supply concerns are met with more demand. The Chinese economy is starting to rebound, which is one reason copper has renewed interest. However, the AI demand involved with copper in data centers is the main catalyst for new all-time highs.

Speculating on the Next Big Jump in 2024

Given the current atmosphere, several commodities show potential for significant price movements in the coming months. Here are a few to watch:

Natural Gas- The reason for higher gas prices in 2022 was mainly related to supply fears surrounding the Russia/Ukraine conflict. While the war continued, there was plenty of natural gas in the world, and the realization of that erased all the gains over the last three years.

However, the ongoing transition to greener energy sources will continue to drive demand for natural gas instead of dirtier alternatives.

As of late, natural gas has started to rally for a new reason in artificial intelligence. Investors are starting to realize that the immense power usage of AI data centers will cause a surge in natural gas demand.

The bullish scenario for natural gas is that the rapidly growing energy demands of technology sectors, especially Generative AI, surpass the growth of the U.S. electrical infrastructure.

Lithium- As the demand for electric vehicles (EVs) continues to grow, lithium, a key component in EV batteries, is poised for a rally. Lithium-ion batteries are also essential for energy storage systems supporting renewable energy sources like solar and wind.

The demand for lithium will increase as the world transitions to cleaner energy. Since supply is constrained due to mining challenges, there is a considerable potential for higher prices.

Wheat- Like natural gas, wheat prices spiked higher after the Ukraine/Russia conflict, but all the gains were erased. However, adverse weather conditions have helped wheat rally off the 2024 lows.

Prices depend on global supply, so weather plays a significant factor in supply availability and quality. The first harvests are just months ahead, and while the U.S. crop looks good, the bulls have returned to this market on fears about Russian crop yields.

How can an average investor play?

Most investors are not sophisticated enough to trade commodity futures. However, some products will allow us to take advantage of the big moves in commodities.

1) Commodity ETPs- Exchange-traded products like ETFs or ETNS allow investors to get broad exposure to the underlying commodity.

For energy, popular products like USO for crude, UGA for gasoline, and UNG for natural gas allow the investor to buy commodities like they would a stock. XLE is a popular option that seeks investment results correlated with stocks in the Energy Select Sector Index.

For grains, there are ETFs for wheat (WEAT), corn (CORN), and soybeans (SOYB).

You can find an ETF for almost any commodity out there. Investors can also go to ETFs that capture a basket of stocks instead of the commodity itself. DBC is the Invesco Commodity tracking fund that diversifies investors into the space. So far this year, this ETF is up over 6%.

Image Source: TradingView

2) Commodity Stocks- Instead of capping upside within an ETF like DBC or XLE, less risk-averse investors can target individual stocks. There have been moves in some commodity stocks that even tech investors are jealous of.

Let us look at some names and what they have done so far in 2024:

Constellation Energy (CEG): +97.31%

• Provides energy products and services, focusing on sustainable solutions.

Southern Copper (SCCO): +40.25%

• One of the largest integrated copper producers, with mining, smelting, and refining facilities in Peru and Mexico, produces gold.

Targa Resources Corp (TRGP): +31.55%

• Provides midstream natural gas and NGL services in the U.S.

Tractor Supply (TSCO): +30.21%

• The largest rural lifestyle retailer in the United States, focusing on supplying farmers, ranchers, and rural communities with products related to home improvement, agriculture, lawn and garden maintenance, and livestock, equine, and pet care.

AngloGold Ashanti (AU): +29.46%

• A major global gold mining company based in South Africa. AngloGold Ashanti operates mines and exploration projects across four continents, primarily focusing on gold but also involving other minerals.

NextEra Energy Inc (NEE): +26.13%

• A clean energy company and one of the largest wind and solar energy producers.

Valero Energy Corp (VLO): +24.94%

• An international manufacturer and marketer of transportation fuels and petrochemical products.

3) Inverse ETPs- Commodity players can also profit from certain commodities going down thanks to inverse ETFs. While these products do not target every commodity space, they allow energy and mining speculators to play on the short side.

In summary

The commodities market 2024 has been characterized by significant volatility and remarkable opportunities. Cocoa, orange juice, and silver have all had their moments of dramatic price movements, offering lessons and insights for savvy investors.

But the fun is not over!

A combination of macroeconomic trends, supply-demand imbalances, technological changes, and geopolitical factors has created a robust bull case for commodities in the back half of the year.

By staying informed and strategically positioning themselves, investors can navigate the commodities world and capitalize on the next big winner.

More By This Author:

Bear Of The Day: CVS HealthBear Of The Day: Winnebago Industries

An Investor Game Plan After a Historic Rally

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more