Commodities For The Long Run

Commodities for the Long Run

- Ari Levine, Yao Hua Ooi, Matthew Richardson, Caroline Sasseville

- Financial Analyst Journal, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the Research Questions?

The paper investigates this issue by answering the following research questions:

- Are commodities returns positive on average?

- How do they vary in different economic states (backwardation/contango; expansion/recession periods; unexpected inflation) ?

- How have they contributed to a broad portfolio?

What are the Academic Insights?

By studying a novel dataset consisting of daily futures prices going as far back as 1877 (manually transcribed from 1877 to 1951 from the Annual Report of the Trade and Commerce of the CBOT; from 1951 to 2012, from the data vendor Commodity Systems Inc. and after 2012 from Bloomberg), the authors find:

- YES- Over the long run, commodity futures average returns have been positive, with return premiums associated more with interest rate–adjusted carry than excess spot returns.

- YES- Economic states are important drivers of commodity returns, even after conditioning on the shape of the forward curve (backwardation or contango). In fact, while confirming higher returns during periods of backwardation (7.7% compared to 1.8%), they find significant positive returns even in contango when inflation is up or the economy is expanding.

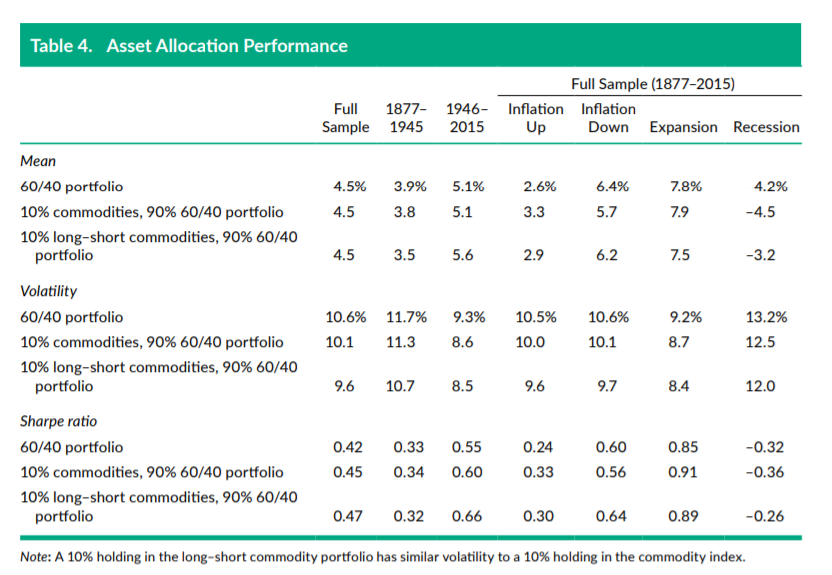

- YES- From an asset allocation perspective, commodities can add value to a traditional stocks/bonds portfolio: they are a good diversifier and perform differently in different economic cycles.

Why does it matter?

The authors are the first to cover a longer time frame (140 years!) compared to prior studies, which focused on the post 1960 periods. They show that commodity futures do provide their own unique benefits to a traditional portfolio.

For a much longer and more detailed post on commodity investing (including the working paper version of this study), click here.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Join thousands of other readers and subscribe to our blog.

Disclaimer: Please remember that past performance is not an indicator of ...

more

Hi, Thanks for sharing the summary, and the link to the original article. I enjoyed the thoroughness of the research in the original study, as well as the concise summary you provided.

Question: As an asset, commodities are very different from equities, in regards to their investment characteristics. I know this makes them a potential diversifier to a portfolio, but is there any kind of systematic way of analyzing them, to invest in them proactively, as opposed to just using statistics? In equities, there is fundamental analysis based on the nature of the underlying business, but with commodities, the main dynamics are supply/demand, which is essentially just a question of surpluses and shortages. While these statistical studies seem to bear out that adding commodities can create diversification in a portfolio, they don't really relate to underlying causes of price movements. I'm sure this is because that wasn't the goal of the study, I'm just asking to get a sense of actionable ideas, based on the article. Do you have any thoughts about this?

Thanks,

Zev.

Good questions.