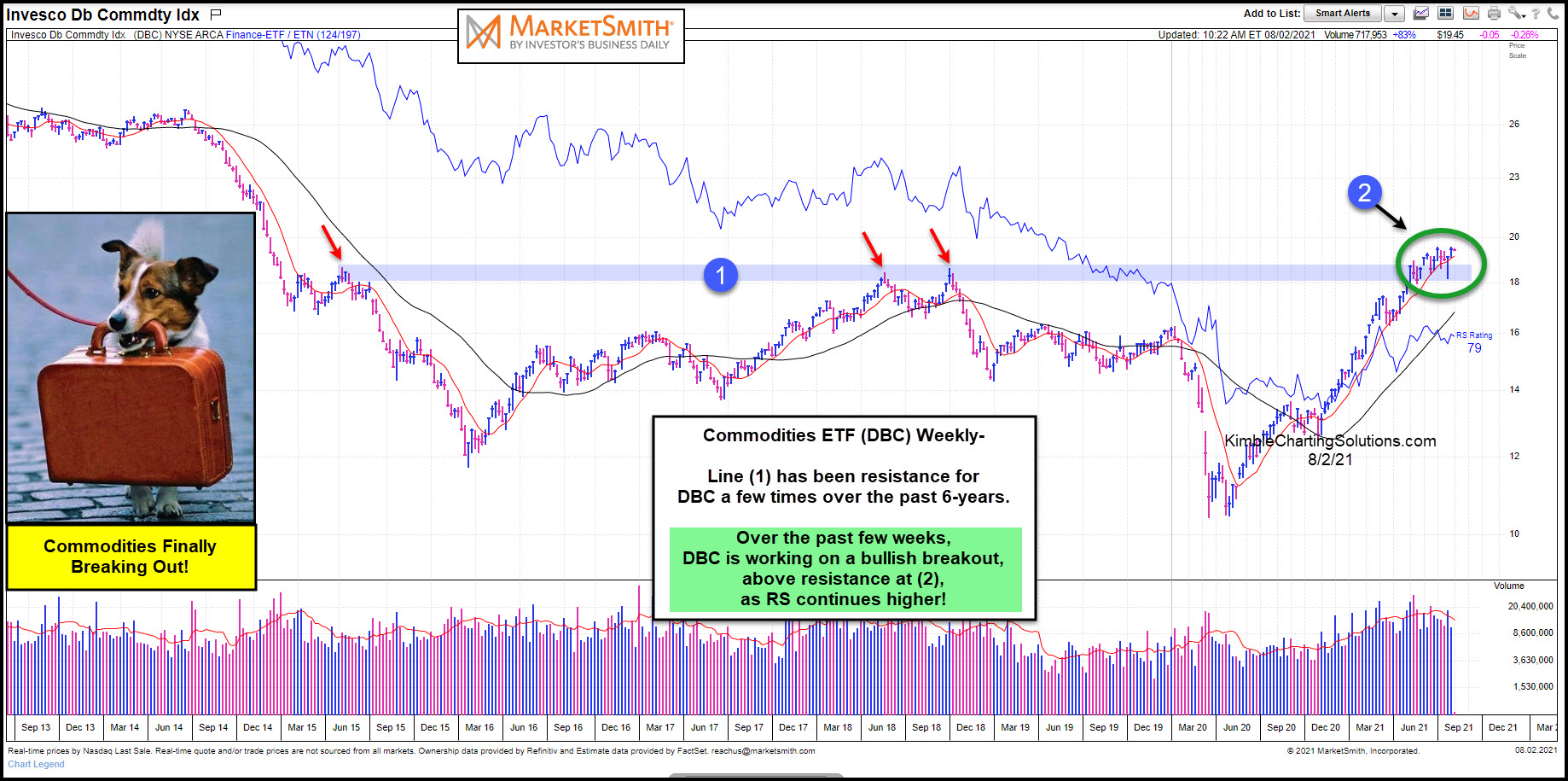

Commodities Attempting To Breakout Above 6-Year Price Resistance

(Click on image to enlarge)

This chart was created at Marketsmith.com, where you can learn how to trade with the pros for three weeks for only $9.95

I have written a lot about select commodities and the potential for breakouts across the commodities industry.

Recently, I have highlighted key inflection points for Cattle / Copper and Steel / and Coffee.

And as long as commodities remain elevated, inflation will linger. Today, we continue that theme by looking at a long-term “weekly” chart of the Invesco Commodities ETF (DBC).

Over the past 6 years, line (1) has been major resistance for this Commodities ETF (DBC). During this time, line (1) has rejected DBC 3 times.

Over the past few weeks, though, DBC is working on a bullish breakout above this key price level at (2). Note that Relative Strength (RS) is moving higher, supporting this breakout attempt.

Bulls are hoping for a clean breakout as commodities dance just above this 6-year resistance. Stay tuned!

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.