Collapse Of Grain Deal Rattles The Market

Grain markets have rallied this week following Russia’s refusal to extend the Black Sea Grain Initiative. The ratcheting up in tensions between Ukraine and Russia means that risks are skewed to the upside, particularly when it comes to the wheat market. However, for now, we do not see the market re-testing the 2022 highs.

How important is the Black Sea Grain Initiative?

The Black Sea Grain Initiative came to fruition in July last year after the UN, Turkey, Ukraine, and Russia agreed on the safe passage of vessels shipping agricultural commodities from three Ukrainian Black Sea ports: Odesa, Chernomorsk and Yuzhny. The deal was originally set for 120 days with the intention for it to be extended by a similar duration. And while this initially happened, since March, Russia has only been prepared to extend the deal for periods of 60 days, which has led to elevated uncertainty across grain markets. In recent months and in the lead-up to Russia pulling out of the deal, flows from Ukrainian Black Sea ports slowed significantly with Ukraine suggesting that Russia was blocking vessel inspections.

However, despite the many challenges and uncertainties with the deal, it has proved beneficial for grain flows and therefore for consumers. Ukraine has managed to ship almost 33m tonnes of grain under the deal since August last year. This has seen CBOT wheat prices trading more than 20% lower between the period the deal was announced and Russia suspending its participation.

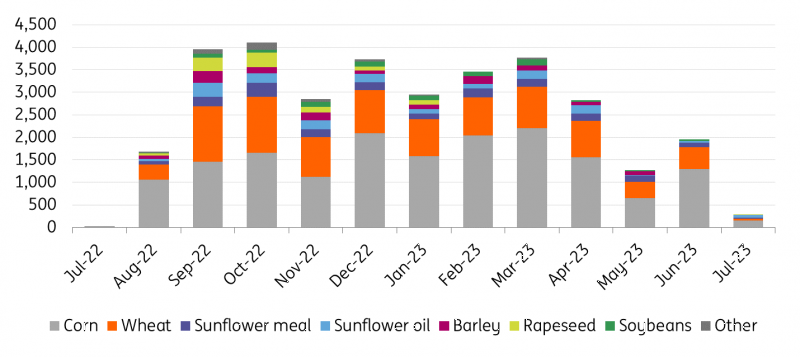

Of the almost 33m tonnes shipped under the deal, 16.9m tonnes was corn, whilst 8.9m tonnes was wheat. The remainder of flows were mostly sunflower oil/meal, barley and rapeseed.

Ukranian grain and oilseed exports under the Black Sea Grain Initiative (m tonnes)

(Click on image to enlarge)

UN, ING Research

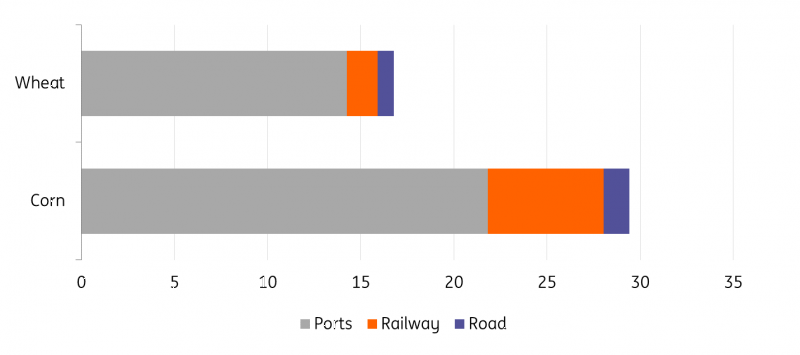

These are not the only export volumes from Ukraine. According to Ukraine’s agricultural ministry, the country managed to ship a total of 29.5m tonnes of corn and 16.8m tonnes of wheat in 2022/23. This is due to the fact that Ukraine has also increased exports through other routes, via river, road and rail.

However, there are obviously challenges in doing this. Firstly, transportation costs will be higher than shipping from the Black Sea in dry bulk vessels, secondly, there will be capacity constraints as well as other logistical issues moving this grain westwards. And finally, there has been pushback from neighbouring EU countries over the influx of Ukrainian grains into these markets, which has weighed on domestic prices.

Poland, Hungary, Slovakia, Bulgaria and Romania have restricted grain imports from Ukraine since the spring, although transit is allowed. Recently, these countries have pressured the EU to extend restrictions which expire on 15 September, given the expectation that more grains will flow westwards now.

2022/23 total Ukranian grain exports (m tonnes)

Ministry of Agrarian Policy & Food of Ukraine, ING Research

The future of the Black Sea deal

There have been some suggestions that the Black Sea Grain deal could continue without Russia. However, shipowners will likely be very reluctant to ship to these ports given the risks, particularly after Russia said that it would consider ships travelling to Ukrainian Black Sea ports as potential military targets. Even if shipowners were willing to risk calling at Ukrainian ports, obtaining the necessary insurance will not only be extremely difficult but also expensive. Therefore, Ukraine will likely have to focus on alternative export routes.

Turkey is set to discuss the deal with Russia in an attempt to try to get the initiative back on the table. However, Russia has said that it would only be willing to rejoin the deal if all its demands are met. Part of these demands appear to include the restarting of a pipeline that carries Russian ammonia to the Ukrainian port of Pivdennyi, and reconnecting Rosselkhozbank (Russia’s agricultural bank) to SWIFT.

Can global grain markets handle a Ukrainian disruption?

The end of the Black Sea Grain deal comes at a time when the 2023/24 season recently got underway and so exports were set to pick up. Ukraine is forecast to produce 17.5m tonnes of wheat this season, down 19% year-on-year. As for corn, 25m tonnes are forecast to be harvested, down 7% YoY. There is a large risk that exports will now disappoint with no Black Sea grain deal, and if we were to see this, it would mean that Ukraine will be carrying larger stocks in its domestic market, which doesn’t bode well for domestic production in the medium to long term.

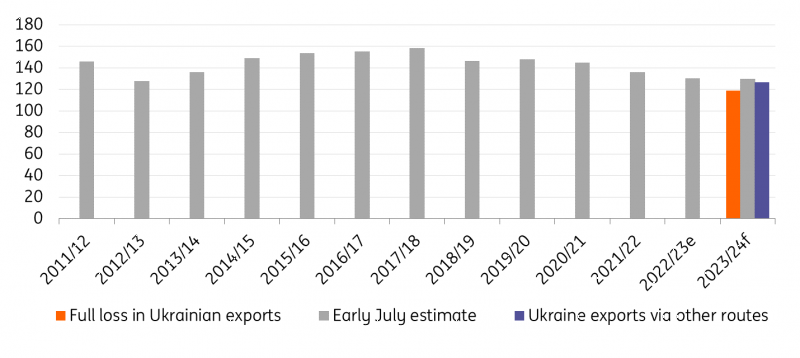

Prior to the war, Ukraine made up around 10% of the global wheat export supply, and last year the country managed to export 16.8m tonnes of wheat (less than 8% of the global wheat export supply), of which 8.9m tonnes was exported under the Black Sea deal. For the 2023/24 season, export volumes were already expected to decline due to lower domestic output with acreage having declined. Prior to Russia pulling out of the deal, Ukraine was forecast to export around 10.5m tonnes of wheat this season. Assuming, Ukraine no longer ships from its Black Sea ports, but continues to export similar volumes to last year along other routes, we could see export estimates falling by around 3-4m tonnes.

The global wheat market was already set to tighten this season, but assuming 3-4m tonnes of less Ukrainian export supply, the market would tighten even further, leaving global wheat stocks (excluding Ukraine) at their lowest levels since 2015/16. However, a large amount of global wheat inventories sit in China and are unlikely to come onto the world market. Therefore, it makes sense to also exclude inventories sitting in China – doing so would leave ending stocks at their lowest levels in more than a decade. The expected tightness in the wheat market should mean that prices remain well supported, and certainly the increased tightness in the market will leave it more vulnerable to other supply disruptions. However, for now, we do not see the market testing the 2022 highs.

Global wheat ending stocks – ex-China & Ukraine (m tonnes)

USDA, ING Research

Note: The above numbers exclude inventories sitting in China and Ukraine

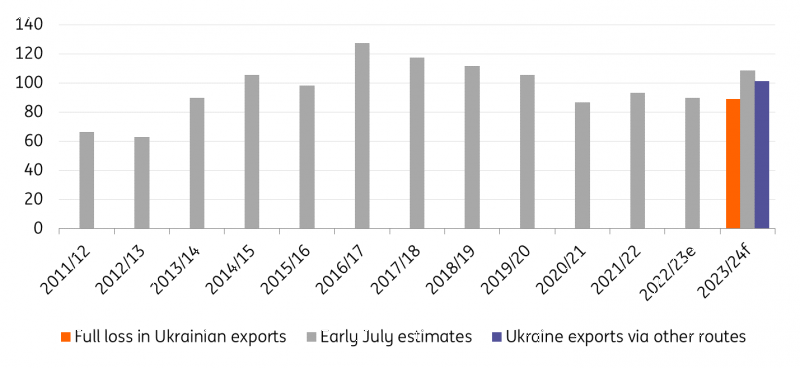

The global corn market should be able to handle the potential loss of Ukrainian supply better than the wheat market. Global corn ending stocks for the 2023/24 season (excluding Ukraine) were already forecast to increase by almost 18m tonnes and to their highest levels since 2018/19. If we exclude Chinese inventories as well, then stocks climb closer to 19m tonnes this season. The expected increase in ending stocks is not too far away from the 19.5m tonnes of corn that Ukraine was forecast to export this season. Therefore, if we were to lose all these exports, it would leave inventories only marginally below last season, but still above ending stocks in 2020/21.

However, like for wheat, it is unlikely that exports will come to a full stop. From the 29.5m tonnes exported last season, 16.7m tonnes were exported under the Black Sea deal, the remainder would have been through alternative routes. If Ukraine is able to export similar volumes this season under these alternative routes, it would leave global ending stocks (excluding Ukraine) still higher year-on-year. Therefore, the global corn market is less vulnerable to Ukrainian supply disruptions.

Global corn ending stocks – ex-China & Ukraine (m tonnes)

USDA, ING Research

Note: The above numbers exclude inventories sitting in China and Ukraine

What further escalation could mean

Since Russia’s comments that any vessels going to Ukrainian ports will be treated as a potential military target, Ukraine has said the same applies to any vessels going to Russian ports on the Black Sea. This increases grain supply risks significantly given that Russia is the world’s largest wheat exporter with substantial flows from Black Sea ports. Risks are not isolated to Russian grains; there is the potential that this spills over into other markets, specifically oil, given the volumes shipped from Russian Black Sea ports. However, for now, we would think it is unlikely that Ukraine would follow through with this, as it would not go down well with allies, given the impact it would have on global food and energy security.

One of the potential ripple effects of the latest developments is that governments around the world have become more concerned about food security again. And so there is the very real possibility that we see the return of food protectionist measures, like we saw last year, which could drive prices higher.

More By This Author:

Fed To Keep Up The Squeeze With Another 25bp Hike

FX Daily: Dollar Bears Being Asked For Patience

Continued Disinflation In Poland Supports Prompt Central Bank Easing

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more