Fed To Keep Up The Squeeze With Another 25bp Hike

The Federal Reserve is set to resume its policy tightening on 26 July. Inflation is moderating but remains well above target and with a tight jobs market and resilient activity, officials may feel they can't take any chances. The Fed will continue to signal the prospect of further hikes, but with the credit cycle turning, we doubt it will carry through.

Image Source: ING

25bp hike is an obvious call

After 10 consecutive interest rate hikes over the previous 15 months, the Federal Reserve left the Fed funds target rate unchanged at 5-5.25% in June. While it was a unanimous decision, there was hawkish messaging in the accompanying press conference and updated Fed forecasts, signaling a broad consensus behind the idea of two more rate rises later in the year.

Fed Chair Jerome Powell stated that the long and varied lags in monetary policy meant that the decision should be interpreted as a slowing in the pace of rate hikes rather than an actual pause. While inflation is moderating, it is still far too high, and with the jobs market remaining very tight, the Fed can’t take any chances.

The commentary since then remains consistent with this messaging, with broad support among officials that the 26 July Federal Open Market Committee (FOMC) announcement will be for another 25bp rate rise, taking the Fed funds range to 5.25-5.5%. Fed funds futures contracts are pricing 24bp with economists nearly universally expecting a 25bp hike.

Keeping the door open for additional tightening

The scenario graphic outlines the options open to the Fed and our sense of the likely market consequences of those actions. The no change and 50bp hike options seem very remote possibilities given comments from officials. The dilemma is whether the Fed hikes 25bp and sticks with the view that it needs to signal the likely need for one or more rate hikes or whether it moves more to a data dependency stance.

A data dependency narrative would be a shift in position and lead the market to latch onto the possibility of the Fed not hiking further. This would likely see Treasury yields and the dollar fall quite significantly, which would loosen financial conditions in the economy. Given low unemployment, robust wage growth, and the fact that core inflation is still running at more than double the 2% target, this is not something Fed officials would willfully countenance.

Consequently, we put a 70% probability on the 25bp hike scenario that includes commentary emphasizing the need to be attentive to inflation risks, that growth needs to slow below trend, and that further rate hikes “may be appropriate”. We would then say there is a 25% chance of a more dovish 25bp hike, signaling a likely peak for rates, while the 0bp and 50bp outcomes each have a 2.5% chance of materializing.

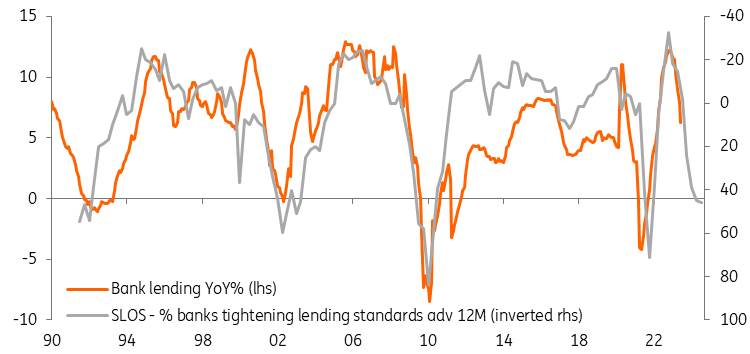

Tighter lending standards suggest credit growth will turn negative

Image Source: Macrobond, ING

But it is likely the last hike for a while...

By the time of the next FOMC meeting on 20 September, we will have had two further job and inflation reports, a detailed update on the state of bank lending plus more time for the lagged effects of the already enacted Fed tightening to be felt.

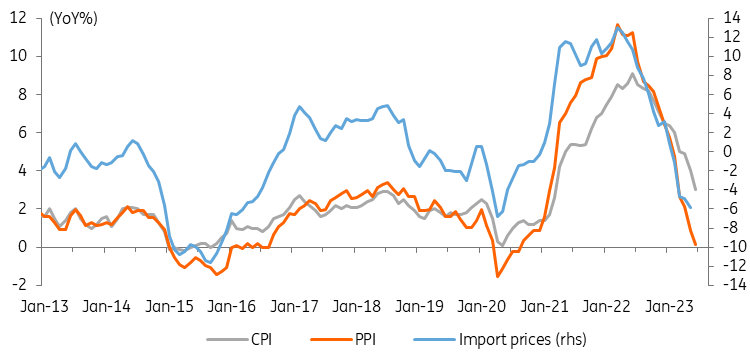

In terms of inflation, the next couple of months have some tough comparisons with last year. Energy prices fell sharply last summer so headline year-on-year CPI could be a tenth or two of a percentage point higher than the current 3% rate at the September FOMC meeting, but core inflation looks set to slow further and could be down at around 4.2% versus the current 4.8% rate. If anything, the risks are that core inflation could be a little lower given decelerating housing rent inflation may materialize more quickly than we are currently conservatively forecasting. It is also the composition of inflation the Fed will be paying close attention to. Is the super core (non-energy services ex housing) slowing meaningfully? We think the answer will be 'yes' based on lead surveys such as the ISM prices paid, PPI trade services, and the National Federation of Independent Business price intentions surveys.

Inflation pressures are fading

Image Source: Macrobond, ING

As for activity, industrial activity is already struggling with the ISM manufacturing index in contraction territory for the past nine months, while consumer spending growth is slowing. Over the next two months, we think the headwinds for activity will intensify with outstanding stock of commercial bank lending set to fall further thanks to the combination of higher borrowing costs and tightening of lending standards. This is a hugely important story given the insatiable appetite for credit within the US economy. We may also see the spreading awareness of the financial implications of the restart of student loan repayments starting to impact the spending behavior of tens of millions of Americans.

So, by the time of the 20 September FOMC meeting, we think the Fed will have evidence to be pretty confident that inflation is on the path to 2% and that activity is slowing to below trend rates and the jobs market is cooling. This is likely to be characterized as another pause and the Fed is likely to keep one additional rate hike in its forecast profile before year-end. However, our base case is that it will not carry through with it, and 5.25-5.5% marks the peak for US rates.

Market rates to edge towards 4% and money markets to slowly re-tighten post the FOMC

The US rates curve has been re-pricing in recent weeks to reflect the relative robustness of the economy, primarily by pricing out many of the rate cuts that had been discounted. The liquid portion of the strip out to early 2025 is now not tending to dip below 3.75%. Adding a 30bp term premium to this suggests that the US 10yr yield could easily be closer to 4%. It’s far from a perfect model, but it does help to explain why the 10yr yield has not collapsed lower, and in fact, we rationalize this as a factor that can force US yields higher as a tactical view. It goes against the consensus out there that the inflation story is behind us but is rationalized by the reality of relative contemporaneous macro robustness. For this reason, we maintain a moderate bearish stance on the directional view, expecting market rates to remain under moderate rising pressure. A hawkish Fed pushes in the same direction, preventing the strip from becoming too inverted.

The Fed may or may not choose to focus on liquidity circumstances at the press conference. If quizzed, it will likely note that the impact of ongoing quantitative tightening and resumed bills issuance by the US Treasury is largely showing up in reduced amounts going back to the Fed on the reverse repo facility. The Fed will generally be happy with this, as this facility is more of a balancing mechanism, one that can take in liquidity that is not flowing into bank reserves. Bank reserves themselves have not seen a material fall, which acts to keep the overall liquidity banks circumstance reasonably ample. It also coincides with money market funds balances still around record highs and bank deposits holding up very well, too. Many of these factors will, in fact, justify the Fed’s decision to maintain a tightening trajectory for policy, as at least the price of money continues to rise even if underlying liquidity volumes are slow to fall.

The dollar could get a lift from the hawkish Fed script

Having hit a new low for the year in the aftermath of the soft June CPI report, the dollar has since been clawing back those losses. At the heart of that story is market uncertainty as to how the Fed may react to one piece of soft price data. As above, it looks a little too early for the Fed to drop its tightening bias and switch to a data-dependent approach. With the market positioning itself for a cyclical dollar sell-off over coming months and quarters, we suspect another reading of the hawkish Fed script could send the dollar a little higher. Looking at the FX options market, the expected EUR/USD 24-hour trading range encompassing both the Fed and European Central Bank decisions next week is only 60 USD pips. Clearly, fireworks are not expected, but EUR/USD could dip back towards the 1.1050 area on the Fed event risk.

Looking beyond next week’s Fed meeting, softer US price data over the summer – plus some softer activity data too – should keep the dollar on the soft side. And dollar losses should accelerate in the fourth quarter when the Fed has more evidence to embrace the disinflation story and we move into what is normally a weak seasonal period for the dollar. We have a year-end target of EUR/USD at 1.15.

More By This Author:

FX Daily: Dollar Bears Being Asked For PatienceContinued Disinflation In Poland Supports Prompt Central Bank Easing

Gold Shines Again With An End To The Fed’s Tightening Cycle In Sight

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more